Martin Weale, a member of the Monetary Policy Committee, has poured cold water on the idea that the Bank of England should cut interest rates next month to help cushion the economy in the wake of the shock Brexit vote.

In comments that fracture the impression of unity on the MPC, Mr Weale said he was not convinced more monetary easing was needed to support demand in the economy after the 23 June referendum.

“I do not have any sense that either consumers or business are panic-struck and…there have been no material signs of financial panic” he said.

Mr Weale, who has been in an MPC minority at points in recent years calling for rates to rise, also dismissed the idea that the fact financial markets are pricing in stimulus next month means it would be unwise for the Bank not to deliver.

“The Old Lady of Threadneedle Street is not a nurse to markets” he said.

“People who trade in markets know that the Monetary Policy Committee sets policy month by month in the way that its members think appropriate.”

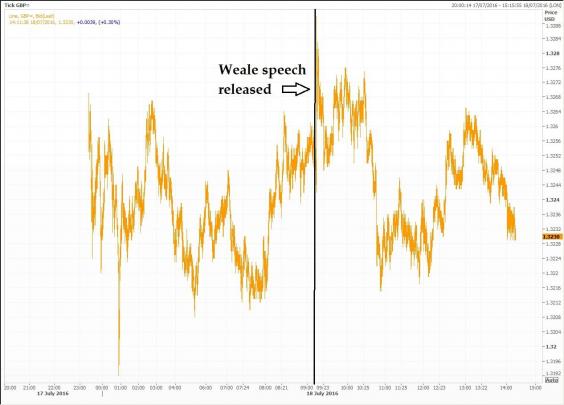

News of Mr Weale’s words helped push sterling to $1.3292 at 9.15am, up from $1.3245 shortly earlier.

Support for Sterling

"This morning’s development suggests a rates cut in just under three weeks’ time may not be as much of a foregone conclusion as some believe at present” said David Cheetham of XTB.

However, August will be Mr Weale’s last month on the MPC, before he is replaced as an external member by Michael Saunders, formerly of the global bank Citi, meaning traders are likely to have somewhat discounted his influence. Sterling subsequently fell back to $1.3234 in afternoon trade.

Mr Weale’s stance certainly represents a stark contrast with the dovish tone adopted by the Bank of England Governor, Mark Carney.

In the wake of the referendum vote Mr Carney helped calm equity markets by saying further action was “likely” over the summer.

Minutes of the MPC’s meeting last week showed members voted by 8 to 1 in favour of keeping rates on hold, but said “most members of the Committee expect monetary policy to be loosened in August.”

Another external member, Gertjan Vlieghe, was in favour of an immediate 0.25 per cent cut in the cost of borrowing.

Andy Haldane, the Bank’s chief economist and MPC member, said last week that he was in favour of “prompt and muscular” action to stimulate the economy.

One survey of consumer confidence, the GfK barometer, showed the biggest drop in the index since 1994 in the wake of the Brexit result. But Mr Weale said that the relationship between this particular indicator and subsequent consumer behaviour had weakened in recent years meaning “it is not clear that it provides a useful signal”.

Mr Weale also said that recent average wage growth at an annual rate of 3.5 per cent “becomes an argument for not making” another cut in the Bank’s base rate from its historic low of 0.5 per cent.