Falls across most of the resources sector plus a big drop for QBE weighed down the ASX on Friday, but it made a recovery in time for weekend knock-off drinks. Find out how the day unfolded by reading back our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:45pm AEST

By Emilia Terzon

- ASX 200: 0.1% to 7,256 points

- All Ordinaries: 0.1% to 7,453 points

- Australian dollar: -0.1% at 66.96 US cents

- Dow Jones: -0.7% to 33,010 points

- S&P 500: -0.2% to 4,131 points

- Nasdaq: +0.2% to 12,329 points

- FTSE: -0.1% to 7,731points

- EuroStoxx: Flat at 464 points

- Spot gold: -0.3% at $US2,010/ounce

- Brent crude: -0.8% to $US74.39/barrel

- Iron ore: -4.5% to $US98.70/tonne

- Bitcoin: -0.7% at $US26,823

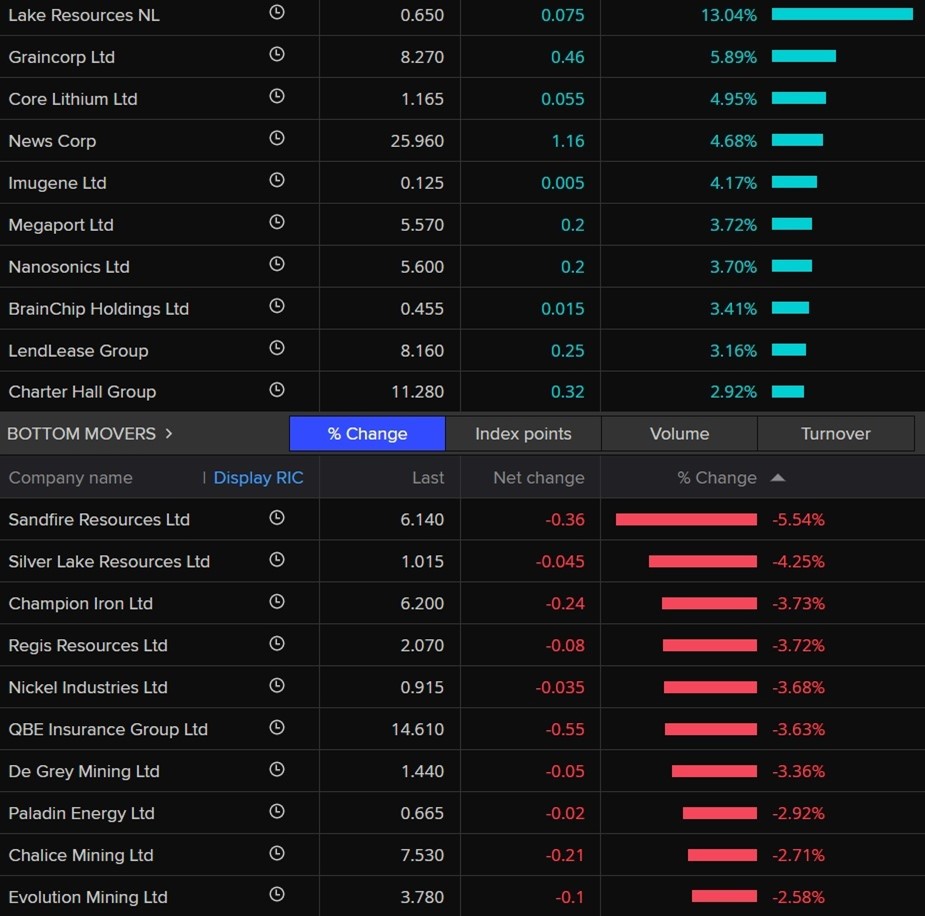

ASX closes just a smidge higher after midday losses

By Emilia Terzon

The Australian sharemarket has recovered from a midday downer to finish in marginally positive territory.

The ASX 200 finished up just 4.8 points (+0.07pc) to 7,256, while the All Ords was just about the same.

The top stock for the benchmark was Lake Resources, showing that when all else fails, we can all rely on lithium.

But the actual mid-afternoon recovery mostly came down to tech and healthcare.

Mining stocks, however, were down. Giants BHP, Rio Tinto and Fortescue Metals all closed lower.

Gold stocks toppled 2.3% as the bullion lost shine.

Overall, the ASX gained 0.5% this entire week, snapping a three week losing streak.

Have a lovely weekend everybody!

AustralianSuper's 'alarming' $70m double-up sparks calls for wider investigation

By Emilia Terzon

Good afternoon!

Emilia from the ABC's business unit here bringing you some developing news on Australia's biggest super fund.

AustralianSuper says it's going to refund an estimated $70 million to around 100,000 customers, who were being double charged fees and insurance costs.

The fund manages almost $290 billion in retirement savings for 3.1 million Australians.

It says it did a review of how it manages multiple accounts, and found it had not eradicated all examples of double up.

That means it had members with multiple accounts under the fund who were potentially paying double the fees and insurance.

AustralianSuper says it expectes to repay around $650 per impacted person.

It says both current and former customers impacted will be contacted in "coming months".

"This should not have happened, and we apologise unreservedly to members," its statement said.

"The Fund is taking appropriate remediation actions and has self-reported the issue to the regulators."

The advocacy group for people with superannuation funds says the revelation by AustralianSuper is "alarming".

"Paying extra fees and insurance premiums for more than one account really adds up," Rosie Thomas, Super Consumers Australia's deputy director says.

"The Productivity Commission found having unnecessary multiple accounts can leave someone over $50,000 worse off in retirement.

"It’s important we fix this problem across the super system, and getting funds to sort out intra-fund consolidation is the first step.

"The laws to encourage super funds to get rid of multiple accounts within their own fund are a decade old.

"We’ve never seen any public statement or actions from the regulators on this issue. It is alarming that such a major player is only discovering issues now."

It now wants a review of all super funds into this issue.

Are you an AustralianSuper customer? Have you been told you've got a double up issue? Send me an email on terzon.emilia@abc.net.au

This saga from AustralianSuper comes off the back of a general crackdown on fees in the super industry. We just published this list with the best and worst performing funds.

I'm outta here

By Michael Janda

After a number of rather long days this week, especially Tuesday, I'm taking a small Friday early mark.

You will be in the safe hands of Emilia Terzon to take you through to market close.

I'll be back on the blog on Monday, so join me for more market and economics fun … it'll be exciting, I promise.

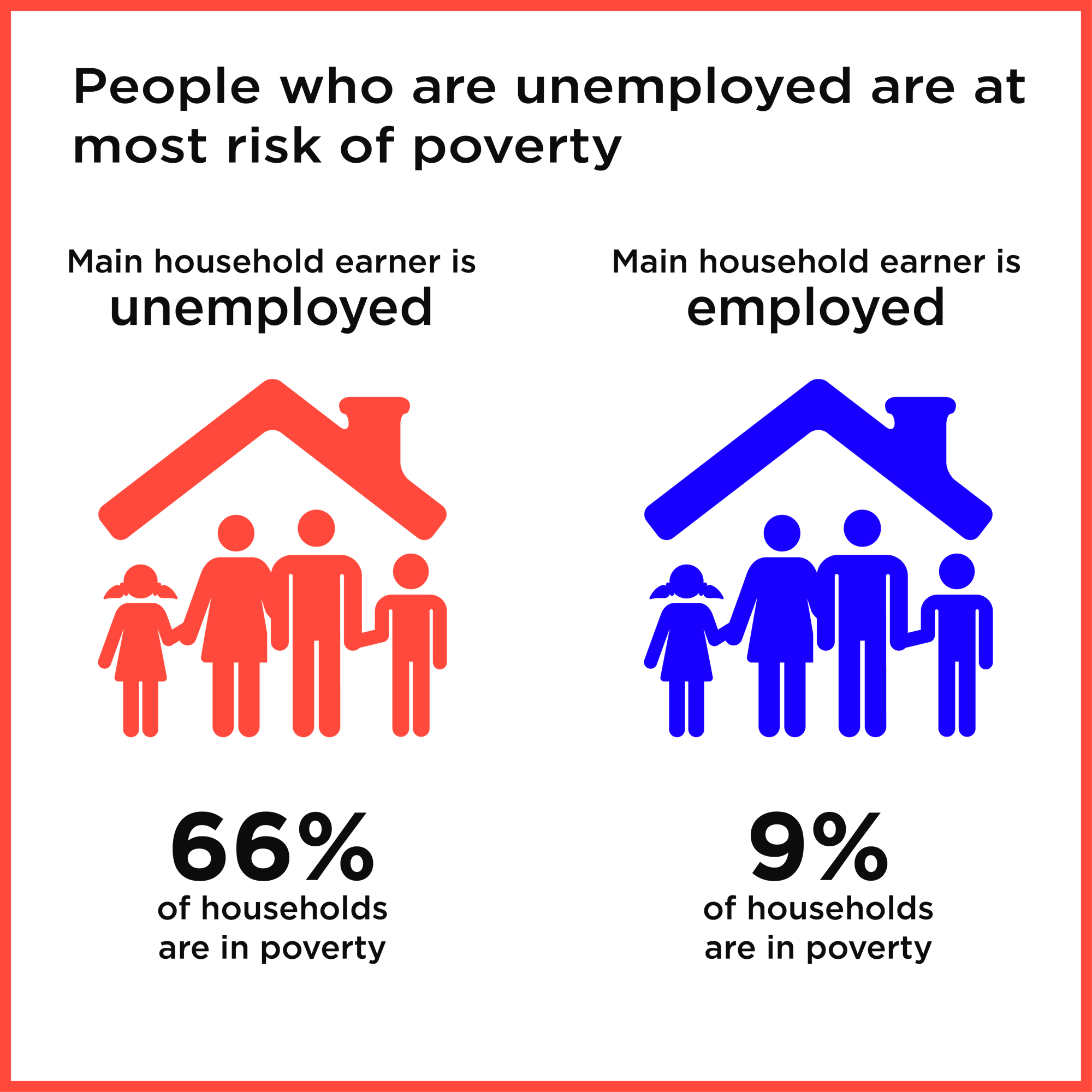

Inflation, wages and poverty

By Michael Janda

If inflation has gone up 7,8% and wages have gone up 3, 4 % does this mean that poverty has gone up by the difference? and why is poverty not measured monthly like CPI, Gdp, or employment?

- Rowan

Good questions Rowan.

Poverty is a tricky one in economics and social policy because there are different definitions of how much someone needs to be earning to be above the poverty line.

Broadly speaking, those are relative poverty — i.e. you earn less than x per cent of what the average person does — and absolute poverty, which is an estimate of how many dollars a week you need to buy the basics — food, shelter, healthcare, etc.

The Australian Council of Social Service (ACOSS) and UNSW do an annual report on poverty that uses a relative measure.

"We use two poverty lines – 50% of median income and 60% of median income, whereby people living below these incomes are regarded as living in poverty.

"We also take into account the costs of housing when calculating income – referring to income before or after housing costs are taken into account. We mostly use 'after housing costs', because housing is the largest fixed costs for most households. Those households with lower housing costs are able to afford a higher standard of living than those on the same income with higher housing costs."

This is what they found last year:

"Our 2022 Poverty in Australia Snapshot found that there are 3.3 million people (13.4%) living below the poverty line of 50% of median income, including 761,000 children (16.6%). In dollar figures, the poverty line works out to $489 a week for a single adult and $1,027 a week for a couple with 2 children."

As for the other part of your question about wages and inflation, that ends up being a slightly different topic to poverty, in most cases.

As the ACOSS/UNSW research shows, poverty is most concentrated in people without work, and is relatively low in households where at least one person has a job.

What the gap between inflation and wage growth shows us is that real wages are falling.

The latest Wage Price Index figures were have from the ABS are from the December quarter (the March quarter ones come out next Wednesday) and show 3.3% annual growth. Inflation over the same period was 7.8%, so real wages fell 4.5% over that period.

Other measures of wage growth that include bonuses, promotions, job changing and working extra hours show worker income has grown more strongly.

The ABS measure of compensation of employees jumped 10.4% over the year to December — but that number includes some very strong population growth.

If the workforce grew by 2 per cent last year, which is a decent ballpark figure for 2022, then that means overall worker pay went up about 5.2% per capita — still a real pay cut, and with some people working longer hours to bring in the extra cash.

This will push some working households into poverty, but it will push many more into hardship — difficulty paying rent or the mortgage, cutting back on food, giving up a lot of life's small luxuries.

As for why there isn't a more regular official estimate of poverty, ask the Australian Bureau of Statistics, and the Australian Government.

Glad you like us!

By Michael Janda

Hi Michael, You have a brilliant team of people at the ABC covering business news. Thank you for your excellent work. Cheers, Michael of Adelaide

- Michael of Adelaide

Appreciate the positive feedback Michael — great name BTW :)

As journos we often hear a lot of critical feedback, which is good because some of it helps improve our reporting, although much of it is just plain mean and uninformed.

So, it's nice when someone bothers to tell us they think we're doing a good job.

After a long week covering budget, RBA and markets, this made my Friday!

Lithium set to over take fossil fuel royalties in WA as renewables transition gathers steam

By Michael Janda

A really great analysis from the ABC's energy reporter Daniel Mercer, using the WA budget as a window into the global move towards renewable energy and electrification.

Aside from the value chain issues Dan raises at the end of his piece, I reckon there's a good follow up examining whether WA and the Commonwealth risk repeating the same mistakes in not capturing enough value through royalties and taxes from lithium, nickel, rare earths, etc… as has happened with gas and iron ore.

Would a rental cap help tenants or backfire on them?

By Michael Janda

It's a contentious issue.

The Greens are arguing for a temporary rental freeze and then longer term caps on rent increases to ease the pressure on struggling tenants.

A lot of economists warn that could just drive investment out of the property market, reducing supply and potentially increasing rents over the longer term.

But a growing number of experts say, given current extreme rental increases, a short-term rent freeze or cap may not be such a bad idea.

Emilia Terzon had a look at the issue for The Business:

And co-authored this online piece with Kate Ainsworth:

Would the RBA lift rates to 4.8% to smash inflation quickly? Economists think not

By Michael Janda

Earlier this year, the RBA modelled some scenarios where the cash rate rose to 4.8%, potentially as early as May (this clearly did not occur, as the current cash rate is 3.85%).

That modelling shows it would have pushed unemployment up to 4.5% by early next year which, on some widely accepted definitions, would constitute a recession.

But economists think the RBA will continue to follow a more moderate path to getting inflation back down, and most believe the economy is already past a turning point where weaker demand will help the central bank get its job done.

Peter Ryan spoke to CBA's Gareth Aird and Betashares' David Bassanese.

Market snapshot at 12:45pm AEST

By Michael Janda

ASX 200: -0.2% to 7,237 points

All Ordinaries: -0.2% to 7,433 points

Australian dollar: -0.1% at 66.96 US cents

Dow Jones: -0.7% to 33,010 points

S&P 500: -0.2% to 4,131 points

Nasdaq: +0.2% to 12,329 points

FTSE: -0.1% to 7,731points

EuroStoxx: Flat at 464 points

Spot gold: -0.3% at $US2,010/ounce

Brent crude: -0.8% to $US74.39/barrel

Iron ore: -4.5% to $US98.70/tonne

Bitcoin: -0.7% at $US26,823

ASX remains slightly in the red by the middle of the trading session

By Michael Janda

As we approach the mid-point of the trading day, the ASX is still posting very moderate losses.

The benchmark ASX 200 index was down 0.2% at 7,240 points at 12:33pm AEST, while the broader All Ords was also off 0.2% at 7,436.

As in early trade, it is the resources sector letting down the market, with both miners and energy companies losing ground.

Basic materials (mostly mining) was down 1.4% and energy was off 1.2%.

Every other sector was up, but this is Australia, and half of our corporate profits come from resource extraction, so where the miners go, often the market goes.

Education and healthcare were still the biggest gainers.

The best performers around 12:35pm were:

- Lake Resources: +8.7% to $0.625

- Graincorp: +5.3% to $8.225

- BrainChip Holdings: +4.6% to $0.46

- News Corp: +4.5% to $25.92

- Nanosonics: +2.8% to $5.55

The worst performers were:

- Sandfire Resources: -6% to $6.11

- Regis Resources: -5.4% to $2.035

- Evolution Mining: -5% to $3.685

- West African Resources: -4.1% to $0.935

- De Grey Mining: -3.9% to $1.4325

Medibank facing privacy breach investigation as customers seek compensation

By Michael Janda

This short statement out today from Medibank:

"Late on 11 May 2023, the Office of the Australian Information Commissioner (OAIC) advised Medibank that it has decided to proceed with the investigation of the representative complaint lodged by Maurice Blackburn on 18 November 2022.

"The OAIC advised it will proceed with the investigation of the representative complaint at the same time as the Commissioner's own investigation.

"Medibank continues to support its customers from the impact of the cybercrime through our previously announced Cyber Response Support Program which includes mental health and wellbeing support, identity protection and financial hardship measures."

This is some further context of the legal actions underway against Medibank over the data breach, with Slater and Gordon last week also announcing a class action.

Where are all the US bank deposits going?

By Michael Janda

I people in America are taking deposits out in droves where are they going to put it if the US banks are in a delema ?

- John

Great question John.

He's referring to PacWest reporting a further 9.5% slump in deposits last week, which sent its share price down more than 20% overnight.

While I don't have any figures to hand, the general feeling is that a lot of businesses or wealthier individuals are taking their uninsured savings out of smaller and mid-sized banks and putting them into accounts with the really big players, like Bank of America, Wells Fargo, Citi, etc...

It's also important to remember that US deposits are guaranteed by federal insurance up to the value of $US250,000.

So it's probably not a flood of everyday people taking their savings out that's the problem — think Northern Rock in the UK around the time of the global financial crisis — instead it's businesses changing which bank they do transaction/payroll banking with, or wealthier individuals who have bigger balances.

That's why particular regional banks, like PacWest, which rely more on these kinds of deposits are being hit hardest.

Elon Musk finds new Twitter CEO

By Michael Janda

Elon Musk has, appropriately, taken to Twitter to announce he's found a new chief executive for the company.

But he didn't name them, leaving a potential pool of more than 4 billion possible candidates because all we know is that it's a woman.

Tesla shareholders were pretty happy, with the company's share price jumping in late trade, no doubt as investors hope Mr Musk will be less distracted with his new social media venture and redirect more of his focus onto making and selling electric cars.

Tesla shares finished 2.1% higher at $US172.08.

You can read more here:

Market snapshot at 10:30am AEST

By Michael Janda

ASX 200: -0.1% to 7,245 points

All Ordinaries: -0.1% to 7,440 points

Australian dollar: Flat at 67.04 US cents

Dow Jones: -0.7% to 33,010 points

S&P 500: -0.2% to 4,131 points

Nasdaq: +0.2% to 12,329 points

FTSE: -0.1% to 7,731points

EuroStoxx: Flat at 464 points

Spot gold: +0.1% at $US2,017/ounce

Brent crude: +0.6% to $US75.40/barrel

Iron ore: -4.5% to $US98.70/tonne

Bitcoin: -0.2% at $US26,950

Miners, QBE weigh on ASX in early trade

By Michael Janda

As indicated by the futures market, it's a pretty flat start to trade on the ASX.

The ASX 200 was up 1 point at 7,253 around 10:15am AEST — that's point, not per cent — and the All Ords was down 2 points at 7,448.

Most companies in the top 200 were doing well, with 131 in the black and only 65 in the red.

But the mining sector, notably the big iron ore miners, were among those losing ground, weighing on the index as a whole.

BHP (-1.7%), Rio Tinto (-1.4%) and Fortescue (-1.6%) were all down after spot iron ore prices dropped below $US100 a tonne, continuing recent trends on signs of Chinese economic weakness.

QBE was another big company dragging on the market — investors clearly not impressed with its first quarter performance update, despite 11% growth in gross written premium.

The company did warn about the cost of a number of natural disasters, which is already creeping towards its first half catastrophe allowance with a couple of months yet to go.

QBE shares were down 5.1 per cent to $14.39.

Healthcare, education and consumer cyclicals were today's leading sectors, with energy joining mining as the laggards.

The big four banks were up between 0.2 and 1 per cent, with Westpac leading.

Five biggest gains on ASX 200:

- News Corp: +4.1% to $25.81

- GrainCorp: +2.6% to $8.015

- Sayona Mining: +2.4% to $0.215

- Imugene: +2.1% to $0.1225

- Polynovo: +1.6% to $1.4125

Five biggest losses on ASX 200:

- Sandfire Resources: -5.2% to $6.16

- QBE Insurance: -4.8% to $14.43

- Champion Iron: -3.7% to $6.20

- Regis Resources: -3.7% to $2.07

- Paladin Energy: -3.7% to $0.66

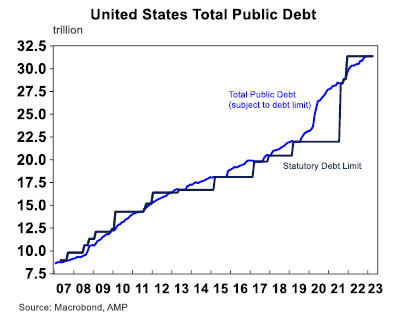

Will the US debt crisis be resolved before a default?

By Michael Janda

Michael, the resolution, or not of the pending US debt ceiling crisis? Where are you putting your money? Will it be resolved with Biden a skilled negotiator and a more moderate, (compared to MAGA area), Republic House leadership? Or are there still not enough adults in the House?

- Johannes, Yarraville

Great question, and if I definitely knew the answer I could make a lot of money.

The markets seem to be assuming it will be, as Wall Street's S&P 500 is trading just a whisker off this year's highs and is up 7.6% so far in 2023.

That's probably because history suggests it will be, as it has been every other time the US government has approached the debt ceiling.

The crisis in 2011 resulted in Standard and Poor's cutting the US Government's AAA credit rating to AA+, a move which the other big ratings agencies didn't follow.

That period saw a big sell-off in markets as the US got within hours of a default, before a quick rebound when a deal was reached.

AMP senior economist Diana Mousina wrote earlier this month saying, while a default was unlikely, the results of it would be so severe that investors should be concerned.

"According to the US Treasury, total US public debt already reached the debt ceiling back in January. However, "extraordinary measures" have been used by the US Treasury to keep paying bills which includes measures like using cash reserves and suspending reinvestment of securities into public benefit and investment funds.

While it may seem inconceivable that the US economy would ever willingly default on its debt obligations but the risk of this happening this year is elevated (we assign a 10-15% probability of a technical default) because political polarisation is at its highest level for years and fiscal policy decisions will influence the 2024 Presidential election.

"Even a high probability of a default would create a lot of volatility in financial markets and large falls in share markets, especially at a time that markets are already grappling with many issues including elevated inflation, high interest rates and looming recession risks."

I'm not sure that totally answers your question, but I'm not sure anyone can.

If AMP is assigning a 10-15% risk of a default, that is pretty significant given the degree of financial fallout if it were to happen.

Watch this space.

Comments and questions welcome

By Michael Janda

We have to remember to click to turn on commenting, and I forgot earlier this morning.

But I would really like to hear from you if you have a question or comment about the blog, markets, business news or economics — preferably economics and rates, as that's my bread and butter.

Fire away.

Telcos pinged over fake sender ID scam texts

By Michael Janda

The Australian Communications and Media Authority (ACMA) has taken action against three telcos for allowing the misuse, or potential misuse, of sender IDs.

"ACMA investigations found Sinch Australia Pty Ltd (Sinch), Infobip Information Technology Pty Ltd (Infobip) and Phone Card Selector Pty Ltd (Phone Card) allowed SMS to be sent using text-based sender IDs without sufficient checks to ensure they were being used legitimately.

"The ACMA found Infobip allowed 103,146 non-compliant SMS to be sent, which included scams impersonating well known Australian road toll companies. Sinch allowed 14,291 non-complaint SMS, which included Medicare and Australia Post impersonation scams.

"Phone Card was also found to have inadequate systems in place to comply with the rules, however there is no evidence that scammers exploited the opportunities it created.

"Text-based sender IDs can be used by scammers to pose as legitimate organisations such as government agencies, banks and road toll companies. Under the Reducing Scam Calls and Scam SMS Code, Australian telcos must obtain evidence from customers that they have a legitimate reason to use text-based sender IDs (such as business names) in SMS."

Despite the tough talk, the penalties for the breaches are … nothing.

"The ACMA has given Sinch and Infobip formal directions to comply with the obligations, the strongest enforcement action available for code breaches. Phone Card has been given a formal warning.

"Combating SMS and identity theft phone scams is an ACMA compliance priority and telcos may face penalties of up to $250,000 for breaching ACMA directions to comply with the code."

Market snapshot at 8:40am AEST

By Michael Janda

ASX SPI 200 futures: -0.1% to 7,247 points

Australian dollar: Flat at 67 US cents

Dow Jones: -0.7% to 33,010 points

S&P 500: -0.2% to 4,131 points

Nasdaq: +0.2% to 12,329 points

FTSE: -0.1% to 7,731points

EuroStoxx: Flat at 464 points

Spot gold: Flat at $US2,015/ounce

Brent crude: -1.3% $US75.43/barrel

Iron ore: -4.5% to $US98.70/tonne

Bitcoin: -0.1% at $US26,984