KEY POINTS

- MtGox wallets moved some $5.8 billion in Bitcoin to new addresses Tuesday

- Kraken confirmed that it received MtGox repayments and will work to distribute the funds

- The market response to may be more 'grievous' than how it reacted to Germany's dump: Chimp Exchange founder

Bitcoin has been in the green since the beginning of the week but slumped in the red early Thursday as MtGox's creditor repayments reignited fears on whether creditors will sell their $BTC and how the selloff will affect prices.

$BTC dips amid renewed MtGox talks

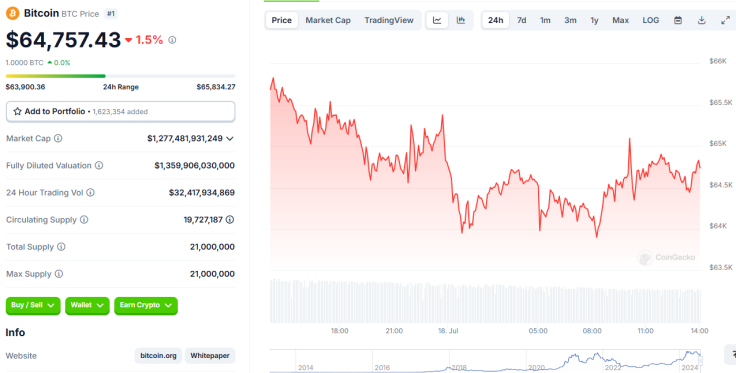

As cryptocurrency users on X (formerly Twitter) started talking about MtGox repayments again, Bitcoin, the world's largest digital asset by market value, started the day in the red. Data from CoinGecko showed that the token has been down by 1.5% in the last 24 hours. At one point Wednesday night, the coin traded below $64,000.

It is worth noting that earlier Wednesday, $BTC reached as high as $65,800 before gradually retreating to $64,000.

MtGox wallets begin massive move

On Tuesday, wallets associated with MtGox moved a total of 91,755 Bitcoins worth around $5.8 billion to new addresses, blockchain analytics firm Arkham Intelligence revealed.

TODAY: $5.8B MT. GOX BTC ON THE MOVE.

— Arkham (@ArkhamIntel) July 16, 2024

Mt. Gox wallets moved a total of 91,755 BTC ($5.8B) this morning to new addresses. pic.twitter.com/BEAmk6E70b

Also on Tuesday, crypto exchange Kraken said it received funds from the MtGox Trustee and will work to distribute funds to customers "as quickly as possible." Kraken was chosen to help support the investigation into the Bitcoins that went missing under MtGox management before the Japanese Bitcoin exchange platform collapsed in 2014.

Kraken Says Sucessfully Received Funds From Mt. Gox Trustee, Will Work to Distribute Within 7 to 14 days: Email Sent to Affected Users pic.twitter.com/OnCp8a7siM

— Tree News (@News_Of_Alpha) July 16, 2024

A bigger scare than the German dump?

There were earlier fears about the possible impact of MtGox repayments on the price of Bitcoin, given the massive amounts of Bitcoin that will be dispersed during the repayment process.

For one industry expert, the MtGox activity may have a deeper effect on the sentiment of traders than the German government's move of selling its multibillion-dollar $BTC stash in the past few weeks.

"MtGox has re-ignited the Bitcoin selloff scare in the market – a trend that might impact traders' sentiment more than Germany's selloff," Akshay Nassa, founder of fully encrypted decentralized exchange Chimp Exchange, told International Business Times.

"The repayment is imminent in the coming months, and the expectation is that beneficiaries will sell their coins as all are in profit at the moment. The market response, which saw $BTC drop from $65K to $63K, might prove more grievous if no complementary positive news hits the market soon," Nassa noted.

MtGox creditors report login issues

Aside from fears surrounding the possible selloff among creditors who receive their repayments, there have also been reports regarding login attempts on the accounts of some creditors.

Some MtGox creditors said they had trouble logging into their accounts on the MtGox website, while others said there were unauthorized log-in attempts. "Is mtgox under attack?" one creditor asked. "It seems we are re-goxxed," another said on Reddit.

Can Bitcoin prices be safe?

Amid continuing fears regarding the impact of MtGox repayments, some analysts said $BTC prices won't be affected as long as the Bitcoins are sold through an over-the-counter (OTC) deal, a method "designed not to affect the market price."

It remains to be seen how the activity of creditors will affect Bitcoin, but for now, the crypto industry may find hope in upcoming big events such as the Bitcoin 2024 conference next week that could up market sentiment.