Providing a diverse range of perspectives from bullish to bearish, 19 analysts have published ratings on Biogen (NASDAQ:BIIB) in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 6 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 2 | 0 | 0 |

| 2M Ago | 4 | 2 | 3 | 0 | 0 |

| 3M Ago | 1 | 2 | 2 | 0 | 0 |

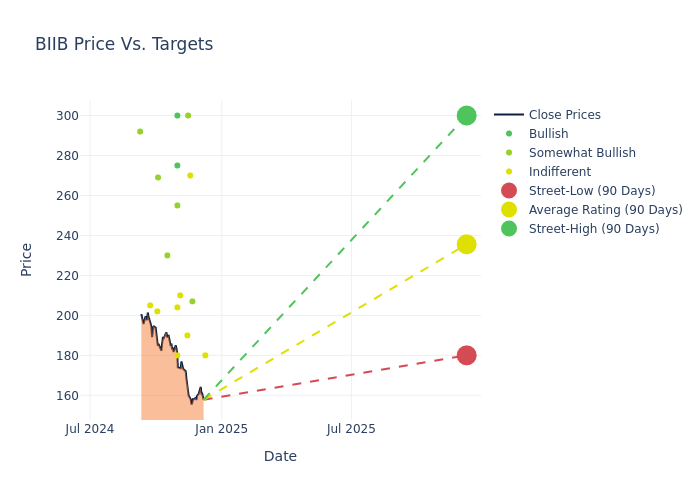

Analysts have recently evaluated Biogen and provided 12-month price targets. The average target is $241.79, accompanied by a high estimate of $300.00 and a low estimate of $180.00. Highlighting a 8.24% decrease, the current average has fallen from the previous average price target of $263.50.

Investigating Analyst Ratings: An Elaborate Study

The perception of Biogen by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Yee | Jefferies | Lowers | Hold | $180.00 | $250.00 |

| Salim Syed | Mizuho | Lowers | Outperform | $207.00 | $251.00 |

| Ami Fadia | Needham | Maintains | Hold | $270.00 | $270.00 |

| Brian Skorney | Baird | Raises | Outperform | $300.00 | $294.00 |

| Geoff Meacham | Citigroup | Announces | Neutral | $190.00 | - |

| Chris Schott | JP Morgan | Lowers | Neutral | $210.00 | $220.00 |

| Jay Olson | Oppenheimer | Lowers | Outperform | $255.00 | $270.00 |

| Carter Gould | Barclays | Lowers | Equal-Weight | $180.00 | $190.00 |

| Phil Nadeau | TD Cowen | Lowers | Buy | $275.00 | $300.00 |

| Andrew Fein | HC Wainwright & Co. | Maintains | Buy | $300.00 | $300.00 |

| Ami Fadia | Needham | Maintains | Buy | $270.00 | $270.00 |

| Matthew Harrison | Morgan Stanley | Lowers | Equal-Weight | $204.00 | $285.00 |

| Ami Fadia | Needham | Maintains | Buy | $270.00 | $270.00 |

| Evan Seigerman | BMO Capital | Lowers | Outperform | $230.00 | $260.00 |

| Brian Abrahams | RBC Capital | Lowers | Outperform | $269.00 | $292.00 |

| Colin Bristow | UBS | Lowers | Neutral | $202.00 | $234.00 |

| Ami Fadia | Needham | Maintains | Buy | $285.00 | $285.00 |

| Laura Chico | Wedbush | Lowers | Neutral | $205.00 | $210.00 |

| Brian Abrahams | RBC Capital | Maintains | Outperform | $292.00 | $292.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Biogen. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Biogen compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Biogen's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Biogen's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Biogen analyst ratings.

Delving into Biogen's Background

Biogen and Idec merged in 2003, combining forces to market Biogen's multiple sclerosis drug Avonex and Idec's cancer drug Rituxan. Today, Rituxan and next-generation antibody Gazyva (oncology) and Ocrevus (multiple sclerosis) are marketed via a collaboration with Roche. Biogen markets several multiple sclerosis drugs including Plegridy, Tysabri, Tecfidera, and Vumerity. Biogen's newer products include Spinraza (SMA, with partner Ionis), Leqembi (Alzheimers, with partner Eisai), Skyclarys (Friedreich's Ataxia, Reata), Zurzuvae (postpartum depression, Sage), and Qalsody (ALS, Ionis). Biogen has several drug candidates in phase 3 trials in neurology, immunology, and rare diseases.

Biogen: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Challenges: Biogen's revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -2.55%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Biogen's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.76% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Biogen's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.41% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Biogen's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.41% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.41.

Analyst Ratings: Simplified

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.