Australian shares finished lower on Monday after US debt ceiling talks failed to make progress in the absence of President Joe Biden.

Look back on the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:20pm AEST

By Michael Janda

ASX 200: -0.2% to 7,263 points

All Ords: -0.3% to 7,450 points

Australian dollar: -0.3% at 66.34 US cents

Nikkei: +0.9% to 31,077 points

Hang Seng: +1.3% to 19,700 points

Shanghai: +0.3% to 3,278

Dow Jones (Friday): -0.3% to 33,427 points

S&P 500 (Friday): -0.1% to 4,192 points

Nasdaq (Friday): -0.2% to 12,658 points

FTSE (Friday): +0.2% to 7,757 points

EuroStoxx (Friday): +0.7% to 469 points

Spot gold: -0.1% to $US1,973/ounce

Brent crude: -1.1% to $US74.74/barrel

Iron ore (Friday): -1.7% to $US105.00/tonne

Bitcoin: -0.1 to $US26,871

ASX finishes lower as financial sector losses outweigh tech gains

By Michael Janda

The Australian share market has closed lower for the day despite strong gains from energy companies and the technology sector.

Overall, the ASX 200 index was down 0.2% to 7,263 at market close, while the broader All Ords was off 21 points to 7,450 points.

The energy sector was up 1.1% at the end of the trading day, followed by healthcare up 0.5%, and technology up 0.1%.

The weakest performers of the day were in the real estate (-0.7%) and consumer cyclical firms (-0.7%), while financials were also lower (-0.6%), with all big four banks ending the day down.

Top gains:

- BrainChip Holdings: +8.5% to $0.51

- Kelsian Group: +3.4% to $6.79

- Nanosonics: +2.9% to $5.40

- WiseTech Global: +2.5% to $73.01

- Sims Ltd: +2.3% to $14.91

Biggest losses:

- Syrah Resources: -4.6% to $0.94

- Core Lithium: -4.0% to $1.08

- Lake Resources: -4.0% to $0.61

- Lovisa Holdings: -3.9% to $24.18

- Super Retail Group: -3.9% to $12.21

That's it for the markets blog today, but we will be back bright and early tomorrow to do it all again. See you then!

Are regional markets close to bottom and will spring see a property clean-out?

By Michael Janda

A couple of interesting notes out today from real estate analysis firm CoreLogic.

One is from Kaytlin Ezzy about the state of the major regional property markets, only seven of which are worth more now than they were a year ago.

The South East region in SA, which includes Kangaroo Island, the Fleurieu Peninsula and the Limestone Coast, remained the best performing regional house market on an annual basis, up 10.8%.

The New England and North West (NSW) and Bunbury (WA) regions were the next best performers, up 4.9% and 4.8% respectively.

In contrast, NSW lifestyle markets, including the Richmond-Tweed (-24.2%), Southern Highlands and Shoalhaven (-16.0%) and Illawarra (-13.7%) regions recorded the largest annual declines in house values, according to CoreLogic's data.

But all of these areas had huge price gains during the pandemic, with Richmond-Tweed up 51% for example.

"Over the past year, premium lifestyle markets have been hardest hit by softer market conditions and rate increases," Ms Ezzy noted.

"These markets were among the largest beneficiaries of regional migration through the COVID-induced upswing and, as a result, became significantly more sensitive to the rising cost of debt and the normalisation in regional migration trends."

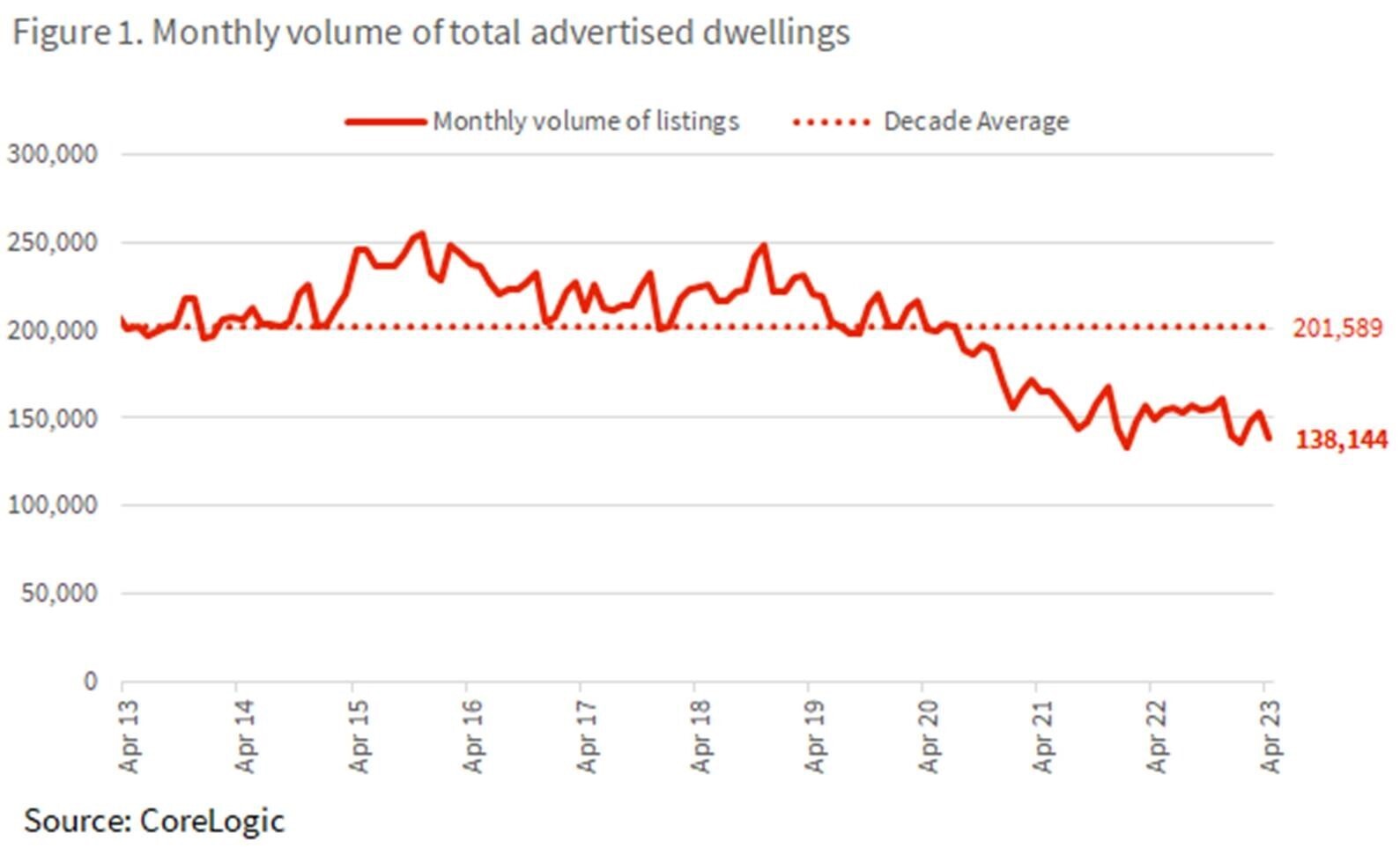

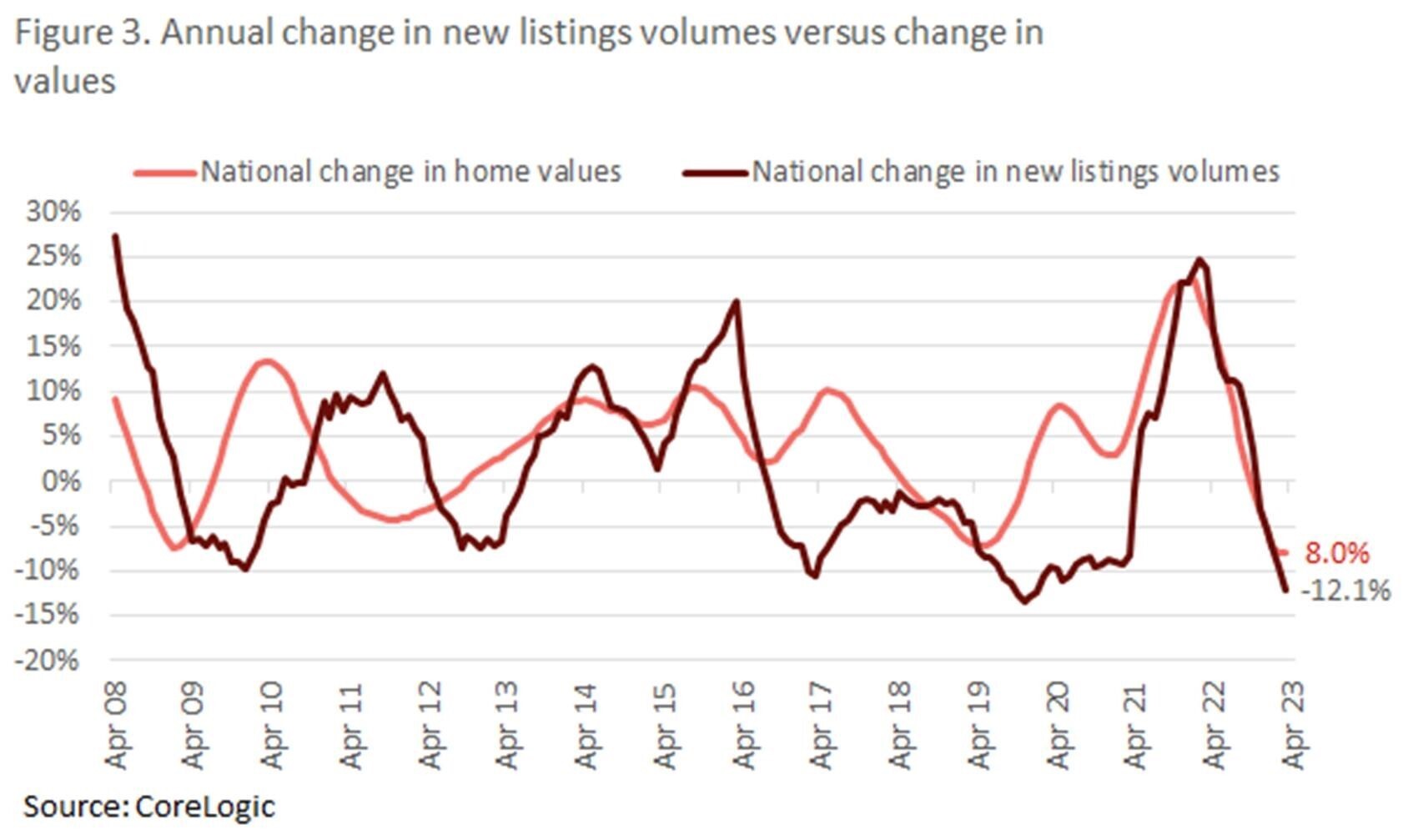

The other note, from CoreLogic's head of research in Australia, Eliza Owen, looks at the number of property listings and whether they're likely to go up.

At the moment, listings are close to the lowest they've been over the past decade.

However, listings are closely correlated with prices — when prices are rising, owners seem more willing to sell, says Ms Owen. Also, as listings peak it tends to drive prices down and when listings are low it can help hold prices up.

"Simple linear regression analysis suggests that for every 1% increase in property values over the year, there is a 0.5% increase in new listings in the same period," she observed.

"Going by the historic average, if national home values continue on the current trajectory through to the end of the year, that is rising at half a per cent per month (as recorded in March and April), home values would end the year around 4.1% higher.

"This would equate to an increase in 2023 listings that was 2% higher when compared to 2022. An additional 2% on the 485,052 new listings over 2022, would equate to 494,753 listings over 2023."

Ms Owen says there's no certainty price growth will continue at the current pace, after this month's surprise rate hike with the threat of more to possibly follow.

However, she adds that rising rates could see more properties listed for sale later this year, even if prices stall or fall again.

"Alternatively, there is a scenario that presents an upside risk for new listings. This would be a situation where vendors may need to sell their home and not voluntarily," she wrote.

"This may include households struggling to service a mortgage at higher interest rates, particularly amid rising unemployment over the course of the year.

"However, this scenario seems unlikely at present, given the low volume of new listings to date through rate rises, and strong pre-payment buffers across mortgaged households."

Coles overtakes Woolworths for price rises as food inflation hits fresh peak: UBS

By Michael Janda

Some interesting data out of UBS Australia's Evidence Lab.

They collect the data to help their clients figure out which stocks to buy, but they're also useful to see where a lot of inflation and cost of living pressures are coming from.

The April study shows Coles has recently overtaken Woolworths for price rises, although Woolworths had been ahead for most of the past few years.

Coles prices jumped sharply in April, up 10.5% over the past year, compared to a 9.1% annual rise in March.

Woolworths prices eased slightly from a 9.7% annual rise in March to an 8.7% increase over the year to April.

Coles had higher price rises for both fresh and dry goods, according to the UBS survey of more than 60,000 prices online.

UBS analyst Shaun Cousins says the monthly data is volatile, but useful nonetheless.

"The increasing rate of food inflation is a surprise, and inconsistent with the declines reported by COL and WOW in 3Q23.

"We suggest the achievement of a new peak in food inflation (ex-tobacco) is due to ongoing cost pressures on suppliers due to commodities & the domestic supply chain including labour."

The good news is that he expects food inflation to likely have peaked last month, with modest declines over the rest of the year.

A separate regular study of food and beverage prices by his UBS colleague Evan Karatzas also found inflation for dairy, spreads, meat, fruit and vegetables was 9% over the year to April, above the general inflation rate of 7%.

Again, the focus is on data useful to investors, so the study focuses on listed companies, such as Bega, Costa and Inghams.

The study found average dairy and spreads prices had increased 13 per cent compared to April a year ago, meat prices were up 9 per cent and fruit and vegetable prices were flat.

There was some positive news for the meat eaters amongst us, though.

"Dollar meat prices across the main categories are starting to decline m/m [month-on-month], although still remain elevated relative to the prior period.

"By product Chicken prices +10% (-1% vs. Mar-23), Pork +10% (-4% vs. Mar-23), Beef+7% (+6% vs. Mar-23), and Lamb +11% (-4% vs. pcp). Chicken remains the best value protein for consumers."

For dairy consumers, the next week and a bit are crunch time for prices, with processors having to tell farmers their planned farmgate milk price intentions for next financial year by June 1.

Coles is planning to offer $10-11 per kilogram and Bulla between $8.80-9.60.

UBS said the average farmgate price last year was $9.40/kilogram, so it looks like dairy price inflation will slow considerably from last year's huge price jumps.

Nerada tea set to suspend production

By Michael Janda

Some sad corporate news for Aussie tea lovers.

Australia's biggest tea grower is planning to suspend production due to declining demand and rising costs.

Nerada director John Russell says demand for the product on supermarket shelves was declining about 10% each year.

He said there was a "pick-up" in consumption "when people were locked down" during the pandemic but "busy lives have resumed again".

"It's hard to get that moment of pause when you're running around to enjoy a cup of tea."

My grandmother used to chug through many a cup of Nerada black tea — always loose leaves, never the bags.

Unfortunately for the company, she'd also get about four or five cups out of a couple teaspoons of leaves by simply refilling her cup with hot water (not my cup of tea!).

Perhaps the gradual passing of that tea-loving generation has contributed to Nerada's decline?

More on the story from ABC Far North's Christopher Testa and Charlie McKillop.

ASX extends losses as big banks lose ground

By Michael Janda

The ASX is extending its losses as the banking sector sheds more value, with the big four banks now down between 0.5-0.9%.

The energy sector is now the only part of the market in the black, up around 0.9%, but everything else is going backwards.

Out of the top 200 companies, 136 were losing ground while only 57 companies were gaining, as of 1:10pm AEST.

However, most of the falls were fairly modest, as investors seem to be waiting for some more clues about how the US debt ceiling crisis is likely to play out.

US president Joe Biden and Republican congressional leaders are expected to meet again overnight (Australian time) to try and hammer out a deal to raise the ceiling and prevent default.

In the meantime, around halfway through the trading day, the ASX 200 index was off around a quarter of a per cent at 7,261 points, with the All Ords off 0.3% at 7,449.

Market snapshot around 1:00pm AEST

By Michael Janda

ASX 200: -0.3% to 7,260 points

All Ords: -0.3% to 7,448 points

Australian dollar: Flat at 66.51 US cents

Nikkei: +0.1% to 30,834 points

Hang Seng: +1.5% to 19,738 points

Shanghai: +0.5% to 3,299

Dow Jones (Friday): -0.3% to 33,427 points

S&P 500 (Friday): -0.1% to 4,192 points

Nasdaq (Friday): -0.2% to 12,658 points

FTSE (Friday): +0.2% to 7,757 points

EuroStoxx (Friday): +0.7% to 469 points

Spot gold: +0.1% to $US1,978/ounce

Brent crude: -0.7% to $US75.06/barrel

Iron ore (Friday): -1.7% to $US105.00/tonne

Bitcoin: -0.7% to $US26,656

UBS US economist warns of up to 30% share price slump if US government defaults

By Michael Janda

Hey Michael, It seems the American's are too busy playing politic to rectify this crisis? If America does default what plays out here? Do we sink with the great American ship?

- Mitchell

Hi Mitchell, I just received a very relevant note from investment bank UBS, where its US chief economist Jonathan Pingle looks at exactly the question of what might happen if the US defaults.

Here are some highlights (or lowlights might be the more apt term). But just remember, this is only the forecasts of economists at one investment bank and not any kind of financial advice.

So UBS is already expecting the S&P 500 share index to drop 5% this quarter (to June 30) and finish the year flat as the US goes into recession. That's its baseline forecast.

"If the X-date is crossed without a formal default, we see the drop in Q2 deepening a further 5% to 3750, but proving temporary.

"A 1-week period of no coupon payment and default would trigger up to a 20% drop in stocks towards 3400, and keep them suppressed at those low levels through Q3 before making a partial recovery towards 3800 by year end.

"The very unlikely scenario of a month long non payment of coupon would not only cause an immediate drop of up to 30% in stocks, it would also see a very weak recovery, the S&P500 ending 5% below current levels even by end '24."

Ouch. 20 per cent is a bear market, so any kind of default is likely to push US stocks straight into one, according to UBS.

But a lot of that money is expected to go into, wait for it, US treasuries. Yes, the very thing that will have just defaulted.

"US yields will fall, not rise, even if the US defaults on its debt obligations. Treasuries flight-to-quality status comes more from liquidity than from credit quality, and the downswing in the economic cycle should obscure the rise in term premia that likely follow missed coupons," Pingle writes.

Here's Pingle's views on the prospects for currencies.

"Only a 1 month long impasse post the X-date is likely to cause a tightening of financing conditions sharp enough that it causes the dollar to rally strongly. In all other cases the dollar is likely to sell off amidst uncertainty.

"The worst case for the dollar is if the X-date is crossed without default; de-dollarisation becomes a real threat in this case. JPY [Japanese yen] longs against AUD [Aussie dollar] and CAD [Canadian dollar] and Gold calls are the cleanest ways to hedge against a US default. We see Gold doing well through all levels of uncertainty and default."

So that's the UBS economics team view. No doubt there are many other opinions on exact outcomes, but a strong analyst consensus that we'd be in for a very wild ride if the US passes the "X date" without a debt ceiling deal.

Comments are published when they are answered

By Michael Janda

Why are comments never published? Not just mine, anyone's.

- Gary Giumelli

Hi Gary, just to clarify, comments are published when we provide a response or answer to them (like this one), but not generally as standalone posts.

There are both technical and editorial reasons for this approach.

I hope that helps answer your question?

How are major BNPL stocks responding to the news of regulation?

By Michael Janda

The federal government is proposing the biggest regulatory shake-up in the fledgling buy now pay later (BNPL) sector's short history.

The proposed changes would see BNPL services regulated as a credit product, albeit with a lighter touch than loans and credit cards.

Block, the owner of Afterpay, was down -1.6% to $87.75 around 11:30am AEST.

"Today's announcement from the Government is a strong first step in the development of a fit-for-purpose Buy Now Pay Later regulatory framework that embeds effective consumer protections, generates positive outcomes for consumers and businesses, and provides certainty for industry," Afterpay said in a statement, adding that it wouldn't be doing any on-camera interviews at this stage.

While it may have to overhaul it's operations in Australia to comply with some of the requirements around credit licensing and checks, the BNPL market here is a relatively small part of its global payments footprint.

ASX-listed Humm Group has also welcomed the changes.

"hummgroup fully supports the Government's position to enhance consumer protection measures and has previously advocated for bringing BNPL within the application of the National Credit Code and the requirements associated with it," it said in a statement.

"In its submission to the Treasury Options Paper, hummgroup supported the requirement for BNPL providers to comply with responsible lending obligations which are calibrated to the level of risk of BNPL products and services (Option 2).

"The Company is particularly supportive of the requirements for BNPL companies to hold a credit licence, conduct scalable lending checks tailored to risk and have complaints and hardship policies in line with regulated products."

Humm shares were up 1.2% to 42.5 cents by midday AEST.

Zip, which already has an Australian Credit Licence (ACL), has welcomed the government's proposal.

"Zip has been advocating for fit for purpose regulation since as far back as 2019," said the company's co-founder Peter Gray told RN Breakfast.

"We generally believe it provides a sensible balance between consumer protection and minimum standards, but also supporting competition and innovation."

Mr Gray said he doesn't foresee many changes to the way his firm operates and the regulation is "likely to be a competitive advantage" for the company, which would not cost it customers.

"For Zip, it's actually business as usual," he argued.

"We already hold an Australian Credit Licence, we do offer regulated credit. We have been conducting ID, credit, banking and affordability checks on all our customers."

Zip investors disagreed, with its share price down 5.7% to $0.5425 around 11:30am AEST.

You can listen to Peter Gray's interview with RN Breakfast presenter Patricia Karvelas via the link below:

Will the US debt ceiling crisis push the greenback down and Aussie dollar up?

By Michael Janda

With the debt ceiling discussions continuing, is it possible we will see the Australian dollar strengthening against the US dollar like we saw around 2010-2013?

- Ethan

It's an interesting question and hard to predict how it might all play out.

Financial markets are still clearly betting that by far the biggest likelihood is a negotiated deal to raise the debt ceiling before the US government runs out of cash.

In the event that doesn't happen, then a US default and credit rating downgrade would cause a huge amount of global financial chaos.

This from Pepperstone's Chris Weston:

"In the art of brinkmanship, it feels that to get a deal we must see greater market volatility and so far, we've not really seen really any stress outside of US Treasury bills," he wrote.

"That could change this week and, while for much of last week the headlines were that a deal is within reach, the breakdown in talks from Republican negotiators on Friday has many thinking that we could be pushed right to the June deadline before we see an agreement – where in the spirit of political negotiations politicians simply have to take this to the wire to make it seem like they've truly fought for the best deal.

"Volatility markets are calm as they come, but don't be surprised if that changes this week."

In times of turmoil, the US dollar often goes up, even when the America is the source of the problem, as during the early part of the global financial crisis.

However, if the US government (i.e. the issuer of the dollar) is the problem then that obviously may not be the case.

That said, the Australian dollar isn't usually seen as a 'safe haven' currency, because of our huge exposure to commodity prices, which are vulnerable to global economic conditions.

If you look at 2011, the first time the US came seriously close to breaching its debt ceiling and defaulting, then you see that there wasn't an enormous jump for the Aussie dollar versus the greenback during July, when the negotiations were stalling (a deal was struck at the end of that month).

The main reason that the Australian dollar was so high then was a massive interest rate differential in favour of Australia over the US, plus very high commodity prices.

Market snapshot at 10:30am AEST

By Michael Janda

ASX 200: -0.1% to 7,272 points

All Ords: -0.1% to 7,461 points

Australian dollar: +0.1% to 66.56 US cents

Dow Jones (Friday): -0.3% to 33,427 points

S&P 500 (Friday): -0.1% to 4,192 points

Nasdaq (Friday): -0.2% to 12,658 points

FTSE (Friday): +0.2% to 7,757 points

EuroStoxx (Friday): +0.7% to 469 points

Spot gold: +0.1% to $US1,978/ounce

Brent crude: +0.2% at $US75.72/barrel

Iron ore (Friday): -1.7% to $US105.00/tonne

Bitcoin: -0.8% to $US26,624

Energy gains hold up ASX as other sectors ease

By Michael Janda

Some strong gains for coal miners and other energy companies are helping to minimise falls for the main ASX indices, while most other sectors trade in the red.

Overall, the ASX 200 index was down 0.2% to 7,266 by 10:20am AEST, while the broader All Ords was off 17 points to 7,454 points.

The energy sector was up 0.8% in early trade, with real estate the only other sector in the black (just).

Education (-1%) and consumer cyclical firms (-0.5%) were the two weakest performers, with most stocks across the market posting only moderate moves.

Top gains:

- BrainChip Holdings: +8.5% to $0.51

- New Hope Corporation: +2.5% to $5.24

- Kelsian Group: +2% to $6.70

- West African Resources: +1.7% to $0.91

- Viva Energy: +1.1% to $3.245

Biggest losses:

- Sayona Mining: -3.3% to $0.2225

- Lovisa Holdings: -3.2% to $24.36

- Fisher and Paykel Healthcare: -3.1% to $24.57

-

Allkem: -2.4% to $15.22

- Metcash: -2.4% to $3.69

Comments on, questions welcomed

By Michael Janda

Not too bad — it only took just over an hour today for me to remember to turn on comments. I'm getting better at it Natty, really.

Bring on the questions or any market/economics/business topics you'd like to hear more about today.

Government considering possible criminal actions arising from PwC tax leaks scandal

By Michael Janda

The PwC tax leaks scandal is far from over for the accountancy and consultancy partnership which used confidential information obtained while assisting the Australian government to draft new multinational tax laws to assist some of the multinationals targeted to plan strategies to legally minimise their tax bills under those laws.

Assistant Treasurer and Minister for Financial Services Stephen Jones has told ABC business reporter Nassim Khadem that it's possible that the matter will be referred to the Australian Federal Police for potential criminal investigations.

"We've got Treasury looking at an investigation into what has occurred, and looking at whether criminal charges should be referred to the AFP," he said.

"We're all appalled with what's gone on with PwC. We want to send a very clear message to them, and anyone else who's providing services to government, that you cannot breach the trust of the government or the Australian people.

"So if criminal charges or other charges can be laid, we're looking forward to the outcomes of that investigation from Treasury."

Nassim asked the minister whether the government might also hit PwC via its partners' hip pockets.

"And so are you reviewing current government contracts [with PwC]?"

"The Finance Minister and Treasury are looking at all of the options that are available to us," Mr Jones responded.

Treasurer Jim Chalmers was slightly more circumspect on RN Breakfast, but also flagged further action against PwC.

"We've taken some steps, there will be more steps to take," he told Patricia Karvelas.

"I'm working on them almost literally right now, and I'll have more to say about it in due course."

The ABC's business editor Ian Verrender had some strong analysis last week on the PwC scandal.

Residents accuse Newcrest's Cadia gold mine of showering their properties in heavy metals

By Michael Janda

The NSW Environment Protection Authority (EPA) is launching an investigation into resident complaints of excessive dust coming from Newcrest's Cadia gold mine near Orange.

Residents say testing has revealed high levels of some heavy metals, which they believe is coming from dust released by the mine.

ABC journalists in the region, Joanna Woodburn and Micaela Hambrett are following the story.

Market snapshot at 9:10am AEST

By Michael Janda

ASX 200 futures: -0.2% to 7,289 points

Australian dollar: Flat at 66.52 US cents

Dow Jones (Friday): -0.3% to 33,427 points

S&P 500 (Friday): -0.1% to 4,192 points

Nasdaq (Friday): -0.2% to 12,658 points

FTSE (Friday): +0.2% to 7,757 points

EuroStoxx (Friday): +0.7% to 469 points

Spot gold: +0.2% to $US1,981/ounce

Brent crude: +0.1% at $US75.64/barrel

Iron ore (Friday): -1.7% to $US105.00/tonne

Bitcoin: -0.1% to $US26,799

Buy now, pay later will be regulated as credit

By Michael Janda

Who would have thought that getting a product now and paying for it later was a form of credit??? Apparently not legislators, until now.

The federal government will regulate the buy now, pay later (BNPL) industry under the Credit Act to better protect consumers against financial abuse by the lending schemes.

But BNPL will not be subject to all the same requirements as other consumer loan products, such as credit cards.

The option chosen by the federal government requires BNPL products meet modified Responsible Lending Obligations under the Credit Act to determine unsuitability, combined with a strengthened Industry Code.

It's a middle of the road option that's unlikely to totally please either the BNPL companies, which sought to largely regulate themselves, or the consumer advocacy groups pushing for tighter regulation of the sector.

"The plan will protect people from the spirals of harm that unregulated, unrestricted lending can cause," said Financial Services Minister Stephen Jones.

"BNPL looks like credit, it acts like credit, it carries the risks of credit."

My colleagues Kate Ainsworth and Nassim Khadem are across all the details, and have the full story.

Welcome to another week of debt ceiling discussion

By Michael Janda

Good morning and welcome to a week in which we're going to hear A LOT about the US debt ceiling.

The US should have enough cash stashed through emergency measures to pay its bills this week, but so-called X day, when the money runs out, looms as early as potentially next week (with estimates ranging from June 1 on), so markets will be hoping Democrat and Republican negotiators make some progress.

That's likely to be easier now that Joe Biden will be present for the talks — his absence at the G7 seemed to stall things, so it's probably for the best he cancelled his trip Down Under this week.

Things didn't go so well on Friday, with Republican house speaker Kevin McCarthy walking out on the talks amid a continued lack of agreement on spending cuts.

"Over the weekend McCarthy said that the impasse was unlikely to be resolved while the president was still overseas," noted NAB's Rodrigo Catril.

"Then late on Sunday, the two parties agreed to resume talks (have we not seen this movie before?) with President Biden and McCarthy set to meet on Monday.

"Speaking over the weekend and adding urgency for a resolution, Treasury Secretary Janet Yellen said the US is unlikely to reach mid-June and still be able to pay its bills."

Staffers have been talking over the weekend and Biden and McCarthy chatted on the phone in what's being reported as a more positive conversation, but the positions are still some way apart.

If you're not up to speed with the US government debt ceiling and what's at stake if it isn't raised before the June deadline, my colleague Kate Ainsworth will get you there with her explainer: