Shares of AT&T (T) are higher on Monday, at last check about 8% up, after the company completed its merger with Discovery on Friday.

The split leaves the pure-play AT&T business under AT&T (and the T ticker symbol, while its WarnerMedia business (including HBO) merged into Discovery — hence the WBD ticker symbol.

(Adjusted for the transfer of media assets to Warner Bros. Discovery, legacy AT&T is trading lower from Friday.)

One could make an argument that AT&T is now undervalued vs. Verizon (VZ) and that Discovery is undervalued vs. other streaming giants, like Netflix (NFLX) and Disney (DIS).

At least, that's the bulls' hope.

Trading T Stock

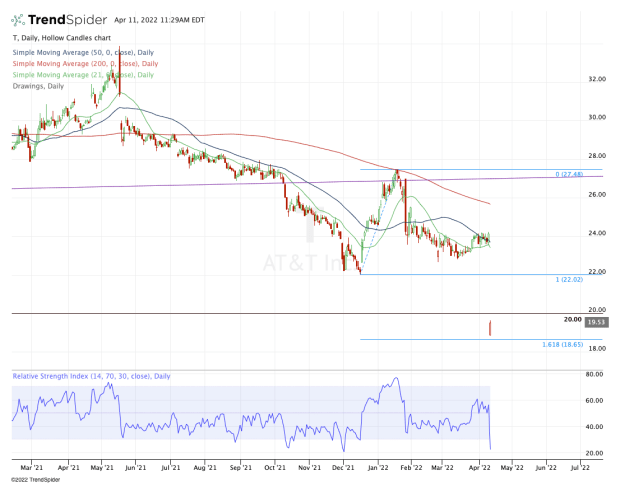

Chart courtesy of TrendSpider.com

I would put up a chart of Discovery, but with just one day of price action, there isn’t much for technical traders to go on. That leaves us with AT&T, which by the way, yields just over 5% with its dividend.

Two analysts have come out with new price targets already, with Deutsche Bank assigning a $24 target and JPMorgan assigning a $22 target.

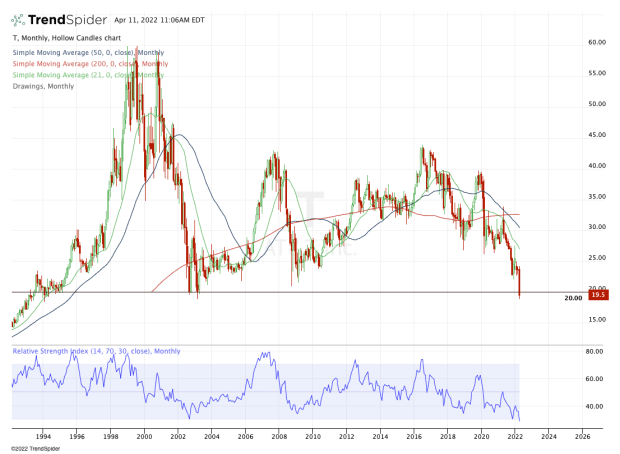

Bulls are now looking to see wAT&T stock can reclaim the key $20 level. As for why this is a key level, you can see how it has been a notable support level for roughly two decades by looking at the monthly chart below.

Chart courtesy of TrendSpider.com

If it can clear $20, then the JPMorgan analysts may have a reasonable price target of $22. That gets AT&T stock back to the prior low when it bottomed at $22.02 in December.

From there, the stock can begin to fill the gap back up to $23.54 — almost back to Deutsche Bank’s target.

If we see the latter action play out and AT&T begin to fill the gap, keep an eye on the short-term moving averages, like the 10-day and 21-day. These could act as resistance amid the rally.

As for the downside, today’s low of $18.85 is a good reference point to keep in mind. Below that opens the door down to the 161.8% downside extension at $18.65, which AT&T stock nearly hit today (and some traders wish it did).