While the S&P 500 tries to carve out a low for the year, bitcoin bumbles along.

It’s not showing any meaningful upside strength but it’s also holding above the 2022 low.

The top cryptocurrency still has its fans — like Ark’s Cathie Wood — but its lack of upside strength combined with a bear market in multiple asset classes has investors shying away from this risk-on asset.

We've seen that bitcoin seems tied more to riskier assets than to inflation measures. As growth stocks soared in late 2020 and into 2021, bitcoin did, too. Once a bear market hit equities and bonds, bitcoin tumbled. That’s even as inflation surged.

Last week, bitcoin dipped below $19,000 for several days but narrowly avoided new lows. But recent action has investors wondering whether new lows are in store.

Trading Bitcoin

Chart courtesy of TrendSpider.com

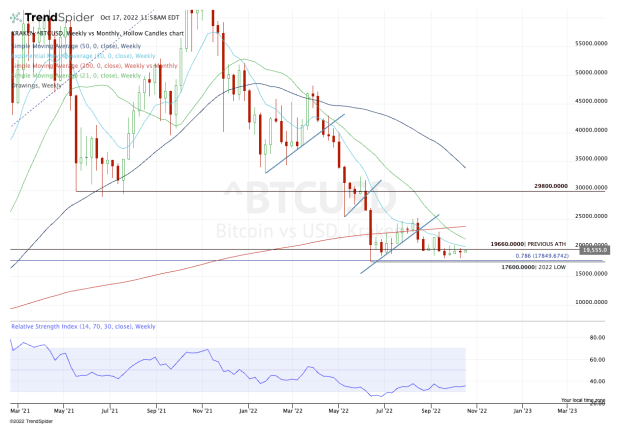

Dating back to January, each uptrend in bitcoin has broken to the downside while key support has given out.

Welcome to a bear market.

Bitcoin now finds itself below all its major moving averages and has been biding its time just below the key $20,000 level.

At the same time, it continues to hold $17,500 to $18,000 as support.

On the upside, the bulls need to see bitcoin reclaim $20,000 and the declining 10-week moving average. The latter has been active resistance since March.

If the crypto can also clear the 21-week moving average, it may have a chance at squeezing up toward the $25,000 area and the 200-week moving average.

On the downside, a break of $17,500 — and particularly a close below this level — could usher in more selling pressure.

In the past, bitcoin has tended to bottom during big, panic-driven selloffs -- not after a slow, sideways consolidation like the one we have now.

While it’s possible it does so this time, the evidence favors a larger downside flush at some point. So we can’t rule out new lows just yet — at least not until we see a new uptrend form.

If bitcoin closes below $17,500, the next support zone becomes a little harder to find. If it flushes lower, $12,000 to $15,000 shouldn’t be ruled out.