Best Buy (BBY) stock is trying to rally on Tuesday, after the electronics retailer reported earnings before the open.

At one point, the shares were up 7.6% on the day, but like the overall market, Best Buy is fading from its session highs.

Unlike the S&P 500, though — which has now turned negative on the day — Best Buy stock is still up more than 3%.

As reported, “back-to-school sales were running ahead of expectations,” while the retailer delivered a top- and bottom-line earnings beat.

Not all was perfect. Earnings fell almost 50% year over year, while revenue dropped 13%. The company also withdrew its fiscal 2025 guidance due to macro uncertainty.

As one Real Money contributor said, “This is probably going to be a tough time for Best Buy.”

But what do the charts tell us?

Trading Best Buy Stock on Earnings

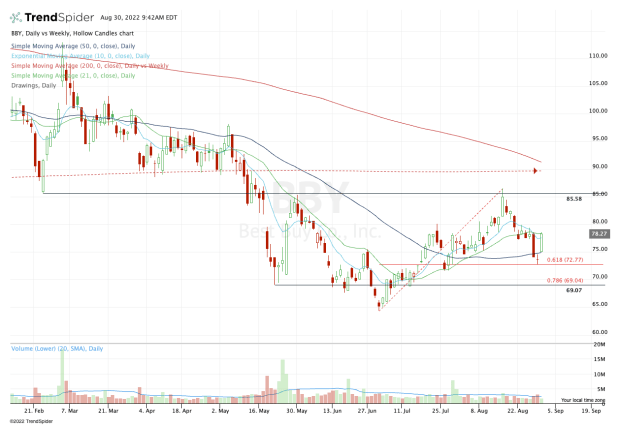

Chart courtesy of TrendSpider.com

On the chart above Best Buy stock has an important $2 range, between $77.50 and $79.50.

Not only has that zone been support and resistance over the past few days, it’s also where the stock finds its 10-day and 21-day moving averages.

If Best Buy can push through this area and clear $80, it stands to reason that it can climb back to the $85 region. Above that opens the door to the 200-day and 200-week moving averages, which come into play around $90.

The only issue? Clearing the $77.50 to $79.50 zone.

At today’s high, Best Buy stock traded $79.31. Now the stock is struggling with this area, trading around $76. That means we have to be very aware of the downside possibilities here, too.

The first level of interest is $75. Not only does that level come into play near today’s low, but it’s also near the 50-day moving average.

If it fails to hold, that brings up $72.75. That level marks this week’s low — and a sessions where we had a doji candlestick on Monday — as well as the 61.8% retracement of the current range.

Lastly, if that area fails as support, then $69 is in play. This level is a general area of support, as well as the 78.6% retracement of the recent rally.

If all these marks fail, then it could usher in a test of the 2022 low at $64.29.

In a time like this, it’s important to play defense before offense, and Best Buy stock is no exception.