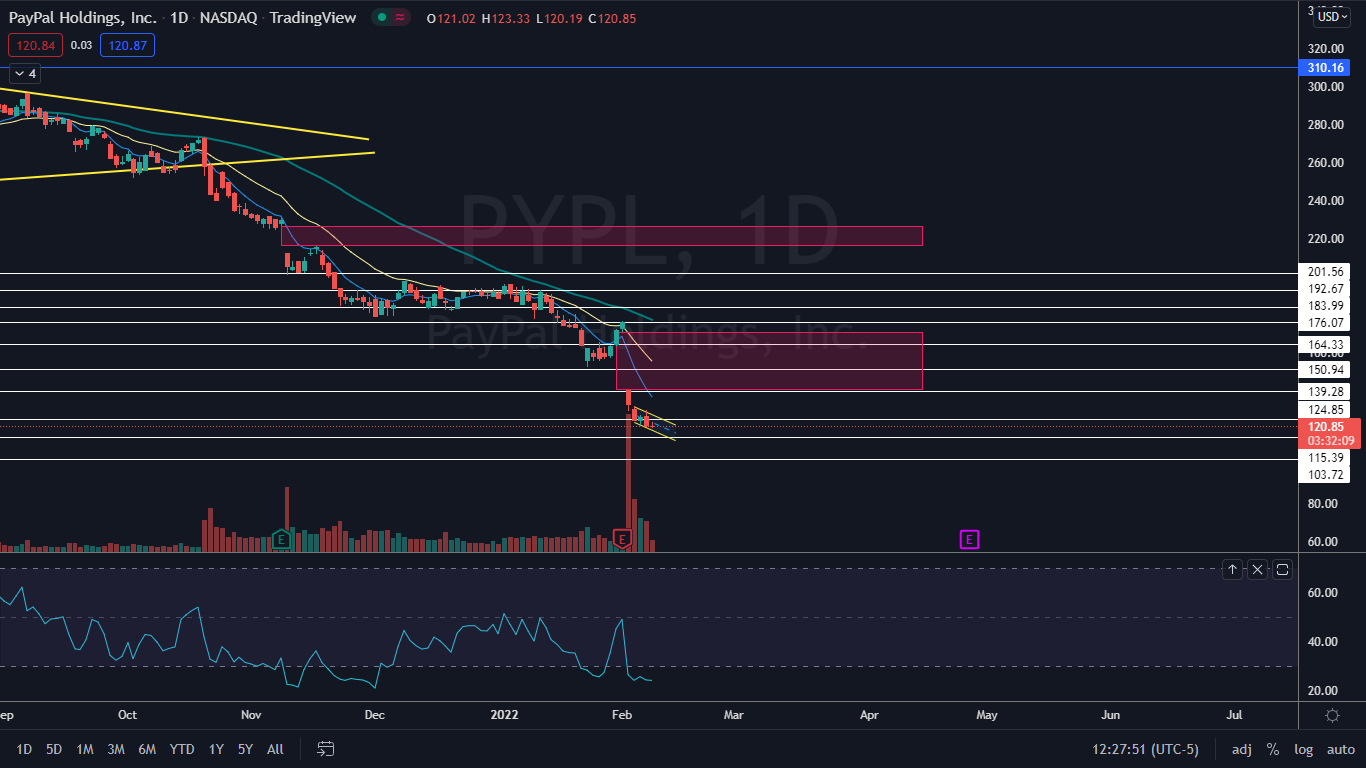

PayPal Holdings, Inc (NASDAQ:PYPL) was falling to a new 52-week low on Tuesday, dropping 1.75% to 119.28 by the afternoon. The move comes after the stock lost over 25% of its value on Feb. 1 due to a bearish reaction to its mixed fourth-quarter earnings print.

The stock has declined about 60% from its July 26, 2021 all-time high of $310.16 and is now trading at its lowest point since May 2020.

PayPal’s President and CEO Daniel H Schulman appears to believe the stock is trading at a discount and on Monday purchased $1 million worth of PayPal’s stock. The insider bought 7,994 shares at a price of $124.57. When PayPal dropped to its 52-week low on Tuesday, Schulman would have been down over $35,000 on his investment.

There are signs PayPal may reverse course to the upside in the near-term, however, whether the upside is merely a bounce or a reversal into a long-term uptrend will take some time to be determined.

See Also: Why Is Long-Time-Backer Peter Thiel Departing Facebook-Parent Meta's Board?

The PayPal Chart: PayPal may be forming a falling channel on the daily chart. A falling channel is considered to be bearish because the stock is likely to continue to make lower highs and lower lows within the pattern. When a stock breaks bullishly through the upper descending trendline of the pattern, however, it can be a strong reversal signal and combined with other indicators, PayPal may breach the pattern over the coming days.

PayPal’s relative strength index (RSI) is measuring in at about 24%. When a stock’s RSI reaches or falls below the 30% level, it becomes oversold, which can be a buy signal for technical traders. When PayPal’s RSI fell to the 26% level on Jan. 26, the stock shot up over 13% over the five trading days that followed.

On Tuesday, PayPal looked to be printing an inverted hammer candlestick. When an inverted hammer candlestick is found at the bottom of a downtrend it can signal a reversal to the upside is in the cards, although it is a lagging indicator, which means Wednesday’s candle will be needed for confirmation.

PayPal has two gaps above on its chart, with the first appearing between $139.90 and $170.53 and the second between the $215.97 and $226.25 range. Gaps on charts fill about 90% of the time, which makes it likely PayPal will eventually trade up to fill both ranges.

PayPal is trading below the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending below the 21-day, both of which are bearish indicators. The stock is also trading below the 50-day simple moving average, which indicates longer-term sentiment is bearish.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

- Bulls want to see big bullish volume come in on Wednesday to bring the stock price higher and confirm the inverted hammer candlestick. There is resistance above at $124.85 and $139.28.

- Bears want to see big bearish volume come in and drop PayPal down below a support level at $115.39. Below the area, there is further support at $103.72 and the important psychological level of $100.

Photo: Courtesy of Diverse Stock Photos on Flickr