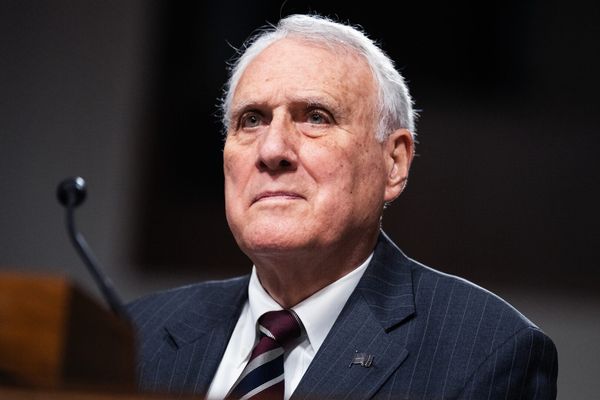

Chicago billionaire Kenneth Griffin, with his vast wealth, is a loud voice in city and state politics and issues.

When he’s not bankrolling Republican gubernatorial candidates such as former Gov. Bruce Rauner and current GOP hopeful, Aurora Mayor Richard Irvin, you might find him in front of an Economic Club of Chicago audience, threatening to relocate his $46 billion hedge fund company, Citadel, because of the city’s crime and gun violence.

“It’s becoming ever more difficult to have [Chicago] as our global headquarters, a city which has so much violence,” he said last October. “I mean, Chicago is like Afghanistan — on a good day. That’s a problem.”

Given this concern, you’d think Griffin would be outraged to learn Citadel and Citadel Securities have $86 million in investments and holdings in gun and ammunition makers, as WBEZ reported last week.

But what’s Griffin’s response? That he didn’t personally chose the stocks; and that the stocks are a tiny part of Citadel’s portfolio.

Both are true. But that response is profoundly underwhelming — at best — given the public and critical stance Griffin has taken on Chicago’s crime problem.

“You absolutely cannot be a voice about crime and murder or shootings on our streets when your company is a major investor in gun manufacturers,” the Rev. Michael Pfleger, pastor of Faith Community of St. Sabina Church, said in response to the report.

The reverend’s right.

A missed opportunity

According to the WBEZ report, also published in the Sun-Times, weapons manufactured by companies within Citadel’s portfolio account for nearly one of every four guns that were recovered by cops and used in Chicago homicides since 2017.

“Ken neither has made nor is he aware of these investments, which are smaller than infinitesimal in light of the size of our firm,” a Griffin spokesperson said.

Fair enough. Companies and individuals alike have portfolios that were purchased as a bundle, but include an assortment of companies not readily known to investors.

So for the sake of argument, we’ll give Griffin a slight pass for not knowing, although his companies list the manufacturers on its federal securities filings.

But Griffin knows now. And rather than merely address technicalities, he could use his voice and position to rise to the moment and initiate an open, honest, sorely needed dialogue about this country’s gun problem and the role played by weapons and ammunitions manufacturers.

And, heck, if he really wanted to show he was serious about it, Griffin could divest in those companies and urge others to do the same.

Scrutiny like this is often the price of admission for playing so openly in the public arena.

Sometimes the moment calls for action instead of just talk.

Send letters to letters@suntimes.com