It’s been a while since we’ve talked about Reddit-fueled short-squeeze stocks, and for good reason. The bear market has throttled growth stocks, with many tumbling by 70% to 80% or more.

But short-squeeze stocks have been making a comeback lately. A strong post-earnings bullish response late last week in AMC Entertainment (AMC) helped set the tone.

We’re seeing upside follow-through on Monday, with home-goods retailer Bed Bath & Beyond (BBBY) surging 64% at one point on Monday and GameStop (GME) climbing 20% at one point in the session. Both stocks are working on their ninth straight daily rally.

Bed Bath & Beyond has been the clear leader. At today’s high, the shares doubled from Friday's open and almost tripled from their low on July 27. GameStop is up just (!) 50% in its current rally.

Now Bed Bath stock is being rejected from a key area on the charts. Let's go deep.

Trading Bed Bath & Beyond Stock

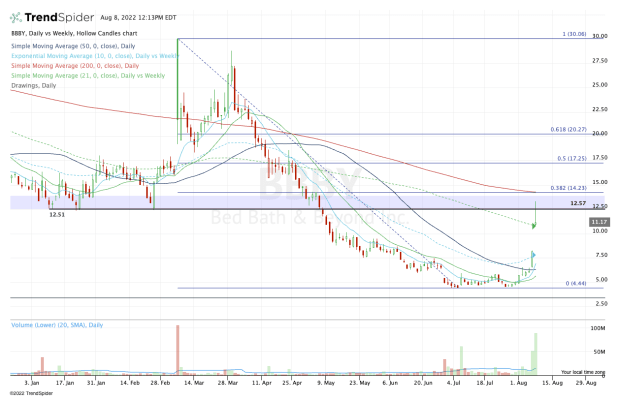

Chart courtesy of TrendSpider.com

First, the environment has sharply changed. When the original short-squeeze trade got started, we were in the midst of a full-blown bull market.

With the short-squeeze trade triggering again, we’re in the midst of a powerful bear-market rally — and we’re in it until a new uptrend forms.

Today’s gap-up put Bed Bath & Beyond above the 21-week moving average and even momentarily sent it above $12.50, which was a key support zone in the first quarter. Once that failed, in May, it’s been a painful decline down to the mid-$4 range.

Bed Bath & Beyond stock is now fading from $12.50. But if it can hold above the $10 level and 21-week moving average, the bulls have a chance at taking the shares higher.

The prudent thing to do for most traders who came into Monday already long Bed Bath & Beyond stock would be to take at least some profit on the move.

Should the shares break lower, the gap-fill level near $8.30 and the 10-week moving average could be in play.

But should Bed Bath & Beyond stock continue higher, there are clear levels to watch on the upside. Back above $12.50 puts this week’s high in play at $13.34.

Above that and the 200-day moving average and 38.2% retracement are on the table near $14.25.

Clearing that level unlocks more upside. Specifically, the 50% retracement at $17.25 and the 61.8% retracement near $20 stand out.

The biggest question is: Will the squeeze continue? It’s hard to know when these moves will fizzle out, but in this climate, it’s hard to be overly optimistic.

Traders should use caution if Bed Bath & Beyond reverts back below $10.