Shares of Biogen (BIIB) are exploding higher on Wednesday, up almost 40% on the day.

The stock is soaring due to promising data from the company’s late-stage Alzheimer's drug trial.

According to Martin Baccardax at TheStreet, Biogen and “its Japan-based partner Eisai Co. Ltd. unveiled better-than-expected results from a late-stage study of their developing Alzheimer's treatment.”

This stock has put together some massive moves over the years in both directions, so to see today’s rally is not surprising. But this rally comes at an interesting time as the S&P 500 made new 52-week lows on Tuesday.

And while today’s move is impressive, it’s not quite the ~50% gain we were seeing in the premarket. It’s got investors wondering if that’s a possibility going forward.

Let’s look at the charts, as Biogen is near a key level that the bulls will want to see as support.

Trading Biogen Stock

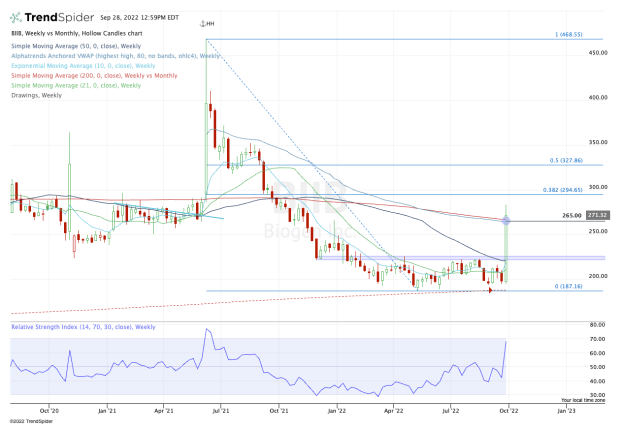

Chart courtesy of TrendSpider.com

With this morning’s surge, Biogen ripped over the $220 to $225 resistance zone, as highlighted on the weekly chart above.

The stock pushed as high as $283.44 in today’s session, short of its premarket highs and below the 38.2% retracement near $295.

One RealMoney contributor was “bearish at anything approaching $300” and that was the right call.

The $295 to $300 area would have been a tough zone to clear, but if it did so, it would open the door for Biogen to test up into the $325 to $330 area.

As it fades a bit from the high, the stock is holding its gains pretty well throughout the session.

The bulls would love to see Biogen stock hold the $260 to $265 area. That’s where we find the VWAP measure anchored back to an explosive move higher in June 2021, as well as the 200-week moving average.

A break below this zone opens the door down to $250 or potentially lower. But above $260 to $265 and the bulls are in control — at least for the short term.

If it holds and the stock rallies, watch today’s high near $283 as one upside target, then $295 to $300.