KEY POINTS

- US spot $BTC ETFs hauled in $555.9 million on Monday, led by Fidelity's $FBTC

- BlackRock's Larry Fink had positive words for Bitcoin during the asset manager's Q3 earnings call

- Some analysts said there are growing signals the US regulatory environment will be more positive after Nov. 5

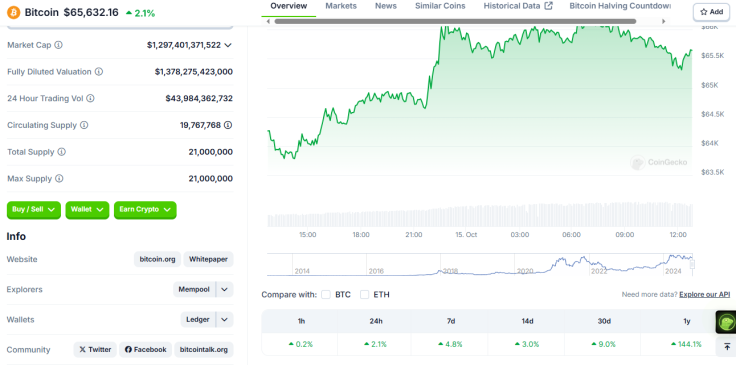

Bitcoin had a good run Monday as the world's largest cryptocurrency by market cap broke above $65,000, at one point hitting $66,000, its highest price yet in over two weeks.

Data from CoinGecko showed that at some point on Monday, BTC passed $66,000 and almost reached $66,500. The digital currency has been up by over 2% in the last 24 hours and by early Tuesday was trading at around $65,600.

The digital coin also increased by nearly 5% in the past week and has been rallying by 3% in the last 30 days. Why is Bitcoin up today?

Spot $BTC ETFs Log Biggest Inflow Day Since June

Probably the biggest driver for BTC's climb in the past day was the massive inflows logged by spot Bitcoin exchange-traded funds (ETFs), which was the funds' largest in the past four months or so.

Data from Farside Investors showed that U.S. spot BTC ETFs saw inflows totaling $555.9 million on Monday, led by Fidelity's FBTC, which hauled in $239.3 million. Bitwise's BITB was second in the running, recording over $100 million in positive flows.

BlackRock CEO's $BTC Statement

Aside from the significant Bitcoin ETF flows, there was also a statement from asset management giant BlackRock's CEO, Larry Fink, who said "we believe Bitcoin is an asset class in itself."

JUST IN: BlackRock CEO Larry Fink says "we believe #Bitcoin is an asset class in itself." pic.twitter.com/XCZT7vqY8s

— Watcher.Guru (@WatcherGuru) October 14, 2024

Fink made the bold statement during BlackRock's third quarter 2024 earnings conference call, marking what could be one of the most significant comments about BTC coming from the executive of a traditional financial institution.

Fink's statements are crucial in the digital asset's journey toward reaching its all-time-high above $73,000, especially with much expectation for October, which the crypto community calls "Uptober" due to historically positive trends during the month.

Positive Crypto Regulatory Outlook

Finally, the atmosphere around crypto regulations has been positive in recent weeks even with the U.S. Securities and Exchange Commission (SEC) pursuing its case against Ripple, the largest holder of the XRP token.

Some analysts believe Bitcoin's climb Monday can be attributed to increasing signals that the regulatory outlook for the crypto industry in the country will improve after the November elections.

A large number of Republican candidates have already publicly expressed their support for the industry's growth, while some Democrats have also been leaning on the sector in recent months.

GOP frontrunner Donald Trump has been on a wild ride in the crypto market, promising to fire SEC Chief Gary Gensler at the Bitcoin 2024 conference earlier this year, and even publicly supporting World Liberty Financial, an upcoming DeFi protocol led by his sons.

Vice President Kamala Harris, on the other hand, has finally spoken on digital asset support for the first time, with digital assets also being mentioned in her economic plan with running mate Tim Walz published late last month.

It remains to be seen how Bitcoin will move as "Uptober" moves closer to election day, but so far, it's holding the green line well and is expected to climb higher in the coming weeks.