Bitcoin has weathered the storm better than many growth stocks have, but it hasn’t been immune to the volatility in the markets.

The biggest cryptocurrency is down almost 5% on Monday, heading for its fifth straight daily decline. In that stretch, bitcoin is down almost 20%. It has fallen in six straight weeks and lost 27.5%.

Coming into that six-week skid, bitcoin was actually up 1.4% on the year, (although it was down 32% from the all-time high in November).

With Monday’s tumble, bitcoin is hitting its lowest levels since last summer. It has investors wondering what’s going on with the cryptocurrency space and what’s around the corner: a rebound or a breakdown?

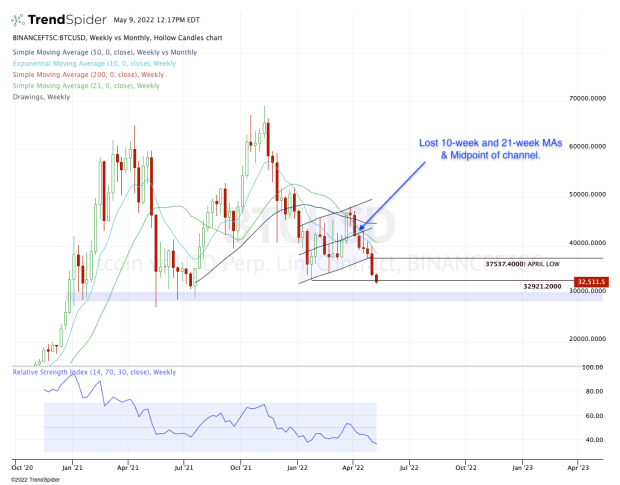

We did not necessarily foresee this skid, but we did know the key support levels that needed to hold. Once they failed, it opened the door to the lower prices we’re seeing now. Here's an update.

Trading Bitcoin

Chart courtesy of TrendSpider.com

Warren Buffett and Charlie Munger, the key principals at Berkshire Hathaway, (BRK.A) (BRK.B) clearly do not care for bitcoin, but that doesn’t mean their sentiment pervades the entire market.

But the bulls about bitcoin should respect the price action. In this case, they should have paid attention in early April. That’s when bitcoin lost the midpoint of its channel, as well as the 10-week and 21-moving averages.

Both moving averages have gone on to act as resistance.

That development was enough to be cautious but perhaps not outright bearish.

The latter sentiment came last week when bitcoin broke below channel support and the April low. As a result, it went monthly-down below $37,500 and has been free-falling since.

My first area of interest was $33,000, which is the first-quarter low and until today, the 2022 low.

If bitcoin can reclaim this level soon, bulls can use this week’s low as their stop-loss and try to ride a bounce back to the upside. Specifically, they will likely look for the $35,000 to $37,500 area.

However, if bitcoin continues to move lower it will have to lean on the key $29,000 to $30,000 support area. That was major support in January 2021 and last summer.

If it fails, we could be looking at a significant dip, potentially down into the low-$20,000 range, where bitcoin finds a major breakout level and the rising 200-week moving average.