The crypto industry has never been more sharply in the crosshairs of regulators than it has this year.

The major regulatory offensive is especially visible in North America. In the U.S. the Securities and Exchange Commission has threatened legal action against various players. Even Coinbase (COIN), the most popular U.S. cryptocurrency exchange, is not immune to the regulator's crusade.

In March, the SEC sent the platform a so-called Wells Notice, a signal that the regulator might sue Coinbase, alleging violations of the federal securities laws.

The dispute between the two concerns the legal qualification of cryptocurrencies. The SEC has indicated that excluding bitcoin, most cryptocurrencies and crypto-related products are securities, which would give the regulator a lot of power over the industry.

A security is, according to the agency, "an investment of money, in a common enterprise, with a reasonable expectation of profit derived from the efforts of others.”

Canada Bars Investors From Buying Stablecoins

The SEC refers to a Supreme Court judgment from 1946, the Howey Test, that sets out what an investment contract is and what makes it subject to U.S. securities laws. An investment contract exists if money is invested with an expectation of profits.

Tokens, also called coins, until now have not been considered securities. This means that they escape strict regulatory supervision and are not subject to the same rules of financial transparency and disclosure, as, for example, shares in a company are. The listing process for tokens is also less strict than that for securities.

Coinbase, like other crypto players, rejects the SEC's approach, which says its goal and concern is to protect investors and the public. Protecting retail investors from scams is also the argument of the Canadian authorities to tighten up their crypto regulation.

In February, Ottawa warned crypto players that they would have to abide by "enhanced investor protection commitments" to operate in the country. These commitments are made in the form of a pre-registration with the authorities while waiting to obtain the license.

"Recent insolvencies involving several crypto asset trading platforms highlight the tremendous risks associated with trading crypto assets, particularly when conducted on unregistered platforms based outside of Canada,” Stan Magidson, chairman of the Canadian Securities Administrators and chairman and chief executive of the Alberta Securities Commission. explained at the time

The pre-registration includes enhanced expectations regarding the custody and segregation of crypto assets held on behalf of Canadian clients and a prohibition on offering margin, credit, or other forms of leverage to any Canadian client.

Crypto platforms are also asked not to allow clients to purchase or deposit stablecoins and proprietary tokens without the prior written consent of the CSA. They had 30 days to regularize their situation from the publication of the official notice.

New Rules Prompt Binance to Leave Canada

These draconian rules have just persuaded a big player in the crypto industry to leave the country.

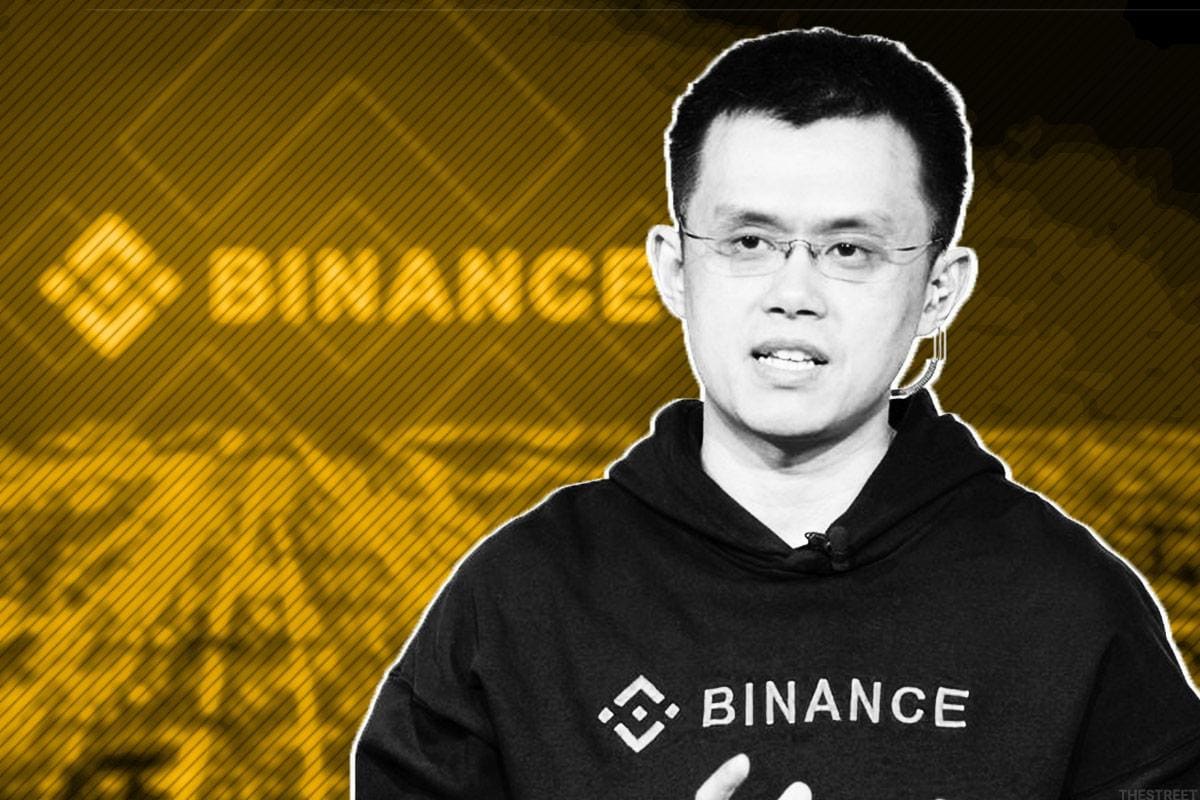

Binance, the largest exchange for bitcoin and other digital currencies, is exiting the Canadian market. The platform, whose founder and CEO, Changpeng Zhao (aka CZ), is Canadian, says his departure from the country stems from the new regulations.

"Unfortunately, today we are announcing that Binance will be joining other prominent crypto businesses in proactively withdrawing from the Canadian marketplace," Binance said on May 12. "We would like to thank those regulators who worked with us collaboratively to address the needs of Canadian users."

It continued: "Albeit a small market, it [Canada] held sentimental value for us as the home country of our founder. We had high hopes for the rest of the Canadian blockchain industry.

"Unfortunately, new guidance related to stablecoins and investor limits provided to crypto exchanges makes the Canada market no longer tenable for Binance at this time. We put off this decision as long as we could to explore other reasonable avenues to protect our Canadian users, but it has become apparent that there are none."

Binance does not rule out returning to the Canadian market one day.

"While we do not agree with the new guidance, we hope to continue to engage with Canadian regulators aimed at a thoughtful, comprehensive regulatory framework," the platform said.

"We are confident that we will someday return to the market when Canadian users once again have the freedom to access a broader suite of digital assets."

The firm said its Canadian users would receive instructions on how the decision will affect their accounts.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.