Equity traders bought up today, adding back almost as much as was wiped off the ASX yesterday, following that ninth hike by the RBA.

More companies reported their earnings — shareholders were pleased with Boral's results, pushing its share price higher.

Catch up on all the day's events as they unfolded.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4.30pm AEDT

By Rachel Pupazzoni

ASX 200: +0.3pc to 7,530 points

All Ords: +0.3pc to 7,739 points

Australian dollar: Flat at 69.62 US cents

Dow Jones (close): +0.8% to 34,157

S&P 500 (close): +1.3% to 4,164

Nasdaq (close): +1.9% to 12,114

FTSE (close): +0.4% to 7,865

EuroStoxx 600 (close): +0.2% to 458

Brent crude: +3.8% to $US84.09/barrel

Spot gold: +0.1% to $US1,876/ounce

Iron ore: -3.5% to $US119/tonne

Bitcoin: +0.2% to $US23,280

Markets close higher recouping some of yesterday's RBA losses

By Rachel Pupazzoni

We've come to the end of another trading day and company stock prices have settled at the end of another.

The top 200 and the broader All Ordinaries index both added about a third of a per cent this Wednesday, after wiping off about half a per cent yesterday (here's looking at you RBA).

- ASX 200 up 0.3 per cent to 7,530

- All Ordinaries up 0.3 per cent to 7,739

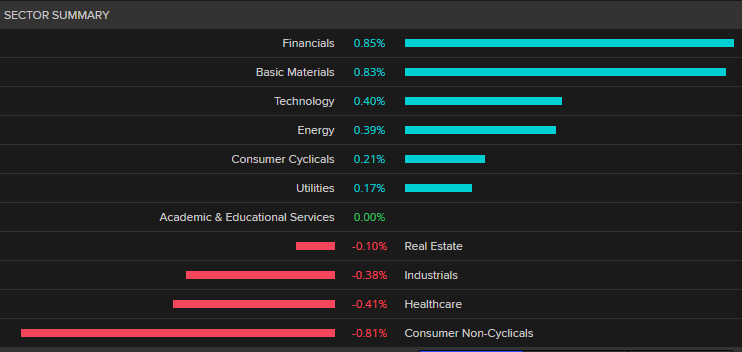

Financials (up 0.85 per cent) and resources (up 0.83 per cent) led the market all day.

Boral was the clear winner, closing more than 12 per cent higher to $3.95 a share, on the back of its half year results.

The best gain among the big four banks was NAB, adding about 1.1 per cent to end the session at $32.08 a share.

Thanks for joining Dan, Michael and me on the blog today - it's great to get your comments and questions.

Catch you next time!

How have mortgage and savings rates responded to the cash rate?

By Michael Janda

Of the two big banks that have announced their response to the RBA's rate rise, both ANZ and NAB passed it on in full to variable mortgage borrowers.

However, ANZ has only passed it through to some savings accounts, while NAB has not yet announced what it will do with savings rates.

"NAB savings customers should not have to put up with this," argues RateCity's Sally Tindall.

"Will they hike? Won't they hike? If you've got your hard-earned cash in the bank, you want it to be upfront so you can make an informed decision."

While some banks are being slammed for not passing on the latest official interest rate rise to depositors at the same time as they announce rate hikes for mortgage borrowers, the most recent RBA data shows that at least some depositors have benefitted.

The key line here is the orangey-red one that shows the gap between the average interest rate on bonus savings accounts and the rate on all variable owner-occupier mortgages.

That gap appears to have peaked in June last year, having risen dramatically early in the pandemic as rates plunged, with savings rates clearly falling a lot further, faster than mortgage rates.

As the cheap emergency funding provided by the Reserve Bank rolls off over the coming months, banks are having to replace it with more expensive money from global financial markets or compete for depositors.

Ms Tindall says savings customers should look for alternatives if their bank isn't passing on at least a quarter of a percentage point increase after the RBA's latest move.

"A decent ongoing savings rate after this latest hike filters through will be over 4 per cent. Anything less, and it could be time to break up with your bank."

As for those on variable mortgages, the half a percentage point gap between the average rate for existing customers and the rates new customers are getting should be a wake-up call to consider the possibility of refinancing, if you still can.

Mortgage customers should also brace for the possibility that their bank may raise rates by more than the RBA to recoup some of the higher funding costs and maintain profit margins, as my colleague Sam Yang explained last month.

Financial advice for all

By Rachel Pupazzoni

The government wants the financial advisory industry to be better and more accessible.

You might remember the banking royal commission (back in 2018) - the issue of dodgy advisers was raised then.

The government has now released a 267-page final report of Treasury's Quality of Advice Review.

It's a report chaired by lawyer Michelle Levy (and handed to the government in December) and considers how to make seeking financial advice more accessible and affordable to more people - while still delivering quality advice that isn't compromised or conflicted.

The Assistant Treasurer and Minister for Financial Services, Stephen Jones, said

"While protecting Australians from dodgy financial advice, we don't want to make it harder to get sound advice.

"We want to see an industry with strong professional standards that's accessible for more Australians and look forward to hearing views on achieving that goal.

"The government will now consult widely on the Review's recommendations.

Consumer advocate group Choice is not happy. Here's some of what Choice's Alan Kirkland told my colleague Gareth Hutchens.

"These proposals won't make independent financial advice more accessible, what they'll actually do is undermine the provision of independent financial advice, because those independent advisors will still be subjected to professional standards, yet banks and super funds, the major firms, will be able to push out advice on mass without any requirement that's provided by qualified staff or that they adhere to ethical standards".

"Independent advisors should be outraged about these changes," he added.

Mr Kirkland said the two tiered system will undermine the provision of quality, independent financial advice and will encourage more dodgy advice.

"One of the most important reforms that was introduced after the global financial crisis was the requirement that financial advisors act in the best interest of their clients.

"This review recommends that we completely get rid of that duty when you seek advice from a bank or a superannuation fund.

"So this is going to make it really easy for those large firms in the system to push poor quality advice on to their customers, who will have very few consumer protections."

Sarah Abood from the Financial Planning Association told Gareth:

"There are quite a few recommendations that just make practical suggestions about ways we can reduce the red tape and bureaucracy, the unnecessary things that are involved in providing advice that consumers are paying for, but they're not actually getting any benefit from."

She said consumer laws exist to protect people from improper advisers.

"There are consumer laws around fit for purpose, around providing advice efficiently, honestly and fairly.

"I don't think it's the case that there would be some kind of open slather where people will be told to do crazy things.

"That's not our reading of the recommendations."

She added, consumers can be overwhelmed by the amount of paperwork when seeking financial advice, not to mention the associated costs which can add up to thousands of dollars - often out of reach for many people.

She supports measures to simplify the process.

"One example is a document called the Statement of Advice, which can now run to well over 100 pages, to read the advice on potentially a quite simple matter.

"Consumers don't read those documents.

"By and large they don't want them and yet, effectively, they're having to pay for them to be produced right now."

The report is open for public consultation, I've pasted the website for you. I recommend you pour yourself a cuppa first.

You can also see more on this on The Business tonight on your TV or catch up on ABC iView - my colleague Gareth Hutchens will break it all down for you.

Australia's gender pay gaps could be exposed in excruciating company-by-company detail

By Daniel Ziffer

Potential good news for workers, particularly women.

Bad news for companies that habitually pay women less.

The government has introduced legislation that would require businesses with over 100 workers to individually report the gender pay gap in their business to an employment watchdog.

The Workplace Gender Equality Amendment (Closing the Gender Pay Gap) Bill 2023 is the latest attempt to fix our stubborn gender pay gap.

The peak union body, the ACTU says the gender pay gap between men’s and women’s earnings is currently 14.1 per cent, with women on average earning $263.90 less than men each week.

There are complex reasons that include things like the gendered division of parenting and caring responsibilities, and industry-wide low pay rates in female-dominated 'caring' professions like health and education.

If the proposed legislation becomes law it could be an excruciating moment for some specific businesses, because the gap will be published by the Workplace Gender Equality Agency (WGEA).

The Australian Council of Trade Unions president Michele O’Neil welcomed the legislation in a statement:

“After nearly a decade of no government leadership on this critical issue, the ACTU welcomes this legislation as a positive step to ensure greater transparency and accountability by businesses regarding their gender pay gaps.

“Equal pay is a right enshrined in law yet in reality there are persistent structural and cultural issues across our workplaces that have contributed to a gender pay gap in favour of men in every single industry across our economy – including female-dominated industries such as education and health care.

In a submission ahead of the legislation being written, the Australian Industry (Ai) Group argued against publication of the data.

"The public disclosure of gender pay gaps within organisations should not be pursued, based on the observed adverse impact on wages growth and productivity within organisations combined with pay transparency’s distant proximity as a key cause to the gender pay gap"

The industry lobby group noted what it believed as the key causes of the gap, being; gender segregation across industries, with female-dominated ones paid less, time out of the workforce impacting career progression; and "bias and discrimination (often ‘unconscious’ or unintentional) in decision-making."

"... Ai Group has significant concerns... and does not support the publication of remuneration data and pay gap percentages in organisations. Pay transparency does not address the causes of the gender pay gap".

A question on rate rises and inflation

By Rachel Pupazzoni

Rachael, I struggle to see the real impact of a rate rise to slow inflation when the majority of inflationary spending is most likely coming from people without mortgage stress, are these increases only compounding the cost of living pressure s on those who can least afford it, we end up with lots of first mortgage holders exiting and back more dependent upon govt assistance, makes no sense. Seems very elementary economic theory to me.

- Evo

Hi Evo, thanks for your question. We love hearing from our readers.

This goes back to some of the questions asked of my colleague Gareth Hutchens on yesterday's rates blog - I linked it for you, below.

We're in a tricky situation aren't we. The RBA knows it, they've talked for a while about being on 'a narrow path' to reign in inflation.

Hike rates too much and we risk recession, don't hike them enough and inflation stays high. It's a classic goldilocks scenario.

We all spend in the economy, groceries, heating, fuel, dinner out, tickets to the game on the weekend and so on, so I think everyone contributes to inflation, regardless if they have a mortgage or not.

But you have a point, rising costs will hurt those with lower incomes than people with more cash to spend.

But let's say our 'well-off' person, let's call them Sally, owns a house that Jack, Oliver and Kate rent.

Sally's just had the interest rate on her mortgage increased for the ninth time since May. Sally's wage hasn't increased so she's spending much more of her cash on her loan repayments.

To recoup some of that increase, she raises the rent she charges.

So now Jack, Oliver and Kate's costs have increased because they're each paying an extra $50 a week on rent (not to mention the extra cash on groceries and power bills).

So while they don't own a home, the increase to the RBA's cash rate is affecting them too.

The RBA wants to inflict this pain on us all, so we stop spending so much in the economy.

If we spend less - that'll mean less demand and prices will naturally come down (as businesses try to encourage us to spend by offering things for cheaper!).

And you raise another valid point - forced sales. There's an expectation people who can't afford their repayments will have to sell their properties in distress (though there's some evidence to suggest it isn't that bad, yet - I wrote about it in yesterday's blog).

There are potentially other, more targeted ways to contain inflation, such as tax increases, which take money out of the economy, just like rate rises do.

One potential example would be the travel and accommodation spending by self-funded retirees, which is contributing to extremely high inflation in that sector.

A rate rise actually gives many in this group a boost to their income, via higher deposit rates.

One alternative would be to increase/introduce taxes on superannuation earnings in retirement, which would take some money out of the budgets of this group.

Thanks for your question Evo.

Banks stocks are leading the ASX pack today

By Rachel Pupazzoni

The banks are doing very nicely on the ASX in early afternoon trade - thanks to the RBA's ninth rate hike yesterday.

Here are how the sectors are performing at 1.30pm AEDT.

- Our biggest bank, CBA is pretty flat in early afternoon trade. Shares are unchanged at $110.29

- ANZ shares are 0.65 per cent higher at $25.81

- NAB is the best performer of the big four, up 1.09 per cent with shares trading at $32.08

- Westpac shares are 0.48 per cent higher at $23.85

When was the last time you sent or received a letter in the mail (bills don't count)?

By Rachel Pupazzoni

Looking at Australia Post's half year results, our lack of penned correspondence is weighing heavily on their revenue.

For a while now, Australia Post has been indicating letter writing was a dying art and today's results show revenue fell 2.4 per cent in the first half of the financial year, to $4.69 billion because we've lost our penmanship.

During COVID-19 we all increased our online shopping (I know I did) and that helped the postie, delivering a temporary surge.

But those days are over.

Letter postage fell 5.7 per cent in the half, compared to the first half of FY 22.

Letter revenue now makes up just 18.8 per cent of total Australia Post revenue.

Parcel and services delivery was also down in the half, falling 1.6 per cent.

Australia Post cited cost increases, mostly from higher wages, severe weather events and labour shortages impacted the profitability of the business.

Group profit was down 88.2 per cent, from $199.8 million in the first half of FY 22, to $23.6 million this half.

Group chief executive officer and managing director, Paul Graham is worried about the future.

"We are at a crossroads and the headwinds facing our business have never been stronger.

Our Letters business continues to decline, as volumes fall and costs increase.

Changing customer behaviours are also impacting our retail network, with continuing digitisation resulting in declining retail transactions at Post Offices.

As flagged in our 2022 financial results, Australia Post will report a full year loss this year for the first time since 2015."

Maybe it's time to post your mum, friend, uncle a letter?

BHP mine site fatality

By Rachel Pupazzoni

Some sad news out of Western Australia's iron ore region today, with a man dying after being hit my a locomotive last night at BHP's rail yard in Port Hedland.

BHP WA iron ore asset president Brandon Craig said BHP was devastated by the accident and in a statement noted:

"That is nothing compared to the grief and loss being felt by the person's family, friends and colleagues.

"Our hearts are with them at this time and we will provide any support that we can.

“As a result of this incident, we have suspended WA Iron Ore operations for 24 hours. Counselling services are available for our team members."

Details are limited, but my colleagues at ABC Pilbara have more in this story.

Prices-wages spiral

By Michael Janda

The RBA's target inflation rate for the current world environment is now too low. The world has changed and conflicts around the world are worsening and this appears to be the new norm. Compared to other interest rate hike periods everyday Australians are enduring increases to everyday life at an unprecedented level. Will the RBA and big business please cease stating there is pressure of creating a wage spiral. The previous governments purposely kept wages from increasing.

- JJ

Hi JJ, you make some interesting observations, although I think the chances of major changes to the RBA's 2-3 per cent inflation target are small.

The RBA review, which is due to be completed within the next couple of months, is looking at this amongst many other issues, but the reality is that Australia's 2-3 per cent target is already higher than many other global central banks, a lot of which target 2 per cent.

On the risk of a wages spiral, the RBA late last year adopted an interesting change of language.

Usually economists talk about a wage-price spiral, i.e. implying that uppity workers have kicked off inflation by demanding more pay, with businesses then increasing prices just to cover their rising costs.

However, the RBA has flipped that conventional terminology on its head, as in yesterday's statement from Philip Lowe.

"Wages growth is continuing to pick up from the low rates of recent years and a further pick-up is expected due to the tight labour market and higher inflation.

"Given the importance of avoiding a prices-wages spiral, the Board will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms in the period ahead."

This appears to be a pretty clear signal that the RBA believes price rises from firms are more at the root of current inflation than wage rises for workers.

And it's hard to argue otherwise, given the recent level of profit growth in the National Accounts, compared to the relatively anaemic level of wage rises until very recently.

I wrote this piece last year looking at the topic.

Nonetheless, whoever is to blame for the current level of inflation, the RBA still doesn't want huge catch up pay rises to further entrench the cycle of rising prices.

Boral best performer on the ASX after strong half year results

By Rachel Pupazzoni

Boral's half year results beat forecasts today, with its underlying net profit after tax up 53 per cent to $56.8 million.

The construction materials maker's revenue was up 12 per cent to $1.68 billion, as demand for its products soared.

In handing down his first results since taking over as chief executive officer, Vik Bansal, noted to the market, soaring inflation is making business conditions challenging.

"I am pleased to report a half on half improved performance on key metrics amidst a challenging inflationary and operating environment.

"We will need to remain highly disciplined and focussed in getting price realisation from the market across the country while maintaining a disciplined approach to cost management.

"Price erosion is not an option for Boral."

It will not pay shareholders a dividend.

Shares in Boral jumped as much as 12 per cent this morning. At midday they're worth $3.92 a share.

Suncorp profit climbs as insurance premiums jump

By Michael Janda

Suncorp shares have jumped after a positive first-half profit result.

The Queensland-based regional bank posted a 44 per cent increase in net profit after tax to $560 million, while the cash earnings measure jumped an even higher 63 per cent to $588 million.

The company said its Australian insurance "gross written premium" had risen 9 per cent, "driven by the pricing response to inflation and increased natural hazard and reinsurance costs".

New Zealand premiums rose an even higher 12.2 per cent "from price momentum".

The banking division also had some price momentum, increasing its net interest margin by a whopping 0.13 of a percentage point to 2.03 per cent as interest rates rose.

The net interest margin is the key source of bank profits, as it measure the gap between the interest rates the bank is paying to borrow money (such as from depositors) and the rates it is lending it out at.

Ratings firm Moody's was impressed with the result, with vice-president Frank Mirenzi describing them as "credit positive".

"The insurance business generated high levels of premium growth and strong underwriting performance, as reflected in its combined ratio of 94.5%.

"The group's banking operations are benefiting from rising interest rates with the net interest margin increasing to 2.03% from 1.9% and credit risks remaining benign so far.

"Over the second half of the year, we expect increasing prices to benefit the insurance business; however, the credit cycle may turn, raising risks and credit costs for the bank."

Investors were also impressed, with Suncorp's share price up 3.5 per cent to $12.90 by 11:40am AEDT.

Suncorp will pay its shareholders a 33 cents per share fully-franked interim dividend.

Alan Kohler's finance

By Rachel Pupazzoni

If you missed Alan Kohler's finance report last night, I've popped it here for you.

As he says in his wrap, banks were bought up yesterday after the RBA rate hike.

Check it out here.

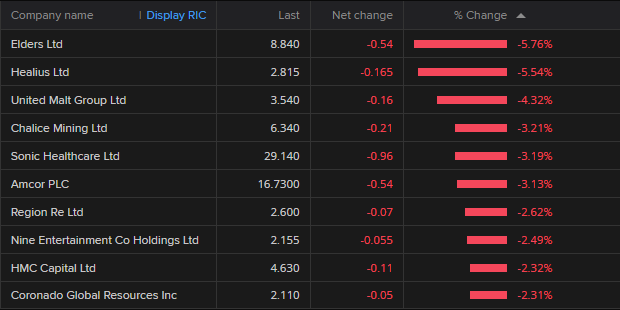

Winners and losers on the ASX this morning

By Rachel Pupazzoni

The ASX has been open for a bit over an hour, so let's check the state of play.

Here are the top 10 companies on the ASX 200.

Boral, the construction materials maker, is having its best day on the ASX in eight months.

It posted its half year results today - and the numbers were up - I'll provide a bit more detail on that in a post shortly.

Agribusiness, Elders, is leading bottom 10 companies on the ASX 200 lower.

RBA recap

By Rachel Pupazzoni

Good morning! I'm Rachel Pupazzoni and jumping in on the blog for the rest of today.

Please let me know if you have any questions or comments using our comment button - we love hearing from you.

I'm still recovering from yesterday's Reserve Bank of Australia (RBA) news - are you?

Did you miss it?

Check out my colleague Stephanie Chalmers coverage of the RBA's 0.25 percentage point increase, taking the official cash rate to 3.35 per cent.

While the increase was widely expected, the commentary about further increases in coming months, was not and that saw many economists revising their forecasts for the months ahead.

It also saw the ASX fall - but it appears most of those losses have been recovered in early trade today.

I'll keep an eye on things for you and let you know how the trading day unfolds.

Market snapshot at 10:25am AEDT

By Michael Janda

ASX 200: +0.3pc to 7,527 points

All Ords: +0.3pc to 7,738 points

Australian dollar: Flat at 69.58 US cents

Dow Jones (close): +0.8% to 34,157

S&P 500 (close): +1.3% to 4,164

Nasdaq (close): +1.9% to 12,114

FTSE (close): +0.4% to 7,865

EuroStoxx 600 (close): +0.2% to 458

Brent crude: +3.8% to $US84.09/barrel

Spot gold: -0.1% to $US1,872/ounce

Iron ore: -3.5% to $US119/tonne

Bitcoin: +0.4% to $US23,287

ASX posts modest early gains on Wall St rally

By Daniel Ziffer

Trading has opened on Australian stock exchanges. In initial trading, the value of the ASX 200 index is up 0.3%.

The move higher came after Wall Street gained strongly over night on the latest rates commentary from Federal Reserve chair Jerome Powell.

The ASX 200 tracks the value of the 200 largest companies in Australia.

Builder takes on, well, entire system.

By Daniel Ziffer

There's massive infrastructure projects and an investment boom, so it might seem strange that large builders have been falling over.

The Australian Constructors Association represents big construction and infrastructure contracting companies and it's boss Jon Davies is not holding back on the problem: greed and stupidity.

In a comment piece about the collapse of century-old company Clough, building the Snowy 2.0 project, he exposes what he thinks is going wrong.

The nature of construction is that contractors and subcontractors price projects months before actual costs are known. They are given only a few months to quantify complex risks on multi-billion-dollar projects and unsurprisingly, despite their best efforts, there is often a difference between the initial budget and the actual cost. In the current inflation environment, that difference can be huge.

Since the pandemic, due to global supply chain problems and labour shortages, costs in construction have rocketed.

Who do you think wears this cost escalation? By default, it’s the contractor. Now you might expect contractors to simply build some ‘fat’ into their budgets to account for possible price rises. You’d be right, but here’s rub. At the tender box, clients still focus obsessively on one criteria—lowest price. This sets up a perverse incentive for contractors to build in as little fat as possible to keep their bid as low as possible and give themselves the best chance of winning.

In effect, the winning bid is the one willing to take the biggest gamble on the risk outcome. At any point in the cycle, there is always someone willing to take a less-than-prudent risk. So we get a race to the bottom, non-existent profit margins, and an adversarial approach to contract management.

I think the last line - "adversarial approach to contract management" - might be code for big project owners squeezing small contractors.

No wonder construction firms account for 26 per cent of administrations on a share of only 17 per cent of all businesses. No wonder that construction productivity is worse now than it was thirty years ago. It’s a brutish game of survival when it should be about producing the best possible infrastructure for the taxpayer.

Administration, winding companies up, is expensive and often leaves people out of pocket. You can read more about it here.

Mr Davies is just winding up, taking aim at the structure of the industry.

Based on productivity alone, neoliberalism in the construction sector has failed. The abolition of minimum fee scales for construction professional services only served to commoditise and cheapen highly specialist skills. A focus on lowest cost at the tender box has increased insolvency levels to record highs and reduced competition at all levels in the industry.

It's an interesting look in - one perspective - on why there are such big problems in construction at the moment. You can read the whole think at this link.

Or learn more about the 'profitless boom' in construction through this article from my colleague.

Telstra left customers with life-threatening medical conditions without a phone for month

By Daniel Ziffer

Cracker article in the Nine newspapers exposing an ACMA report about Telstra's failure to help with customers needing 'priority assistance'.

Some patients with life-threatening medical problems were left without phone services for up to three months because Telstra failed to fix faulty lines.

I don't need to explain to you why this is a huge problem.

The watchdog, the Australian Communications and Media Authority found Telstra failed to respond to hundreds of calls for help.

It also didn't give information about registering for priority assistance, which in turn put some of its most vulnerable customers at risk.

People with life-threatening medical conditions to do with their heart, breathing, diabetes, mental health and others can get extra help - because they need emergency access to their phones.

ACMA chair Nerida O’Loughlin is quoted in the piece laying it out:

“These are some of Telstra’s most vulnerable customers and the telco must have adequate systems in place to make sure these important obligations are always met,” she said.

Trust is falling in institutions

By Daniel Ziffer

Australia is at risk of polarisation — a societal split — with low trust in institutions such as the government and media being a key element.

A new global study by communications firm Edelman warns the nation is on a divisive path - towards countries with high socio-economic inequalities such as the US, South Africa and Argentina - if the direction is not corrected.

It's a fascinating report, and here's my summation of it.