Average household energy bills are set to fall below £2,000 for the first time in over a year after regulator Ofgem slashed the price cap by around 7 per cent.

But campaigners warned millions of households will continue struggling to pay their bills, which will remain hundreds of pounds higher than in the winter of 2021, before energy costs sky-rocketed.

The price cap is the maximum amount paid by a customer for units of gas and electricity as well as daily standing charges. It is reviewed four times a year in winter, spring, summer and autumn.

Ofgem, the energy regulator, on Friday said it was cutting the price that a supplier could charge for gas from 6.9p per kilowatt hour (kWh) today to 6.89p from 1 October.

The price of electricity, meanwhile, will fall from 30.1p per kWh to 27.35p, meaning average bills for households in England, Wales and Scotland will fall £2,074 per year to £1,923.

Last year the government introduced a number of financial assistance packages to help households pay their fuel bills.

But that help has run out and campaigners fear the coming winter could be worse for families across the country, already struggling with higher mortgage, food and borrowing costs.

Ofgem itself has warned that many households will not feel the benefit of Friday’s cut in the price cap.

Jonathan Brearley, Ofgem chief executive, said it was “welcome news” for families that the price cap had fallen but warned he could not offer “any certainty” that this winter would be easier than the last one.

In an interview with Sky News, Mr Brearley said “of course” it would be “helpful” if the government reintroduced subsidies to help families directly with their bills.

Dame Clare Moriarty, the chief executive of Citizens Advice, urged ministers to “look seriously” at more help to assist those worst affected by higher energy bills.

Earlier this week Citizens Advice warned that a record number of people had been seeking help for energy bill help.

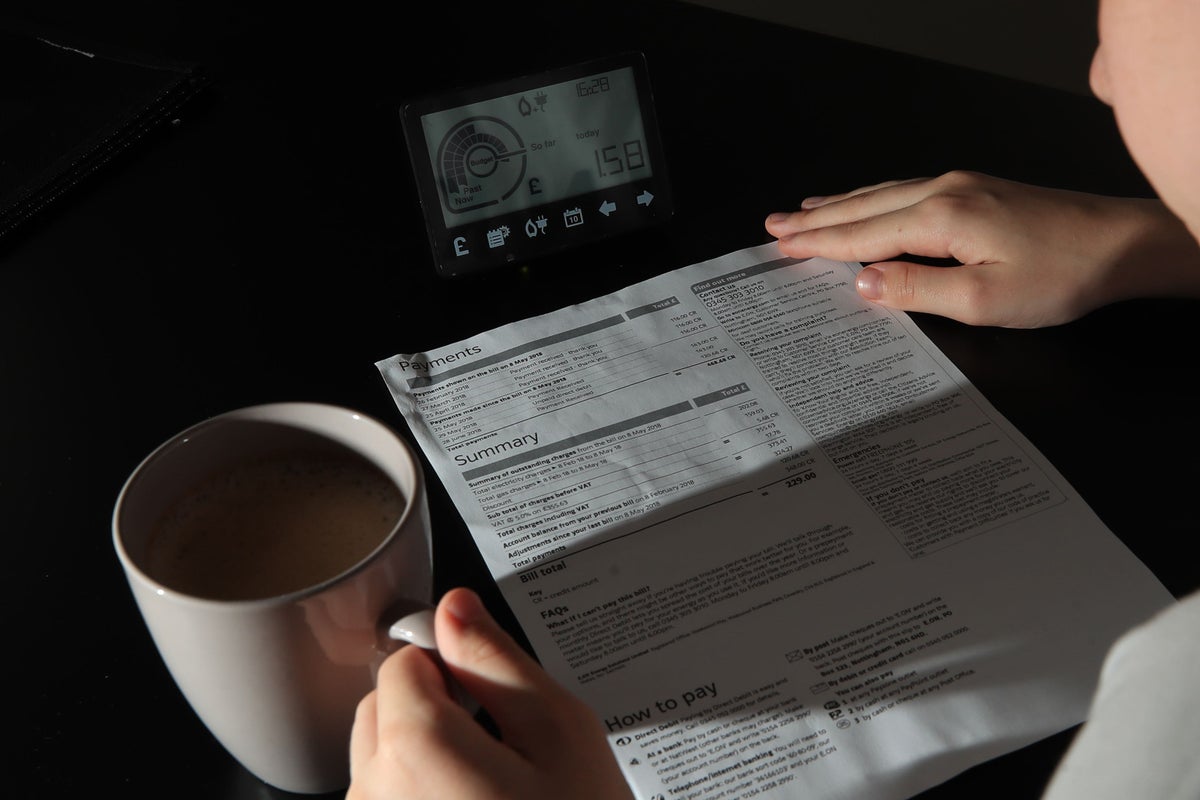

Energy bills to fall below £2,000 for first time in over a year but households still facing high costs— (PA Wire)

Some 7.8 million people borrowed money to pay their bills in the first six months of 2023 and one in four said their gas and electricity costs were the essentials they were most worried about paying.

Citizens Advice said its research showed that disabled people, single parents and low-income households earning less than £29,000 will be the hardest hit this winter.

It also estimated that the average household can expect to pay “slightly more” in the coming winter than they did between January and March 2023 - if current forecasts hold - due to the winding up of government support and the price cap being reviewed again in the winter.

National Energy Action said 6.3 million people would remain in fuel poverty despite the slight fall in costs.

Richard Neudegg, director of regulation at Uswitch.com, which helps customers find the best gas and electricity deals, said any gains from Friday’s announcement could be short-lived ahead of the winter, when households typically use more energy.

He said the average household may only save around £47 in the next quarter compared to current rates and warned that energy bills are likely to remain higher for some time. “We’ve landed in an environment in which we are expected to simply accept expensive energy costs.”

The Green Party reiterated its call for the government to roll out a home insulation programme to help families bring down the cost of their bills and reduce energy consumption.

Labour said it would “close loopholes” and bring in a “proper” windfall tax on the profits of oil and gas giants to help fund energy bill support.

Andrew Bowie, the energy minister, described the drop in the price cap as “incredibly heartening”.

Asked on BBC Breakfast if the annual typical household energy bill is a “fair and affordable price to pay”, he said: “I think it’s incredibly heartening. Good news that the energy price cap is falling. “

Mr Bowie, in a separate interview with Sky News, said ministers would consider “any and all options” on energy bills moving forward.