Australia was the first major financial centre to react to UBS's takeover of Credit Suisse and coordinated action by central banks to pump more US dollars into the global banking system — and the response was hardly enthusiastic.

Read how it all unfolded on our markets blog for Monday, March 20.

Disclaimer: This blog is not intended as investment advice.

Key events

Live updates

Here's where we are sitting at 4:30pm AEDT

By Emilia Terzon

- ASX 200: -1.4% at 6,899 points

- All Ords: -1.4% to 7,085 points

- Australian dollar: +0.2% to 67.05 US cents

- Nikkei: -1.4% to 26,956 points

- Hang Seng: -2.7% to 19,004 points

- Shanghai: flat to 3,250 points

- Dow Jones (Friday close): -1.2% to 31,862 points

- S&P 500 (Friday close): -1.1% to 3,917 points

- Nasdaq (Friday close): -0.7% to 11,631 points

- FTSE (Friday close): -1% to 7,335 points

- EuroStoxx 600 (Friday close): -1.2% to 436 points

- Brent crude: -0.9% to $US72.28/barrel

- Spot gold: +0.3% $US1,979/ounce

- Iron ore: +0.3% to $US129.50/tonne

-

Bitcoin: -2.9% to $US27,505

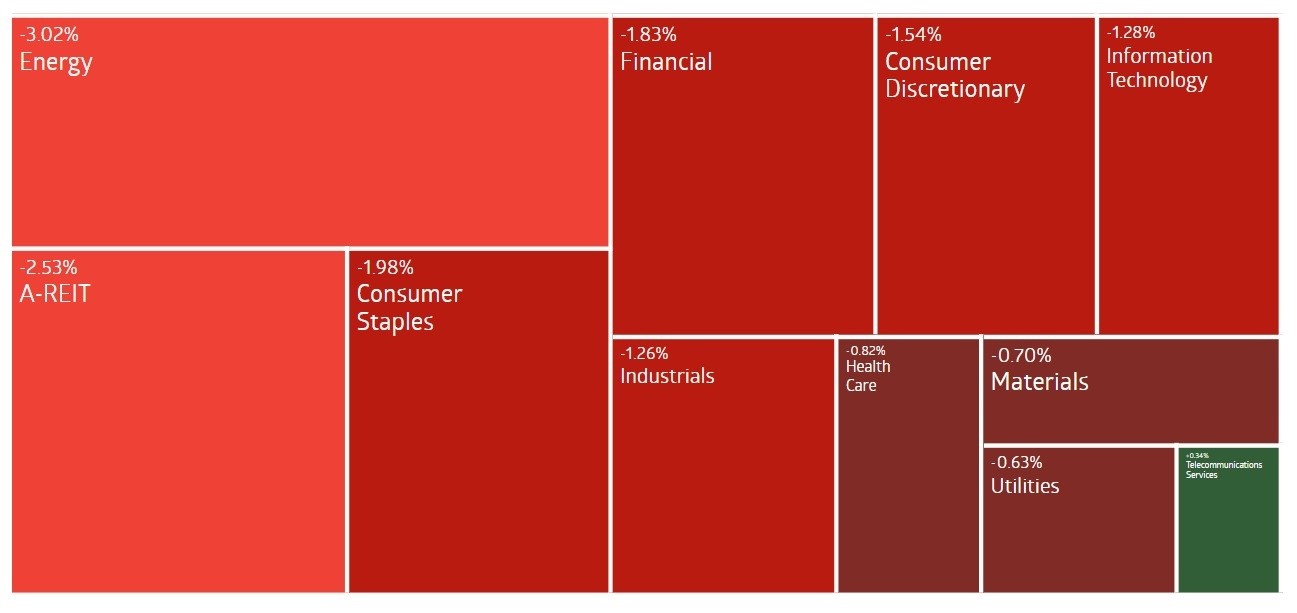

Australian shares dive in late afternoon trade

By Emilia Terzon

Australian shares really took a beating in the last few hours of today.

We had the ASX 200 and All Ords both take a turn around lunchtime, and end both down 1.4 per cent.

IG's economist Tony Sycamore noted this afternoon that it appears the Credit Suisse package hasn't calmed investor worries, and also now some may fear there is tighter regulation of banks on the way after the global calamity.

"More broadly, a banking crisis is typically followed by increased funding costs, tighter regulation, and slower loan growth – a toxic combination for bank stocks regardless of size," Tony writes.

"No respite for the Energy sector, already on the canvas after being pulverised over 10% in the past fortnight."

"Another day of heavy falls for coal miners as the price of coal extended its decline to over 55% during the first three months of 2023."

The financial sector was one of the biggest losers of today, along with energy socks. We also had the price of gold switch up in the last few hours, which pumped up gold companies in Australia.

Today may be better, though. We've got US market futures trading up now (local time) as Wall Street prepares to open for its first day of trading for the week.

See you all tomorrow.

Latitude Financial's cyber attack 'even more concerning'

By Emilia Terzon

Emilia Terzon from the business unit with you for the end of today's live blog.

Today I've been reporting on the growing concerns over the cyber attack on Latitude Financial.

The finance company says it is not ruling out that more data than originally expected has been accessed, and that the situation "remains active".

UNSW Institute for Cybersecurity's Associate Professor Rob Nicholls just had this to say to me:

This is even more concerning.

It suggests that Latitude's service providers have not really addressed the problem.

It also increases the likelihood of a hybrid attack that is both ransom and theft.

If the intruders are still in the system, they have an opportunity to encrypt files.

Latitude hasn't confirmed if it has been asked to pay ransom.

Medibank's data started being posted to the dark web last year after it refused to cough up. The federal government generally backs companies not coughing up, although there's no fixed law.

More on this story here:

ACL lobs offer for Healius

By Michael Janda

Australian Clinical Labs (ACL) is launching an unsolicited, off-market takeover bid for rival pathology operator Healius.

The company is offering 0.74 ACL shares for every Healius share, which would offer no premium to Healius shareholders based on recent market pricing.

However, it would leave Healius shareholders owning 68 per cent of the merged company, and ACL's chief executive officer Melinda McGrath said it would deliver efficiencies that would profit both sets of investors.

"Our vision is to create Australia's largest pathology provider, with enhanced scale, profitability, and potential for expansion.

"The Proposed Merger is expected to unlock $95 million in synergies and de-risk the required operational turnaround at Healius, with the potential for an additional $95 million of Potential Operational Improvement Benefit to be achieved through improved performance at Healius.

"Together, this is expected to deliver stronger earnings, and has the potential to create a value uplift for the Merged Group of $2.1 billion."

For its part, the board of Healius has said it will evaluate the offer and provide a recommendation to share holders in due course.

In the meantime, it said its shareholders do not need to take any action.

By 2:40pm AEDT, Healius shares were up 8.6% to $3.02, while ACL shares were up 3.2% to $3.715.

Gold miners benefit from banking jitters

By Michael Janda

I've posted a few times today about how gold miners are today's big winners on the ASX, as investors search for safe havens despite moves to rescue struggling banks.

CBA's commodity analyst Vivek Dhar said, while gold is one haven, investors have traditionally sought out the US dollar when serious crises hit.

"Gold futures have lifted ~6% since 10 March to ~$US1983/oz. Futures are still below peaks of ~$US2052/oz and ~$US2043/oz reached on August 2020 and March 2022 respectively.

"Safe haven demand, triggered by the risk off market reaction to the banking crisis, helps explain the lift in gold futures.

"Whether gold can hold on to these gains will really depend on the US dollar. The US dollar has weakened since 10 March, but has been volatile. We consider the US dollar a stronger safe haven asset than gold. That means that if risk events are large enough we will typically see markets shift from gold to the US dollar.

"While financial stability risks have increased substantially since the collapse of SVB, it hasn't yet led to a surge in the US dollar.

"There are notable differences from the current banking crisis and what led eventually to the Global Financial Crisis in 2008. However, the movement in gold when Lehmann Brothers collapsed in September 2008 provides some good colour of how gold behaves during a financial crisis.

"Initially, gold futures gained when Lehmann Brothers collapsed in line with a weakening of the US dollar. It didn't take long before the US dollar started rallying aggressively as global financial stability risks escalated. Gold initially held on to its gains before falling as the rising US dollar eventually weighed on gold."

Will history repeat? Most people are hoping not, given that the GFC led to America's Great Recession, which was followed by a decade of first widespread economic stagnation and then growth but with rampant inflation.

Market snapshot at 1:25pm AEDT

By Michael Janda

ASX 200: -0.78% at 6,939 points

All Ords: -0.8% to 7,128 points

Australian dollar: +0.2% to 67.05 US cents

Nikkei: -0.6% to 27,169 points

Hang Seng: -1.4% to 19,240 points

Shanghai: +0.5% to 3,268 points

Dow Jones (Friday close): -1.2% to 31,862 points

S&P 500 (Friday close): -1.1% to 3,917 points

Nasdaq (Friday close): -0.7% to 11,631 points

FTSE (Friday close): -1% to 7,335 points

EuroStoxx 600 (Friday close): -1.2% to 436 points

Brent crude: +0.5% to $US73.31/barrel

Spot gold: -0.9% $US1,970/ounce

Iron ore: +0.3% to $US129.50/tonne

Bitcoin: +3.5% to $US27,768

ASX down despite global banking bailout moves

By Michael Janda

We're halfway through the local trading session and the ASX is still losing ground, despite central banks, private banks and governments teaming up to help out struggling financial institutions.

The benchmark ASX 200 index is down around two-thirds of a per cent, which is milder than some of the falls seen on overseas markets on Friday, but hardly a huge vote of confidence in all the moves over the past day to try and sort out US and European banking woes.

UBS is buying Credit Suisse at a bargain basement price, wiping out most of the value of its current owners' investments.

Over in the US, regulators have been quick in stepping up to protect depositors, but shareholders are facing a total wipeout to their investments in any of the banks that collapse.

It's probably little wonder then that investors are hardly keen to dive in to buying bank shares, although CBA and Westpac are up slightly even as ANZ and NAB trade a little lower.

The bigger moves are for investment bank Macquarie (-3.1% to $170.29), which is more globally exposed, and some of the regional banks and insurers, such as Suncorp (-3.8% to $11.69).

US share market futures were about half a per cent higher in what Reuters described as "bumpy" early trade.

"The best we can say was there are certainly a lot of concerns about Credit Suisse contagion risk," Rodrigo Catril, a senior currency strategist at National Australia Bank in Sydney told Reuters.

"The news overnight from Switzerland has helped," he said, though adding that the central bank moves had created nerves as well as calmed them.

"It's great we're seeing this concerted effort from central banks, and it's positive, but it does also highlight how troubling the circumstances are and how worried central banks appear to be as well."

The big winners from all the uncertainty continue to be gold miners, with some enjoying gains above 10 per cent, while Australian gold giant Newcrest was up 6.2% to $25.71.

Latitude Financial's hack may be worse than originally thought

By Emilia Terzon

Emilia from the ABC's business unit here.

We've just had an update from finance company Latitude about the cyber-attack on its systems.

It's given more clarity on what sorts of data has been stolen, including passports, Medicare numbers and drivers licences. We already knew that the vast majority of the theft is drivers licences.

The company has also indicated that the amount of data stolen may be wider than the 330,000 customers already impacted.

As our review deepens to include non-customer originating platforms and historical customer information, we are likely to uncover more stolen information affecting both current and past Latitude customers and applicants. We will provide a further update when we have more information to share.

I also covered the Medibank cyber attack last year, and that was an exercise in a worsening situation day by day.

It appears Latitude is starting to prepare its customers for this hack to be worse than originally thought, and it is also noting that the situation "remains active".

The AFP is investigating.

The non-bank lender's stock is still in a trading halt.

Here is a wrap of the story that I filed for the ABC network over the weekend, featuring many angry and distressed customers.

'It could get a little wild' with Fed and BoE to meet amid banking turmoil

By Michael Janda

Pepperstone's Chris Weston with his analysis on what's happening on the market reaction to the Credit Suisse takeover by UBS.

"The initial move in markets to the news has been to buy risk and we see EU equity futures +1.2%, NAS100 [Nasdaq] +0.5%, AUD +0.8% and UST 2 yr [two-year US Treasury bonds] +17bp [basis points]," he wrote.

However, he says investors should buckle in for a "wild" ride, with continuing problems for smaller US banks and two key central bank meetings this week.

"There was talk on Friday that 'dozens' of other banks may fail soon as depositors take their cash and run. In fact, the WSJ said 186 banks are facing the same issues/pressure as SVB bank — this has the market on edge, and they crave an even bigger response," Weston notes, citing the Wall Street Journal.

"For perspective, if any bank fails from here and the FDIC does not make all depositors whole the market will take this as a systematic event, regardless of the bank – it will rock the markets in a massive way – which is why it won't happen at this point.

"Case in point, and this is very important — Late last week we heard First Republic Bank (FRC) had been given a $US30b injection of deposits from 11 of the biggest US banks. A private market response is old school and shows the banking industry is working together . The globally systemic banks looking after the smaller banks is 100% designed this liquidity to show their faith in the FDICs deposit insurance.

"Why? These banks are all non-secured creditors for FRC and, in theory, could lose it all if First Republic go under and the FDIC doesn't pay out.

"Unfortunately, on Friday shareholders didn't take heart on this incredible action and sold FRC's equity down 33% and the share price now eyes new lows – clearly, not a great look and this resonated through US equity markets. Deposit holders may get it all back, but equity holders won't."

The key question is whether central banks will pause their rate hikes to let the financial dust settle a little before resuming their battle against inflation, if necessary.

"This week with the FOMC [Federal Reserve Open Market Committee] and BoE [Bank of England] in play we should get more answers to help us price risk more effectively — that said, there is still much that can go wrong for risk, and it could get a little wild."

Currently the market bets for the Fed are roughly 60% for a 0.25 percentage point hike, 40% for a pause; for the BoE it's flipped, with 58% for no change, and 42% for a 25 basis point rate hike.

Stock market winners and losers at midday

By Michael Janda

As a sector, the big winners so far today have been gold miners, which dominate the top five, along with takeover target Healius.

Five biggest gains:

- Gold Road Resources: +10.1% to $1.6575

- Healius: +9.7% to $3.05

- Evolution Mining: +9.7% to $2.83

-

Regis Resources: +8.4% to $1.9025

-

Perseus Mining: +8.3% to $2.295

Five biggest loses:

- Liontown Resources: -5.8% to $1.555

- Pinnacle Investment Management: -4.8% to $7.60

- Virgin Money: -4.5% to $2.55

- Suncorp Group: -4.4% to $11.62

- Magellan Financial: -4.2% to $7.71

Cheaper petrol, mortgages consumer-friendly flow-ons from global banking woes

By Michael Janda

The banking chaos for US regional lenders and Credit Suisse has had a couple of handy short-term flow-ons for Aussies struggling with the cost of living.

For those with home loans, it makes a pause to the Reserve Bank's program of 10 straight interest rate increases increasingly possible.

The latest market bets translate to a 94 per cent chance of the RBA holding rates steady next month, and the 6 per cent chance of a cut (presumably a bet on the odds of this whole banking crisis blowing up before the RBA's next board meeting on April 4).

The US Federal Reserve meets this week, and initial expectations of a half a percentage point rate rise have now been scaled back to a 60 per cent chance of 0.25 percentage points and a 40 per cent chance that rates will stay on hold.

The lower expectations for US rates have pushed the greenback down.

"A slowdown in interest rate hikes could depress the greenback, making dollar-denominated commodities more affordable for holders of other currencies," Reuters observed.

The prospect of slower growth due to a banking crisis-induced recession has already dampened the US dollar prices of some major commodities, notable oil.

Brent crude futures lost nearly 12 per cent last week, in the biggest weekly fall since December.

Despite a modest bounce this morning, Brent is still trading at $US73.16 a barrel, well down from recent peaks close to $US87 just a couple of weeks ago.

Of course, the trade-off for cheaper fuel and mortgages will be the severe economic fallout if that global financial crisis and recession does actually eventuate.

Citi analysts on reducing the risk of 'an economic heart attack'

By Michael Janda

A pretty sobering note from US-based Citi foreign exchange analysts Ebrahim Rahbari and Brian Levine.

They think regulators, central banks and governments will have more work to do to sort out the current crises, especially among regional US banks, potentially including investing in them ("capital injections" in the jargon).

"These measures are important, but additional ones are likely required to stabilize confidence in regional US banks in particular.

"Raising the FDIC cap on insured deposits (potentially uncapping it) would be helpful, but capital injections are likely to be more effective, and probably necessary.

"Encouragingly, discovery of new asset quality weaknesses in this crisis so far has been limited, outside of regional US banks. If that continues, we are hopeful that policymakers and private entities will address the remaining gaps fairly promptly, and we therefore do not see a spiraling (global) financial crisis, even if some stresses are unavoidable."

This time around, unlike in some instances during the GFC, authorities are making sure that shareholders and bond investors cover most of the losses, not taxpayers.

"Shareholders in three failed US banks were wiped out, which is a common approach in FDIC action, and mainly notable for the size of their institutions, while unsecured debt holders are not unduly protected, except for uninsured depositors.

"In Europe, Credit Suisse AT1 instruments are to be written down as part of the merger with UBS.

"The general theme is that taxpayer exposure is meant to be minimized, with the details depending on the options available, but depositors are deemed to be 'systemic'."

In other words, the regulators' message is that depositors, even high wealth ones, are generally to be protected in order to head off catastrophic bank runs, but pretty much all other investors in failing banks will wear the cost.

And while central banks have been ploughing on with interest rate hikes up to this point (for example the European Central Bank's 0.5 of a percentage point rise last week, even as Credit Suisse was teetering on the brink of collapse), Citi doesn't expect this to continue.

"The situation is clearly serious, with some of the largest bank failures in US history and a rushed takeover of a globally systemic bank.

"Banking sector stress is likely to weigh on credit availability and private sector confidence, which will dampen growth and probably be disinflationary.

"That makes it easier for central banks to pivot, and we would expect central banks to lean on the potential for disinflation to justify pauses ahead.

"Less helpfully, higher policy rates may exacerbate financial stability concerns, eg for US regional banks, and at a different time horizon than any disinflationary effects.

"That means even for the Fed, a hike this week is at least in the balance, and even if the Fed did hike, it'd likely come with a signal that they may pause thereafter. We wouldn't expect the BoE [Bank of England] or SNB [Swiss National Bank] to hike this week."

The Citi analysts say the global financial system, and economies that rely on it, are not out of the woods just yet, but they're hopeful of avoiding another global financial crisis.

"Current extreme rates volatility reflects previous large short positions, the relatively high level of rates and also the wide uncertainty of outcomes, including a 'sudden stop' for economies.

"We think such sudden stops are conceivable given the severity of recent events, but we are cautiously optimistic that they can be avoided for now. That would allow rates volatility to stabilize in line with the reduced risk of an economic 'heart attack.'"

They're not alone. Even before the Credit Suisse takeover, analysts my colleague Nassim Khadem spoke to last week thought the risk of a "GFC 2.0" remained low.

Market snapshot at 10:45am AEDT

By Michael Janda

ASX 200: -0.7% at 6,948 points

All Ords: -0.7% to 7,139 points

Australian dollar: +0.3% to 67.13 US cents

Dow Jones (Friday close): -1.2% to 31,862 points

S&P 500 (Friday close): -1.1% to 3,917 points

Nasdaq (Friday close): -0.7% to 11,631 points

FTSE (Friday close): -1% to 7,335 points

EuroStoxx 600 (Friday close): -1.2% to 436 points

Brent crude: +0.4% to $US73.27/barrel

Spot gold: -0.6% $US1,976/ounce

Iron ore: +0.3% to $US129.50/tonne

Bitcoin: +4.8% to $US28,120

Local investors unimpressed by Credit Suisse bailout

By Michael Janda

The ASX is providing the first major test of market reaction to UBS's takeover of Credit Suisse and the latest moves by central banks to make more US dollars available to the global banking system.

The verdict so far seems to be "meh".

In the first 20 minutes of trade, the benchmark ASX 200 was down three-quarters of a per cent at 6,942 points.

The banking sector, which has of course been the centre of recent market stresses, was down 1.4 per cent.

The big four banks were all off around 1 per cent in early trade, with Macquarie and the smaller banks posting slightly bigger losses.

The mining sector, in particular gold miners (where investors often run to in times of stress and uncertainty), was the only one in the black.

More than three-quarters of stocks on the market were losing ground, while only 32 companies traded higher.

Central banks step up to unblock the plumbing in the global banking system

By Michael Janda

At times of market stress, banks can get pretty reluctant to lend money to each other, with worries about whether they'll get paid back.

This happened on an extreme scale during the global financial crisis.

With the recent US bank collapses and Credit Suisse troubles, central banks are again concerned that there might not be enough "liquidity" available in the financial markets.

So they are providing it themselves. This was a press release from the US Federal Reserve this morning.

"The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

"To improve the swap lines' effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 20, 2023, and will continue at least through the end of April.

"The network of swap lines among these central banks is a set of available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses."

US Treasury secretary Janet Yellen and Federal Reserve board chair Jerome Powell also released a joint statement backing the Swiss banking moves.

"We welcome the announcements by the Swiss authorities today to support financial stability.

"The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient. We have been in close contact with our international counterparts to support their implementation."

The long and winding road (for interest rates to have an effect)

By Michael Janda

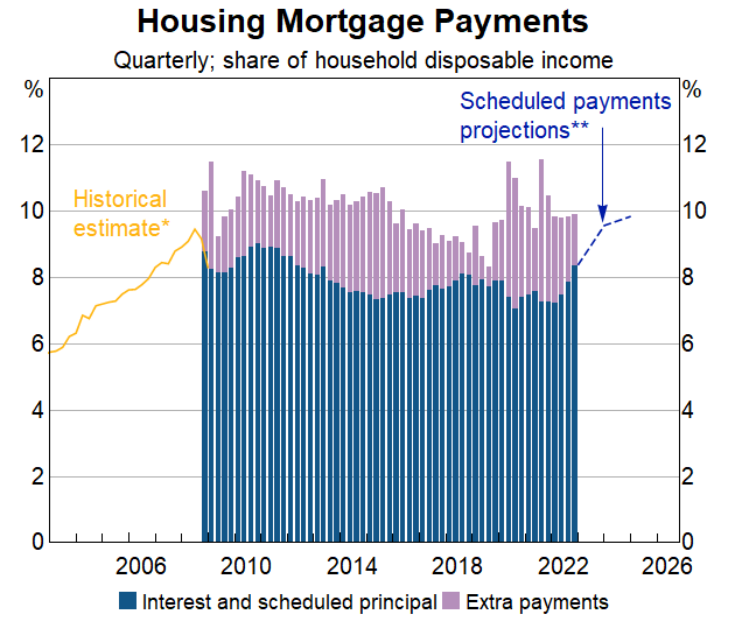

The Reserve Bank's assistant governor (financial markets) Christopher Kent has spoken about the lags in interest rates affecting the economy, and thus inflation, which may be getting longer.

Basically, it takes quite a while for interest rate rises to increase mortgage repayments and have a number of the other effects that slow economies.

Australia tends to have a faster pass-through from interest rates than many other countries, because most home owners are on variable mortgages and feel the impact of rate rises within three months.

But Chris Kent says that's changed a bit with the switch towards the ultra-cheap fixed rates during the pandemic.

"Fixed-rate loans peaked slightly above 35 per cent of all housing credit in early 2022, compared with a pre-pandemic average of closer to 20 per cent," he told the KangaNews summit.

"Since last May, the average outstanding mortgage rate across all loans has increased by around 110 basis points less than the cash rate.

"More than half of this difference owes to the effect of fixed-rate mortgages that haven't yet rolled onto higher interest rates.

"Also, the average outstanding rate for variable-rate mortgages has risen by around 40 basis points less than the cash rate as a result of competition among lenders for good-quality borrowers."

While some very organised borrowers are probably putting extra money aside in anticipation of their cheap fixed rate rolling off this year or next, the RBA is not counting on all borrowers being that forward thinking.

"Despite the potential for some forward-looking behaviour, it is plausible that the high share of fixed-rate loans has contributed to a longer lag for the cash flow channel," Dr Kent said.

"Scheduled mortgage payments – interest plus scheduled principal repayments – are shown in the blue bars.

"These rose by about 1.1 percentage points of household disposable income over 2022.

"The blue dashed line provides an estimate of how much further scheduled mortgage payments will rise based on the current cash rate: around 1.5 percentage points further by the end of 2024, with the bulk of that flowing through by the end of this year.

"Hence, only about 45 per cent of the rise in the cash rate to date had passed through to total scheduled mortgage payments at the end of 2022, though slightly more will have passed through in the early months of this year."

Bond market volatility continues

By Michael Janda

While we write a lot about stock markets, the global trade in government and corporate bonds (debt) is much more significant.

And it's been in relative chaos over recent weeks, with some of the biggest moves in decades.

NAB's head of foreign exchange strategy Ray Attrill said there were some pretty wild moves on Friday in Europe and the US.

"Extreme bond market volatility was again present, globally, on Friday.

"The failure of the mid-week actions by the SNB and US regulators to shore up the likes of First Republic's or Credit Suisse's share prices more than monetarily, means that financial stability concerns and their potential implications for central bank policy contuse to drive strong demand for shorter dated government bonds.

"US 2-year notes lost 32bps Friday to 3.84%, down exactly 75bps [basis points] on the week. 10s [10-year US Treasury bonds] were down 15bps Friday to 3.43% for a weekly loss of 27bps.

"This curve re-steepening (reduced inversion) in the last week or so is consistent with US recession starting about now, albeit nowhere to be seen in latest economy data."

Banking is a risky business, as we get reminded periodically

By Michael Janda

A typically on-point column from Ian Verrender today, looking at why banking is about the riskiest business you can get into.

"It's just that most folk don't realise is that banking is the riskiest business of all.

"Why? Because they operate on relatively small capital or equity bases compared to the size of the debts they carry and their commitments to depositors."

And for the whole system to work, you gotta have faith.

"Unlike almost any other industry, banking overwhelmingly is built upon trust: an assurance that you'll be able to retrieve your cash when you want it.

"But in a system that is so leveraged and so highly geared, even minor ructions can quickly undermine that trust."

You can read Ian's column in full here.

UBS provides a lifeline for rival Credit Suisse

By Michael Janda

The ASX will be the first major market to react to the big news overnight.

Of course the biggest news is that UBS is taking over its Swiss investment banking rival Credit Suisse, with some assistance and guarantees from the Swiss central bank and government.

It's a cut-price takeover at $3 billion Swiss francs ($4.8 billion), but the owners of Credit Suisse are probably happy to get out with any cash at all given the parlous state the bank found itself in.

You can read more details about the deal in our story from Reuters and AP.

Good morning, big day ahead

By Michael Janda

Good morning and welcome to our live blog, I'll be with you today to keep track of what's happening — and there's an awful lot on.

Huge bank bailout/takeover, coordinated central bank action, a speech from one of our own central bank officials and Australia is of course one of the first markets to deliver its verdict on a crazy weekend.

Strap in.