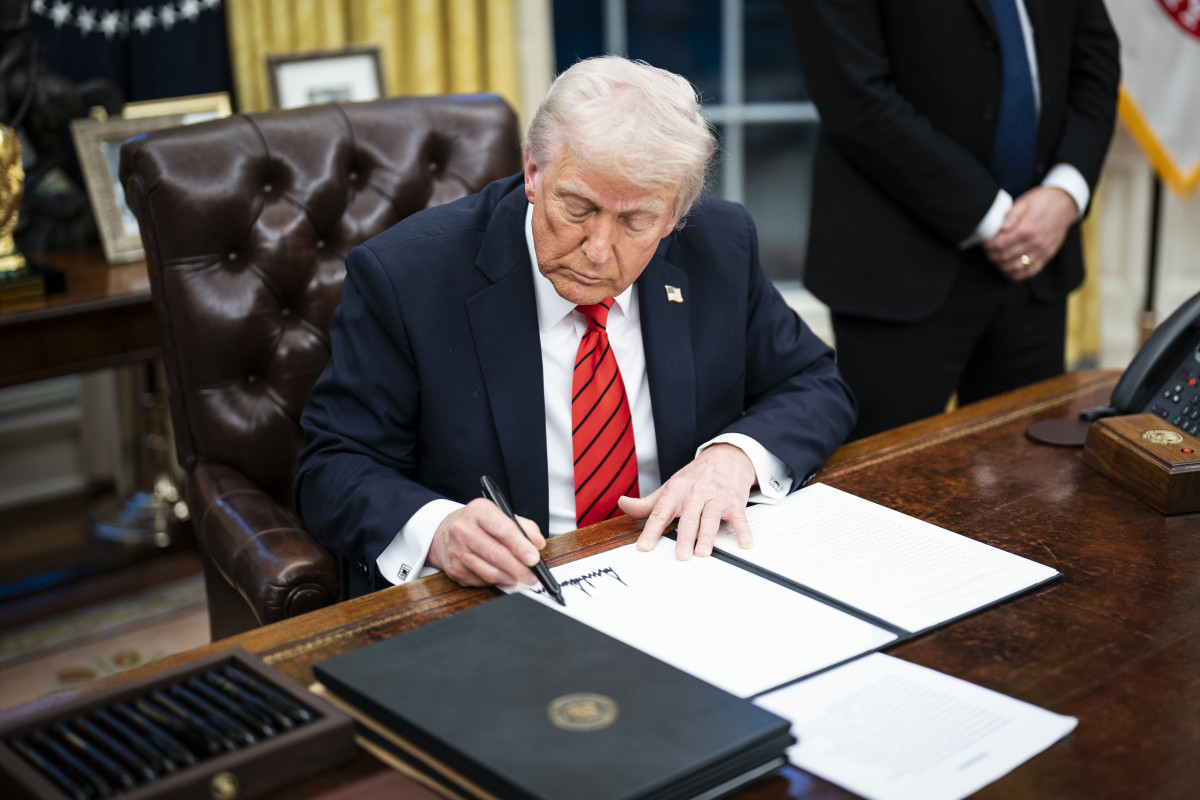

U.S. stocks face significant risks tied to President Donald Trump's trade and tariff policies, JP Morgan Chase analysts warned Tuesday, as the domestic economy slows and earnings forecasts falter.

The S&P 500 extended declines from its biggest decline of the year Tuesday, and as given back all of its Election Day advance, following President Donald Trump's decision to impose 25% tariffs on goods from Canada and Mexico and an additional 10% duty on imports from China.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

Each of the U.S.'s biggest trading partners responded with retaliatory levies on American-made goods, some of which will be imposed over the coming weeks, but the collective tariff impact is likely to hit nearly $2.2 trillion of global trade over the coming months.

The President is also planning so-called reciprocal tariffs on U.S. trading partners, starting next month, and he unveiled new export levies on American agricultural exports that will begin in early April.

"Investors are catching on to our months-long conviction that the Trump administration’s flavor of economic nationalism would be implemented," said Lauren Goodwin, economist and chief market strategist at New York Life Investments.

Related: U.S. consumers are wilting under renewed stagflation risks

"Though we cannot know the exact end game of changes to trade, immigration, spending, and foreign policy, the direction of policy change is clear: We believe the balance of economic policies put in place will result in slower growth and higher inflation."

BlackRock's Trade Policy Uncertainty Index, which tracks media coverage of tariff policies, this month is at the highest levels in six decades.

"Tariffs of these magnitude will drive both Canada and Mexico into a recession," JP Morgan analysts wrote in their daily Tuesday note, adding that U.S. growth and domestic stocks will also suffer from the added costs and supply-chain disruptions tied to the president's tariff strategy.

JP Morgan 'tactically bearish' on U.S. stocks

"Look for US GDP growth expectations to crater and for earnings revisions to be materially lower, forcing a rethink of year-end forecasts," JP Morgan analysts warned.

The bank also changed its overall market view to "tactically bearish," down from its previous outlook of "neutral."

Growth pressures are already starting to mount; The Institute for Supply Management's benchmark survey of manufacturing activity for last month held barely above the 50-point mark that separates growth from contraction, amid the biggest decline in new orders in more than two years.

Soft-data indicators on the consumer side, meanwhile, show declining sentiment and surging inflation expectations tied to tariff and job market concerns.

Related: Fed inflation gauge indicates big changes in key economic driver

The Atlanta Fed's GDPNow tracker suggests a current-quarter contraction of 2.8%, a nearly four-point swing from last week's update and a worrying indication that the economy faces recession risks tied to the president's policies.

Since the start of the year investors have also been marking down first-quarter and full-year earnings forecasts, seen as the most-important driver of stock market performance.

LSEG data suggest S&P 500 earnings will rise around 8.1% from 2024 to a collective total of $508.8 billion, but that's down from an early January forecast of 12.2% growth.

For the full year, LSEG data suggest overall S&P 500 earnings growth of 10.8%, down from the 14% estimate published on Jan. 3.

Rough road ahead for earnings growth

Both outlooks follow one of the strongest fourth-quarter-earnings seasons in two years, where collective profits rose 15% and topped Wall Street forecasts by around 6%, according to data from Bank of America.

"But the road ahead gets tougher," said Jeffrey Buchbinder, chief equity strategist for LPL Financial. "With new tariffs in place and more likely on the way, on top of mounting evidence that the U.S. economy is slowing, achieving double-digit earnings growth in 2025, as many expect, will be a tall task."

"Upside could come from an AI-productivity boost or continued margin improvement, while downside could come from harder-hitting tariffs and more retaliation from our trading partners," added Buchbinder, who forecasts S&P 500 earnings growth of between 8% and 9% for the year.

Related: Target issues stark warning following solid Q4 earnings

Target Corp. (TGT) has already warned investors that profit margins are likely to narrow as a result of tariffs on Canadian and Mexican supply chains, with CEO Brian Cornell adding that price increases could come "within a couple of days."

Consumers are braced for that, as well as other tariff impacts, according to data from a Morgan Stanley survey published Tuesday.

The poll of around 2,000 American consumers found a "marked deterioration in consumers’ outlooks for the US economy and their own household finances."

"Only 38% of respondents expect the economy to get better in the next six months (while) 48% expect the economy to get worse,” the bank noted.

Possible tailwinds for the stock market

Stocks could see some tailwinds from the current market reaction, however. The U.S. dollar has fallen to the lowest levels since early December against a basket of its global peers, and Treasury yields are retreating hard on accelerated bets for more Federal Reserve interest rate cuts over the back half of the year.

More Wall Street Analysts:

- Analyst revisits Palantir stock forecast after annual report filing

- Veteran analyst sounds the alarm on Google and Mag 7

- Veteran stock analyst delivers blunt 3-word message on tariffs

Jean Boivin, who heads BlackRock's Investment Institute, remains bullish on U.S. stocks even amid the heightened policy uncertainty, but he said he's "ready to pivot" should conditions worsen.

"The AI theme and strong earnings give us more tactical conviction in U.S. stocks, even as the runup of U.S. stocks to record highs has shined a spotlight on historically rich valuations by most gauges," he said.

"While some of the incoming information on U.S. policy has been noisy, we expect that to become a concrete signal to adapt to," he added.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast