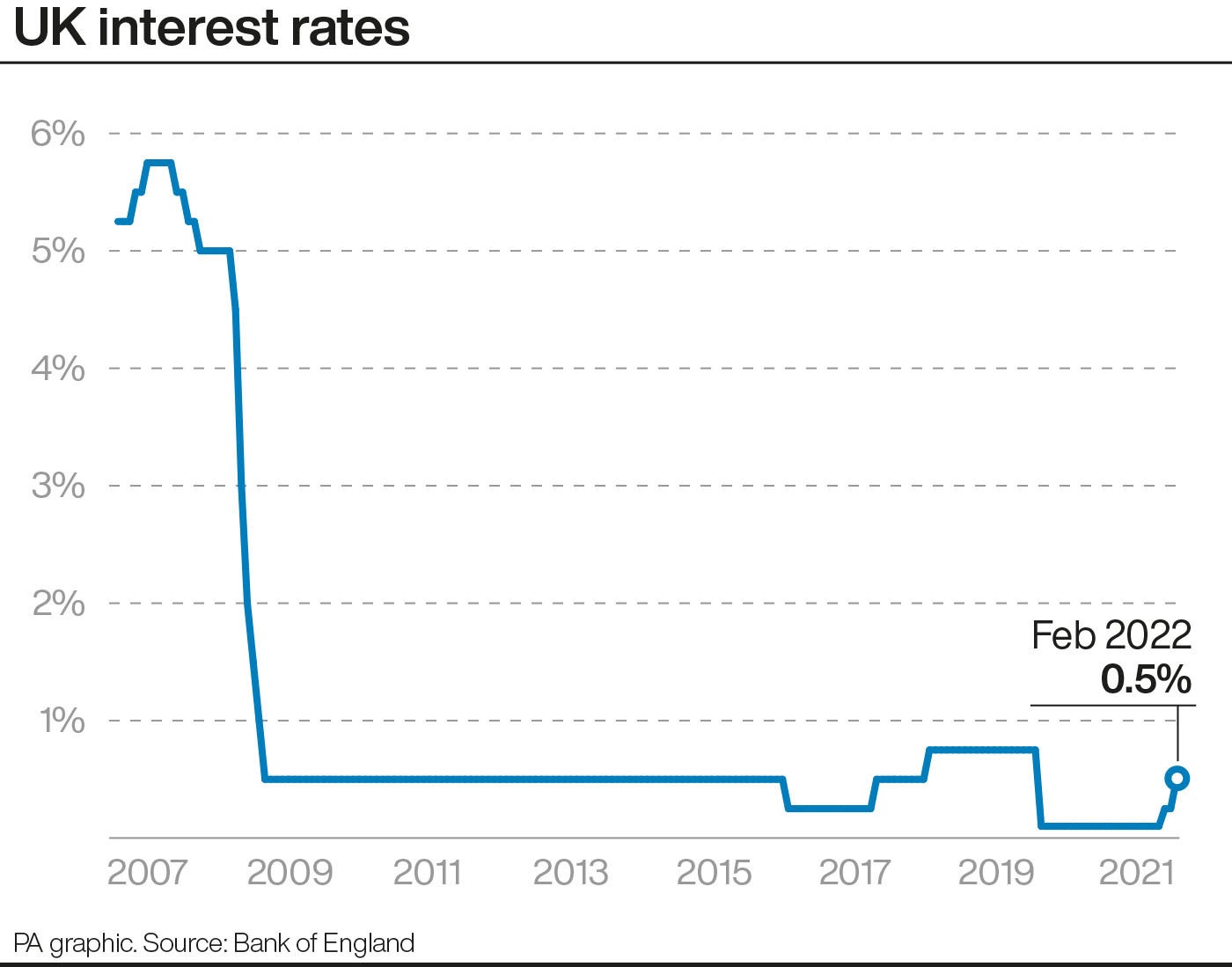

The Bank of England has raised interest rates to 0.5% and signalled more hikes are on the way as it warned rocketing inflation will see the worst hit to household income for at least 32 years.

The Bank’s Monetary Policy Committee (MPC) voted 5-4 to raise rates from 0.25% to 0.5% – marking the first back-to-back rise since 2004, coming after a quarter point increase at its last meeting in December.

Four of the nine members called for a steeper rate increase – to 0.75% – to help put the brakes on rampant inflation.

It came as the Bank cautioned that rocketing energy prices will drive inflation to an eye-watering 7.25% in April, which is the highest level since August 1991.

In a gloomy prediction for under-pressure households, the Bank said this will see disposable incomes fall by around 2% – the worst impact since Bank records began in 1990.

Ofgem’s 54% energy price cap increase to around £1,971 in April is the driving force behind the inflation forecast hike, with the Bank predicting around another 10% rise in the cap this October.

But its forecasts do not take into account the Chancellor’s package of measures announced on Thursday, offering £350 support for the majority of UK households.

The Bank said while the economy is expected to bounce back quickly from an Omicron impact in December and January, growth will then slow to “subdued rates” as inflation impacts spending.

This is set to send Britain’s jobless rate rising from 4% this year to 5% in 2024.The Bank also announced the start of so-called quantitative tightening, by allowing its £895 billion quantitative easing programme to begin winding down naturally.

It will stop reinvesting money in further assets when gilts and bonds mature, while it will also begin selling off its £20 billion corporate bonds portfolio.

In minutes of the rates decision, the Bank said: “Given the current tightness of the labour market and continuing signs of greater persistence in domestic cost and price pressures, the committee judges that an increase in Bank Rate of 0.25 percentage points is warranted.”

It added that “some further modest tightening in monetary policy is likely to be appropriate in the coming months”.

But the Bank cooled financial market forecasts of a flurry of rate rises in 2022.

It predicts that inflation will undershoot its 2% target in the medium term if rates rise to 1.5% by the middle of 2023, as financial markets expect, signalling it will take a more cautious approach.

However, it gave a sobering alert on the impact of rising inflation on consumers and the wider economy.

The Bank said sharp rises in energy prices and the cost of goods amid supply chain pressures will weigh on spending and growth.

“This is something monetary policy is unable to prevent,” it cautioned.

The Bank downgraded the growth outlook to 3.75% in 2022 and 1.25% in 2023 from the 5% and 1.5% respectively predicted in November.