Bitcoin and Ethereum lost ground at press time on Monday evening, as both coins failed to breach their key levels amid diminishing returns, with the global cryptocurrency market cap falling 3% to $1.25 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -3.7% | -2.4% | $29,169.44 |

| Ethereum (CRYPTO: ETH) | -3.2% | -2.5% | $1,977.84 |

| Dogecoin (CRYPTO: DOGE) | -3% | 5.5% | $0.08 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Bitcoin Gold (BTG) | +25% | $24.37 |

| TerraUSD (UST) | +11.8% | $0.0715 |

| Stacks (STX) | +9.4% | $0.61 |

See Also: Best USDC Interest Rates

What Happened: While U.S. stocks rallied on Monday, the momentum fizzled out after the closing bell. At press time, S&P 500 and Nasdaq futures were down 0.3% and 0.7%, respectively.

Risk assets like Bitcoin failed to attract investors and will remain a “choppy trade” throughout the summer, according to Edward Moya, a senior market analyst at OANDA.

“Bitcoin prices remain weak despite a broad risk rally on Wall Street. It looks like most crypto traders are hesitant to buy the dip, which most likely means that the bottom has not been made,” said Moya.

Moya said the apex coin could rebound once Wall Street believes the Federal Reserve will stop hiking rates near the 3% level.

Bitcoin Investor sentiment has hit a “rock bottom” and is at its lowest since the Black Thursday in March 2020, said Santiment on Twitter.

“Weak hands may continue to present opportunities for the patient,” said the market intelligence platform.

#Bitcoin's sentiment is at rock bottom, indicating the amount of doom and gloom surrounding $BTC and #crypto in general is at its most negative since #BlackThursday in March, 2020. Weak hands may continue to present opportunities for the patient. https://t.co/xrYR9idNXj pic.twitter.com/PKLO0d6xEO

— Santiment (@santimentfeed) May 23, 2022

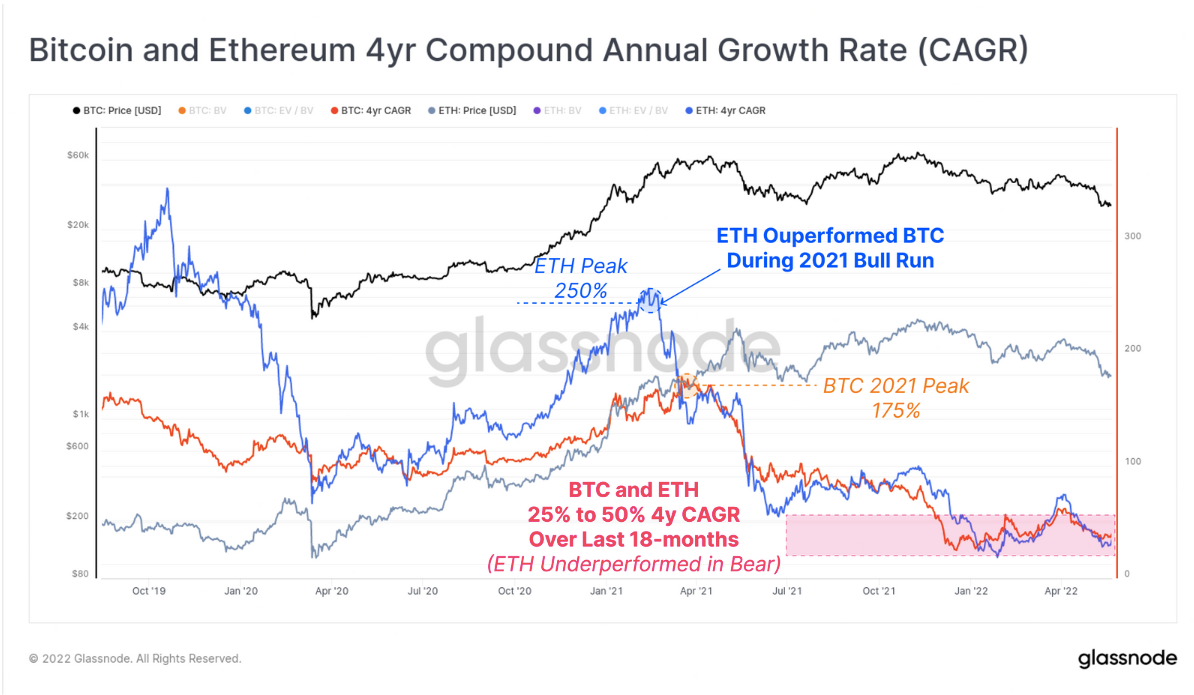

Bitcoin and Ethereum losing some sheen have taken place in the backdrop of diminishing returns, Glassnode noted in a weekly post.

The apex coin's compound annual growth rate has dropped from 200% in 2015 to less than 50%, and it has lost 1% of its market value each day over the last month alone, according to Glassnode.

The four-year CAGR for Ethereum over the last 12 months has dropped to just 28% per year from 100% per year, while Bitcoin’s has fallen to 36% per year.

The most important support level for Bitcoin is between $29,330 and $30,200, where 1.23 million addresses hold almost 850,000 BTC, chartist Ali Martinez tweeted.

Bitcoin “needs to hold above this demand wall for a chance of rebounding. Failing to do so can lead to the continuation of the downtrend,” said Martinez.

The most significant support level for #Bitcoin sits between $29,330 and $30,200 where more than 1.23 million addresses hold nearly 850,000 $BTC.#BTC needs to hold above this demand wall for a chance of rebounding. Failing to do so can lead to the continuation of the downtrend. pic.twitter.com/No086S0Jw2

— Ali Martinez (@ali_charts) May 20, 2022

Read Next: Gold Production Releases Five Times More Greenhouse Gases Into The Air Than Bitcoin Mining