AT&T (T) stock's underperformance had been well documented even before the 2022 bear market.

The stock is down 45% over the past five years, 44% over the past 10 and 57% this century.

So what does everyone like about this company? Clearly, the dividend. Until this year, AT&T was a dividend star, having raised its payout for more than 30 consecutive years. It often had a big yield, too.

That streak came to an end when the company recently failed to raise its dividend, then spun off its media assets in what became Warner Bros Discovery (WBD).

When we include the dividend in the total return for AT&T stock, the shares are down 18% over the past five years and up 16% over the past 10, and they've doubled since 2000.

In other words, the dividend saved AT&T shareholders -- but that does little to soften the blow.

Let’s look at two charts — one adjusted for the dividend and one unadjusted — as both show notable potential support areas nearby.

Trading AT&T Stock

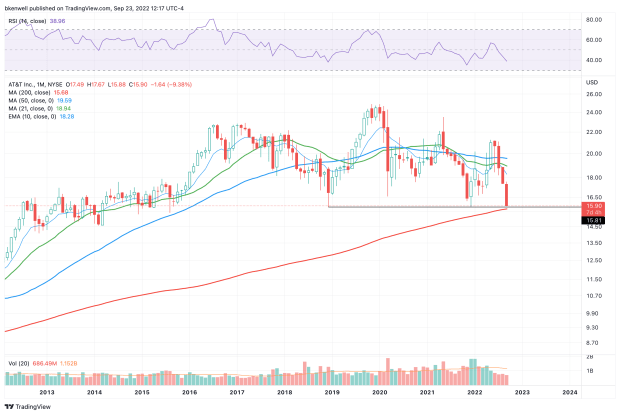

Chart courtesy of TradingView.com

Above is the dividend-adjusted look. As you can see, AT&T stock is coming into the $15.75 to $16 area, which has been significant support over the past few years.

Generally speaking, this zone has buoyed the share price, while the 200-month moving average looms just below it. That gives bulls a reasonable risk/reward setup, assuming they plan to hold for a while.

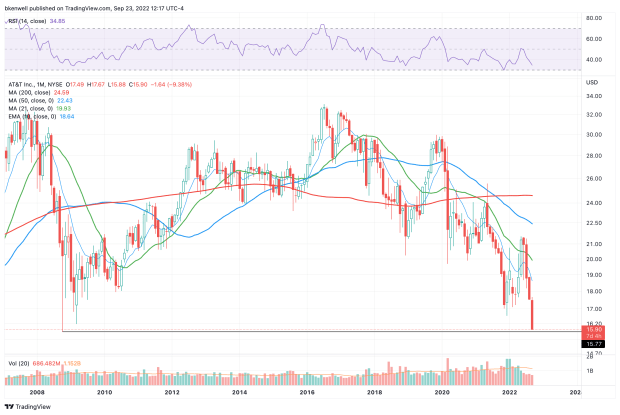

Below is the unadjusted chart for AT&T stock, which also highlights a notable level.

Chart courtesy of TradingView.com

That’s as the stock price is approaching its lowest level since 2008.

Generally, the $15 area has been decent support and has marked the low for AT&T over the past 22 years. Investors who are buying today will again expect that to be the case going forward.

That said, we must also realize that the company has spun out a notable portion of its business with the Warner Bros Discovery asset.

Still, when we consider the charts and where support may come into play, alongside the fact that AT&T carries a whopping 7% dividend yield, buyers may be interested.

If the shares fail in this support zone, it may be dead money for a while.

But as long as AT&T is above these levels, the longs can soak up the dividend payments. A rally in the stock would just be a cherry on top.