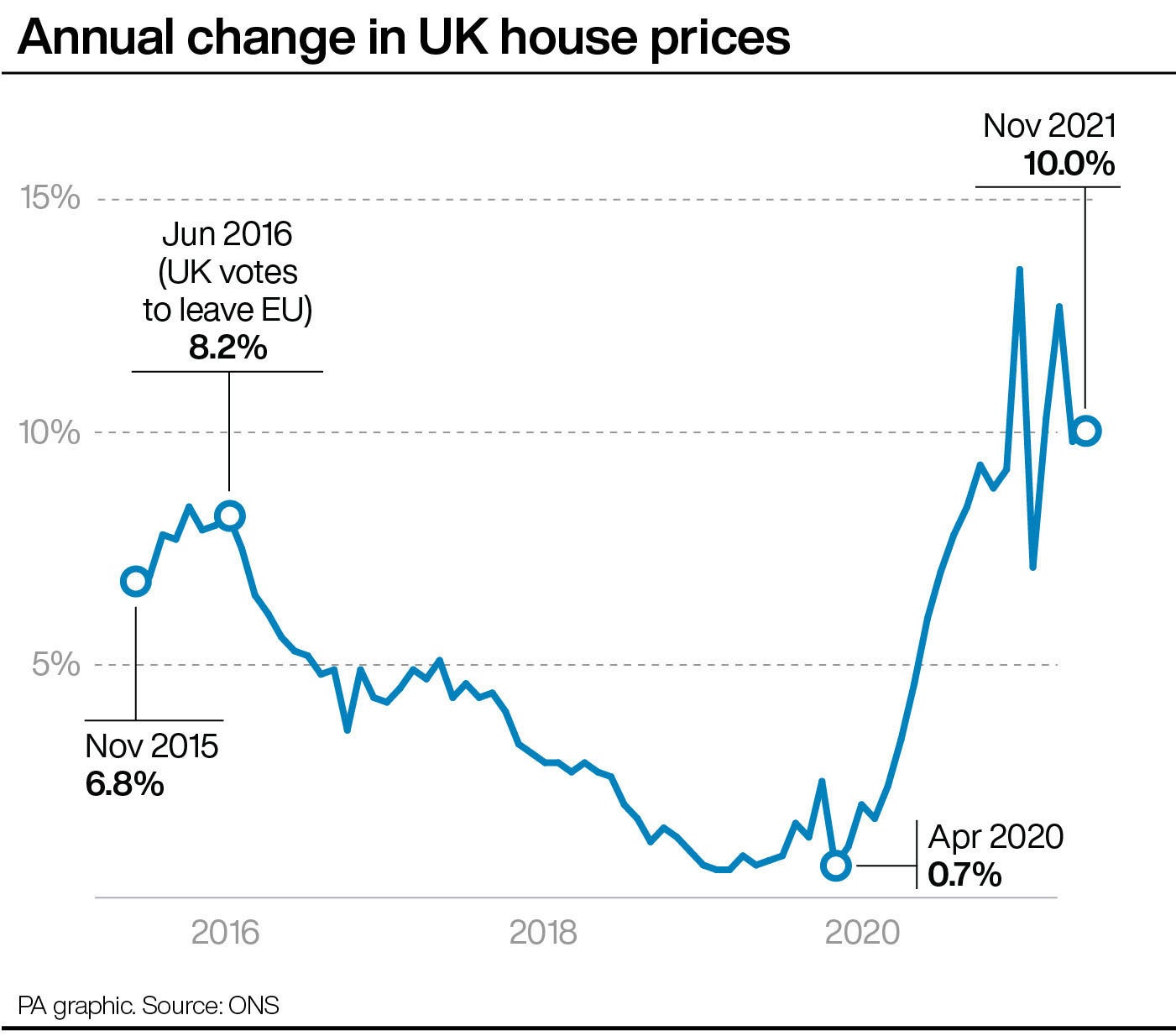

House prices surged by 10.0% annually in November 2021, official figures have shown, accelerating from 9.8% growth in October.

Experts warned that, with general living costs such as energy bills also rocketing, it is imperative that buyers do not overstretch themselves when chasing their “dream home”.

Some also suggested that rising living costs could limit people’s confidence to buy a property.

The average UK house price in November was £271,000, which was £25,000 higher than a year earlier, the Office for National Statistics (ONS) said.

In Scotland, the average house price hit a record level of £183,000 in November. Property values increased by 11.4% over the year, accelerating from 11.0% growth in October.

Average house prices increased over the year in England to £288,000 (9.8% annual growth), in Wales to £200,000 (12.1%), and in Northern Ireland to £159,000 (10.7%).

Within England, the South West had the highest annual house price growth, with average prices increasing by 12.9% in the year to November.

The lowest annual house price growth was in London where average prices increased by 5.1% annually.

The figures were released on the same day that separate ONS figures showed inflation surged to its highest level in nearly 30 years in December, placing a further squeeze on households’ living costs.

The ONS said Consumer Prices Index (CPI) inflation jumped from 5.1% in November to 5.4% in December – the highest level since March 1992.

Jamie Durham, an economist at PwC UK, said: “Going into 2022, the most significant risk to the (housing market) outlook is the ongoing pressure on the cost of living…

“This may impact consumer confidence, and limit willingness to make major financial decisions like buying a home.”

Emma Cox, sales director at Shawbrook Bank, said: “The harsh reality is that this extended period of ground-breaking house prices will provide challenges for the market as we move further into 2022.

“With inflation reaching 5% this year and the cost of living rising, it’s imperative that buyers don’t overstretch themselves in pursuit of their dream home.

“A mortgage is likely to be the most significant amount of debt an individual takes on.”

Miles Robinson, head of mortgages at online mortgage broker Trussle, said: “Increased interest rates have already had a big impact on mortgages, with sub-1% mortgage rates all but disappearing from the market overnight.”

He added: “Rising energy costs look set to affect mortgage affordability.

“Not only could this prohibit first-time buyers with smaller deposit sizes, but it could also ring-fence more competitive mortgage deals.”

Phillip Stevens, director of estate agent Antony Roberts, said: “The interest rate rise does not appear to have dented buyers’ confidence thus far, nor their ability to purchase property, but with inflation at a 30-year high that could change.”

Guy Gittins, chief executive of Chestertons, said: “Due to demand outstripping supply, we have seen properties being snapped up much faster compared to previous years.”

Jeremy Leaf, a north London estate agent and a former residential chairman of the Royal Institution of Chartered Surveyors, said: “Rising interest rates, inflation, stretched affordability and in particular insufficient stock are likely to keep property prices more in check this year.”

Lucy Pendleton, property expert at estate agent James Pendleton, said: “The way property price growth strengthened on an annual basis underlines the fact that this is a rally with a very long tail.

“However, the headwinds that will undoubtedly slow the market later this year are already staring us in the face.”

Nicky Stevenson, managing director at estate agent group Fine & Country, said: “Looking ahead, those market fundamentals are unlikely to shift dramatically in the coming months, and this remains a red-hot sellers’ market.

“While interest rates are expected to creep higher, the effect of this may only become clear over a multi-year period.

“Unless we see significant numbers of new listings before the spring, double-digit house price growth is likely to remain persistent for some time.”

Nitesh Patel, strategic economist at Yorkshire Building Society, said: “With buyers still re-evaluating their housing needs and first-time buyers increasingly important in the market we expect demand will continue to exceed supply, with fewer homes from existing stock coming up for sale and new builds still low.”

Iain McKenzie, chief executive of the Guild of Property Professionals, said: “Estate agents’ portfolios are at historic lows, with many branches having a dozen or fewer properties to sell, and there is no sign of this situation changing.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “Low mortgage rates have been one of the contributing factors to the housing boom and although some lenders are tweaking mortgage rates upwards on the back of higher money market rates, pricing remains competitive.”

Myron Jobson, personal finance campaigner, interactive investor, said: “With the ‘bank of mum and dad’ also facing its own cost-of-living challenges, many wannabe homeowners will struggle to realise their goal.”