Kansas City-based James B. Nutter & Co., one of the nation’s largest private mortgage lenders that since its founding in 1951 helped hundreds of thousands of Americans buy their first homes, has announced that it is going out of the home loan business.

The news comes as the company enters the third year of a costly legal battle with the U.S. Department of Justice over Nutter’s alleged mishandling of so-called reverse mortgages.

The government sued Nutter in September 2020, alleging that the company engaged in fraudulent and deceptive practices in originating the federally backed mortgages. The lawsuit said that involved forging signatures to make it seem like qualified underwriters approved the loans when in fact they were not qualified.

The alleged misconduct occurred from 2008 to 2010, the suit said, and resulted in the Federal Housing Administration paying out tens of millions of dollars in mortgage insurance claims on properties that were worth less than the amount of the loan.

The company continues to deny wrongdoing and predicts it will prevail in court in a case that could stretch on for years.

“Since the complaint was first filed in September 2020, Nutter has maintained that the Justice Department’s allegation are completely meritless,” said Jim Nutter Jr., the company’s’ president and CEO, in a written statement provided to The Star.

“Moreover, nowhere does the complaint allege that any of Nutter’s borrowers were ineligible or unqualified to receive any loan, nor that any action taken by Nutter hurt any borrower, in any way.”

The lawsuit and the company’s decision to go out of business are not unrelated, according to two sources close to the family who spoke on the condition of anonymity. Jim Nutter Jr. has been experiencing health issues, they said. Along with the stress brought on by the lawsuit, that contributed to his decision to withdraw from the mortgage industry and begin closing down the business.

In a business sector where companies that originate loans often sell them off to other lenders for collection, Nutter was atypical. If you got your loan from Nutter, that’s who you sent your monthly check to until the loan was paid off. The company serviced almost all of its own loans until this past spring.

Nationwide reach

At its peak, Nutter serviced $7 billion in loans on homes in all 50 states and was one of the top 100 mortgage companies in the country, a company spokesman said.

“Where the company ranks now, we frankly don’t know,” the company said in response to questions from The Star.

James B. Nutter & Co re-branded as Nutter Home Loans in 2019 and a year later announced “an alliance” with Tamara Day, the Kansas City-based star of TV’s “Bargain Mansions” home remodeling show on HGTV. As the company’s spokesperson, Day endorsed Nutter as a source of funding for home remodeling projects and her photos are featured prominently on the lender’s website.

Nutter Home Loans stopped originating loans on Oct. 20. Other than a small group of workers that will remain, most of the company’s 125 employees will be laid off.

“We are currently working diligently to take great care of our many loyal and longtime employees by providing them with well-earned severance pay and access to professional outplacement services that will allow them to pursue other career opportunities,” Jim Nutter Jr. said in his written statement.

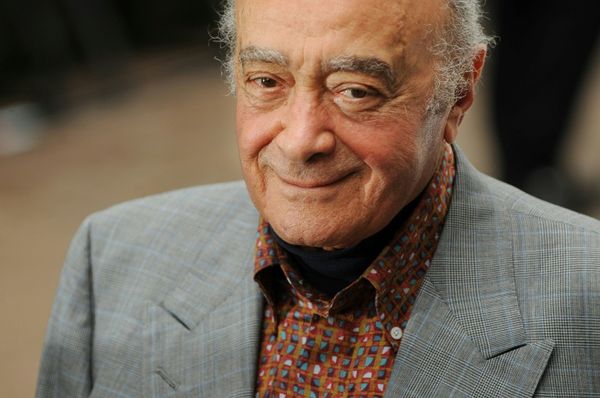

His father, James B. Nutter, founded the company in the post-World War II era by making home loans out of his apartment in Kansas City at a time when the demand for housing was soaring.

Nutter & Co. was among the first mortgage companies to offer Veterans Administration loans and developed a method for efficiently dealing with all the red tape that had other companies avoiding Federal Housing Administration loans.

The company’s founder also took pride in making home loans within minority neighborhoods when other lenders avoided those areas, but did not get caught up in the subprime mortgage mess.

“We lost market share because we didn’t make those horrible loans, because it was wrong,” the senior Nutter told The Star in 2012.

When Nutter died in 2017, former Ivanhoe Neighborhood Council executive director Margaret May praised him for his commitment to predominantly Black neighborhoods like hers, for not only helping people become first-time home owners but also in supporting underprivileged areas with charitable gifts.

“He was a good man. He was a friend of Ivanhoe,” she said at the time. “When you give your money and your time ... on numerous occasions, when we had special events, he’d be right there.”

The company was a pioneer in initiating the government’s reverse mortgage program when it started in 1989. Reverse mortgages allow homeowners 62 and older to get loans roughly equal to the equity they have in their homes so they can afford to stay in them until they die.

The money helps many seniors pay rising tax and insurance bills on their homes at a time in life when they often have less income. The loans are paid off when the house is later sold.

The company maintains that it did not abuse the program and claims the government’s lawsuit was an overreach.

‘Sign of the times’

David Westbrook, a former public relations executive and longtime friend of the Nutter family, said he’s sad to see the company come to an end, but that the company’s namesake left a positive legacy.

“He made it possible for the average consumer to get a first-time loan that they otherwise probably wouldn’t have got,” Westbrook said.

Privately owned companies like the one James B. Nutter started, Westbrook noted, are becoming rarer all the time.

“Their withdrawal from this business is a sign of the times because the industry has consolidated so much that the big players are the only ones who remain, and that’s sad,” he said.

Many of Nutter’s loans are being shifted to those big players. Stacy Ford, who lives in a suburb of San Antonio, Texas, told The Star that she and her husband had a mortgage through Nutter when they bought their first house in 2004 and that her parents had been doing business with Nutter for 30 years.

She valued the longstanding business relationship. But when the Fords sold their house and bought a new one this summer, they again financed it through Nutter, only to learn that Nutter immediately sold their mortgage to Planet Home Lending LLC, which as of Sept. 30 had $62 billion in its loan portfolio.

A Nutter loan officer told her in an email that the company began selling off mortgages last spring in order “to remain viable” due to the volatility in the market.

“We had to do this because the rate we were offering at application had increased so much by the closing that we were losing money on almost all loans that we closed for a period of time,” the loan officer wrote.

The company said on Friday that it has not sold all of its loans yet and is working with potential buyers to ensure that Nutter loans will be given “the best and most professional level of care.”

Borrowers will be given 15 days notice, as required by law, before their loans are transferred. The company said the Nutter family will remain active in other business and civic interests in the community.