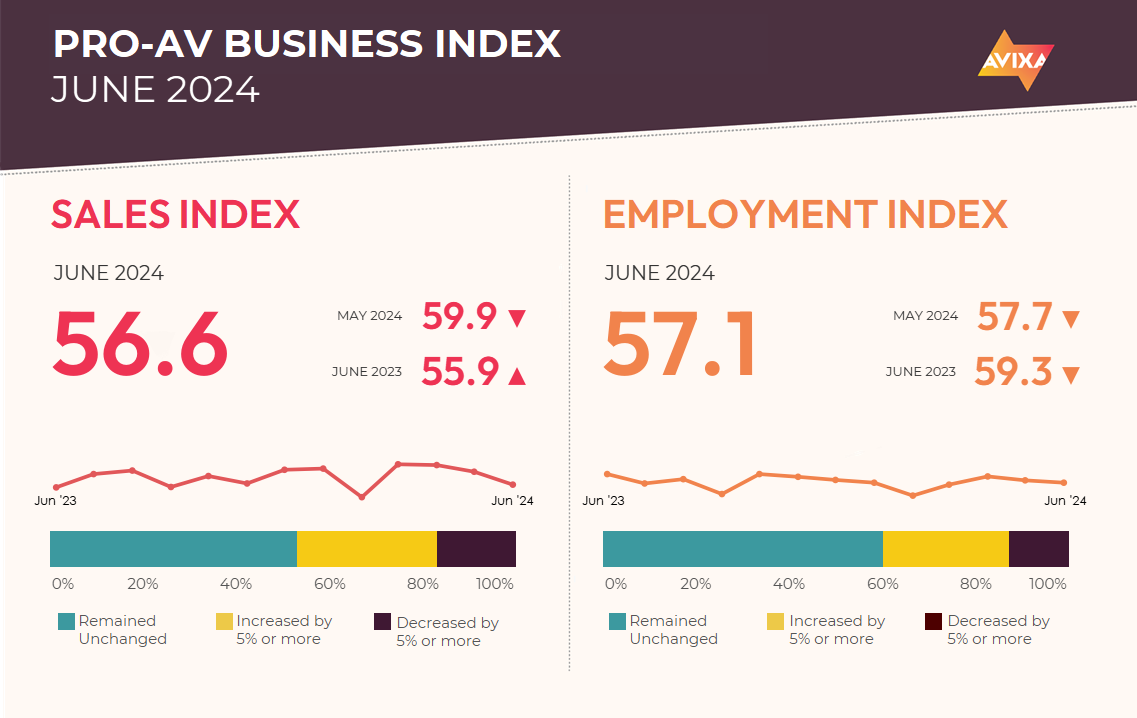

The June index is not bad news, but it is a disappointing result. Growth continued at a moderate rate, as the AV Sales Index (AVI-S) measured 56.6. But it's disappointing because recent months have been higher, staying around 60.

Comments cited a variety of causative factors behind the movements their businesses experienced. For some, seasonal factors were critical. For others, it was supply issues, skewing toward positive news as those challenges eased. Randomness was also cited: For the small companies that compose so much of our industry, it’s normal for months to jump up and down by meaningful amounts.

[AVIXA Report: April Numbers Reinforce March Positivity]

In sum, there wasn’t a clear reason why the numbers were softer this month. That gives confidence for reversion to the mean next month.

The stock market is often given more weight as an economic indicator than it truly deserves. That said, it does matter: It affects consumer and business confidence, and it also influences businesses’ ability to invest (higher valuation means more ability to finance capital expenditures). And the stock markets skew positive these days.

U.S. stock performance is particularly strong, with the S&P 500 regularly setting new record highs in the last month. International stocks have also hit record highs recently, with the STOXX 600 hitting records in May. Asia stock indexes are more mixed, but this year, the Nikkei 225 finally surpassed the 1990s record level, with the most recent record set in July.

[Viewpoint: The Burden of Burnout]

For Pro AV, these numbers are more background/foundational rather than direct drivers of spend. But they indicate the strength of the current economy and indicate positive news for the pipeline in coming months—and even years—for major projects started on the current money wave.

The AV Employment Index (AVI-E) outperformed the AVI-S in June. It stayed nearly steady from May to June, downshifting just 0.6 points from 57.7 to 57.1. This is good news for Pro AV and further evidence that the disappointing AVI-S isn’t a concerning sign of significant weakness.

In the wider economy, the labor market remains tight, with relatively few available workers for the open jobs. One point of emphasis on the current labor market: There is very low churn right now. This is likely a consequence of the high-turnover pandemic recovery period that saw many workers quit to find better jobs. Now they’re steady-on in their new(ish) roles.

To share the topline numbers from the latest U.S. report, payrolls added another 206,000 jobs in June. This is another month of strong growth. The one fly in the ointment is the unemployment rate. At 4.1%, it’s still low, but it has climbed meaningfully from a bottom of 3.4% in April 2023. The accumulation of small increases is causing a tiny bit of concern in the macroeconomic community, increasing pressure on the Federal Reserve Board to finally transition to lower interest rates (which will likely happen in September).

[On Your Business: Technology Isn't Enough]

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.