Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending Dec. 6:

Protara Therapeutics (NASDAQ:TARA): Protara shares soared on the week after the company reported Phase 2 results from its ADVANCED-2 trial. The trial, which is for TARA-002 which targets invasive bladder cancer, showed a complete response for many patients.

The company reported the results at the 25th Annual Meeting of the Society of Urologic Oncology. Protara will report the data from 12-month evaluable patients for the trial in mid-2025.

"We believe these encouraging data together with our international site expansion will accelerate patient enrollment, and we look forward to reporting initial data from 12-month evaluable patients in mid-2025," Protara Therapeutics CEO Jesse Shefferman said.

The Benzinga Pro chart below shows the soaring price of the stock during the week. Protara shares are up over 180% year-to-date in 2024.

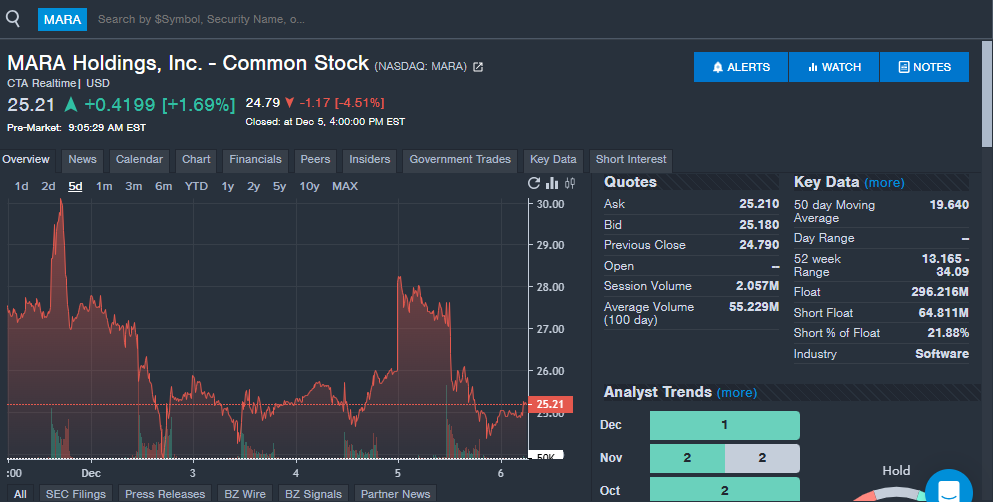

MARA Holdings (NASDAQ:MARA): The price of Bitcoin (CRYPTO: BTC) soaring past $100,000 and company updates helped MARA Holdings see strong interest from readers during the week. The company recently shared it mined 907 Bitcoin in November, up 26% month-over-month. In 2024, the company has mined 8,563 Bitcoin.

"November was a record-breaking month for MARA, with our mining operations achieving unprecedented levels of production driven by the successful deployment of additional miners and enhanced operational efficiency," MARA CEO Fred Thiel said.

The company also announced plans to offer $700 million of 0% convertible senior notes that it will use to buy existing convertible notes and acquire additional Bitcoin. The convertible note strategy to buy additional Bitcoin is similar to what MicroStrategy Inc (NASDAQ:MSTR) has been doing.

MicroStrategy Chairman Michael Saylor said MARA is a "company on the Bitcoin Standard."

As of Nov. 30, MARA held 34,959 Bitcoin, making it one of the largest holders among public companies.

The Trade Desk (NASDAQ:TTD): Merger speculation with Roku Inc (NASDAQ:ROKU) saw Trade Desk shares jump on the week and gain interest from Benzinga readers.

Guggenheim analysts laid out the case for a merger between the two companies that would combine Trade Desk's advertising platform with Roku's streaming footprint and make a juggernaut in the connected television space. Guggenheim analysts said the benefits of the merger would outweigh any risks and would make the combined company a better competitor against the likes of Amazon and Alphabet.

Merger speculation comes less than a month after Trade Desk unveiled its Ventura streaming operating system, which it plans to deploy in collaboration with smart TV manufacturers. Ventura is expected to roll out as early as 2025.

The Trade Desk recently saw several analyst notes, including Scotiabank initiating coverage with a Sector Outperform rating and $133 price target. Macquarie maintained an Outperform rating and raised the price target from $133 to $150. Evercore ISI maintained an Outperform rating and raised the price target from $110 to $135.

SoundHound AI (NASDAQ:SOUN): The artificial intelligence-related company saw increased interest from readers during the week, which comes with shares up over 500% year-to-date in 2024.

Shares traded higher after the company announced the deployment of its voice AI Smart Ordering system at additional restaurants. The company's AI-powered restaurant solutions are in use at more than 10,000 locations around the world, with the technology helping with phone, kiosk, drive-thru and headset ordering systems. The company also recently said its Amelia conversational AI agent has handled over 100,000 customer calls in 2024, helping with operational efficiency for customers.

SoundHound shares continue to trade higher in 2024 and are up over 60% on the week, which comes shortly after the company reported third-quarter financials in November. The company raised its full-year revenue outlook for both 2024 and 2025 and the stock will be closely monitored by investors going forward.

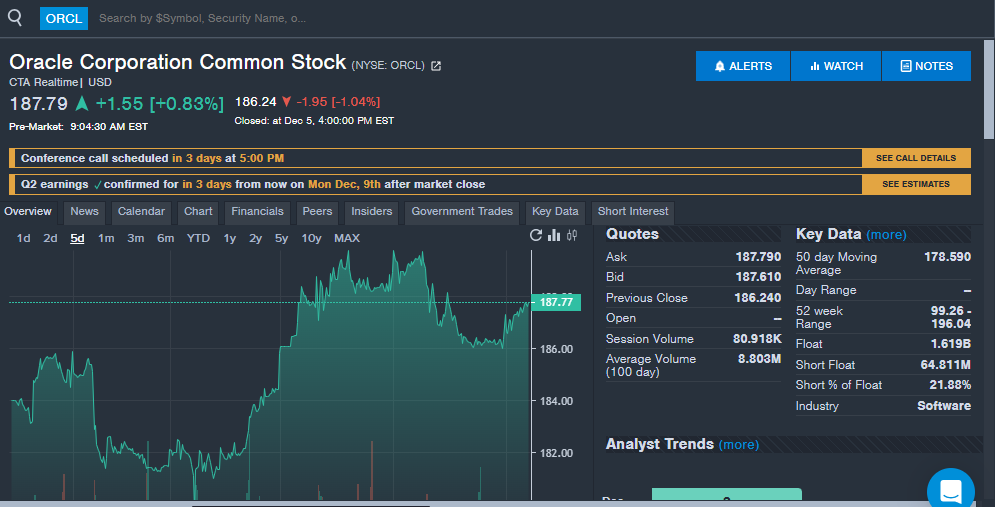

Oracle Corporation (NYSE:ORCL): Another stock seeing strong interest from investors is Oracle, which comes ahead of the company's second-quarter financial results.

Oracle will report second-quarter results Monday after market close. Analysts expect the company to report earnings per share of $1.48, up from $1.34 in last year's second quarter. The company has beaten analyst estimates for earnings per share in eight straight quarters. Analysts expect the company to report quarterly revenue of $14.1 billion, up from $12.9 billion in last year's second quarter.

While the company has a recent string of beats for earning per share, it has struggled beating revenue forecasts. The company has beaten analyst estimates for revenue in only four of the last 10 quarters.

Wedbush analyst Daniel Ives recently said Oracle is set to benefit from the "AI revolution" in 2025. Analysts have been raising their price targets on Oracle stock ahead of the quarterly financial results.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: