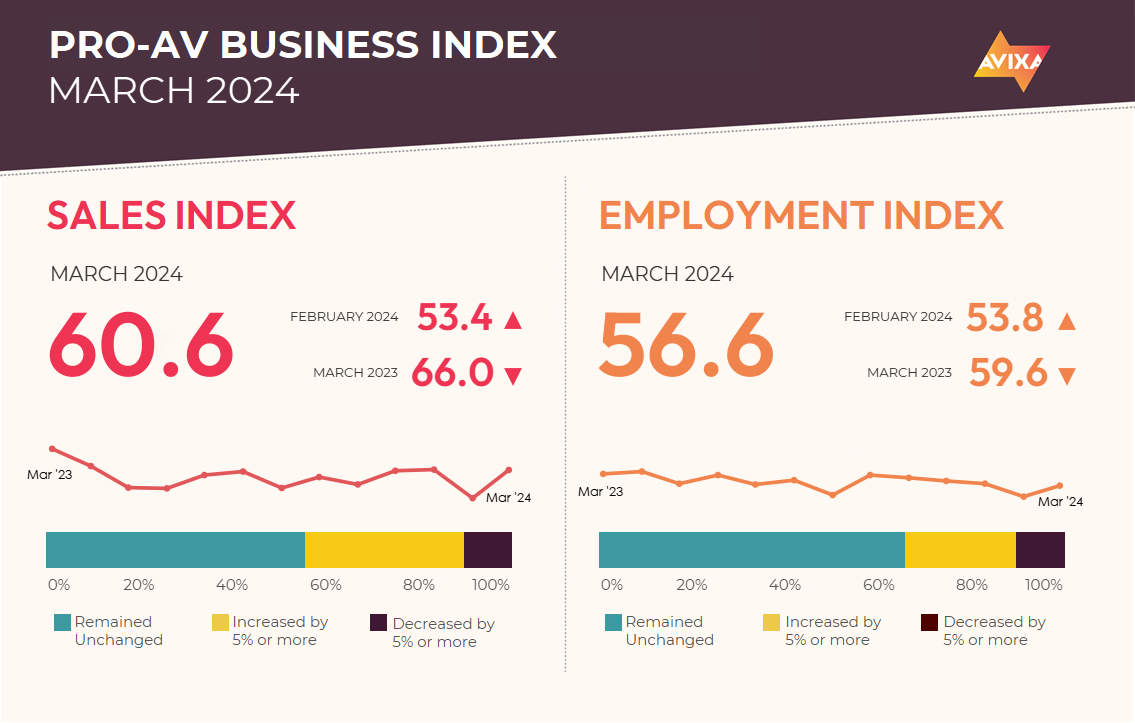

Pro AV is back on track. February delivered surprising disappointment after a solid start to the year, with the AV Sales Index (AVI-S) falling from 60.7 in January down to 53.4. Now we’re all the way back and even beyond, with the March AVI-S at 61.8. Given the lack of clear causation, we suspected and certainly hoped for a quick rebound. It’s a pleasure to see it happen.

Commenters cited a number of factors affecting their business in the period, with uncertainty chief among them. In some ways, uncertainty was positive in that it’s reducing: Companies are settling into post-COVID work models, which is releasing funds.

In other ways, uncertainty was a negative, with fluctuating revenues straining businesses. One interesting comment identified supply problems as their top concern, but in a totally different way than it has been for the past three years: They’re finally getting stuff in after long delays, and so much so that they’re running out of storage space!

[How To Build a Better Airport]

Milestone alert: The U.S. employment report showed a heartening milestone in March: The Leisure and Hospitality sector has now recovered its pre-pandemic job levels. Given the rise of factors such as QR-code ordering, no-contact check-in, etc., recovering back to the 2020 level is a strong signal of how “back” this sector is.

The recovery and growth align with the restoration of a broad trend we’ve tracked for years as it relates to Pro AV: the rise of the experience economy. This story was very much disrupted by COVID-19, but our research shows it coming back. For example, AVIXA’s Industry Outlook and Trends Analysis (IOTA) report shows live events leading Pro AV revenue growth right now. We expect the experience economy to continue robust growth for the foreseeable future.

There’s good news on employment, too. The AVI-E (AV Employment Index) hadn’t suffered as dramatic a drop as the AVI-S, and it hasn’t recovered quite as strongly. But positive news here is welcome just the same. For the AVI-E, the course was 57.1, 53.8, then 56.6 for January, February, and now March.

[Immersive WWII 'Expressions' in New Orleans]

In the wider economy, the U.S. employment report delivered more good news. Payrolls added 303,000 jobs, comfortably above expectations, and wages increased at an annual rate of 4.1%. These datapoints confirm a strong and healthy economy, which positions Pro AV for a solid year in 2024.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.

Peter Hansen is an economist at AVIXA.