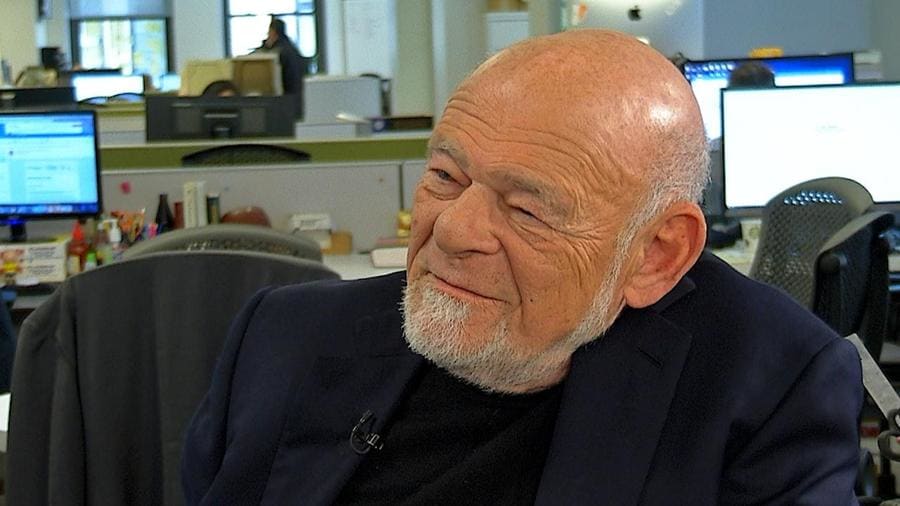

He was a legend in American capitalism.

One of the last self-made billionaires, who built his fortune with willpower and determination, Sam Zell was a legendary real estate investor who made his fortune by gambling on distressed commercial properties and turning them into winning bets.

The real estate investor died on May 18. He was 81.

"It is with great sadness that we announce that Sam Zell, chairman of Equity Group Investments, Equity LifeStyle Properties, Equity Residential, and Equity Commonwealth, died today at home due to complications from a recent illness," his company said in a statement.

His net wealth was estimated at $5.9 billion as of May 18, according to Bloomberg Billionaires Index.

Born in Chicago to immigrant parents from Poland, Zell distinguished himself from business protocols with his colorful personality. He was ubiquitous in the media, using colorful language and displaying a passion for motorcycles. This passion led him to create Zell's Angels, a group of tycoons who rode motorcycles worldwide.

'I Was Dancing on the Skeletons of Other People's Mistakes': Sam Zell

Zell's career began when he was a student at the University of Michigan: He managed the building in which he lived in exchange for free rent. He went on to manage other properties, then teamed up with a college friend, Robert Lurie. They began to acquire distressed properties, a strategy that the recession of the mid-1970s favored.

He rose to fame in 1976 when he wrote about his strategy in an article in Real Estate Review. The piece was titled "The Grave Dancer,” a nickname that stuck with him since it summed up his business philosophy.

"I was dancing on the skeletons of other people’s mistakes,” he wrote.

He earned a reputation for his ability to revive dying real estate businesses.

The risk-loving investor embarked on a series of real estate acquisitions in the 1980s and later encouraged institutional investors to pool their money to acquire commercial real estate.

At the time of his death he was at the head of a company present in real estate, radio stations, drugstores, parking lots, mattresses and Schwinn bicycles.

The year 2007 is noteworthy in Zell's career. That year he sold his company, Equity Office, to Blackstone for $39 billion. This was the largest private-equity transaction in history.

The cash he obtained in this deal enabled him to finalize a huge acquisition the same year: the leveraged buyout of Tribune Co., which owned the Chicago Tribune, Los Angeles Times, Newsday, the Chicago Cubs and a portfolio of television and radio stations.

Tribune Co. Tribulations

Zell took the company private, using a legal method that enabled him not to pay a lot of taxes. He cut thousands of jobs to make the media group profitable. He then sold some Tribune Co. assets -- the Major League Baseball Cubs and Newsday, the New York news group -- but still and all, Tribune filed for bankruptcy a year later.

Some Zell advocates blame the resounding failure on the 2008 financial crisis.

"Sam Zell was a self-made, visionary entrepreneur. He launched and grew hundreds of companies during his 60-plus-year career and created countless jobs," Equity Group Investments said.

"Although his investments spanned industries across the globe, he was most widely recognized for his critical role in creating the modern real estate investment trust, which today is a more than $4 trillion industry."

He is survived by his wife, Helen; his sister Julie Baskes and her husband, Roger Baskes; his sister Leah Zell; his three children, Kellie Zell and son-in-law Scott Peppet, Matthew Zell, and JoAnn Zell; and nine grandchildren.