Although advancements that SMIC and Huawei have made in the semiconductor sector in recent years are pretty impressive, the companies are 10 to 15 years behind industry giants like Intel, TSMC, and Samsung, said Christophe Fouquet, chief executive of toolmaker ASML. It's well known that even with the best-in-class DUV tools, Chinese fab SMIC will be unable to match TSMC's process technologies cost-effectively. This is because Chinese companies cannot access leading-edge EUV lithography tools.

"By banning the export of EUV, China will lag 10 to 15 years behind the West," said Christophe Fouquet in an interview with NRC (machine translated). "That really has an effect."

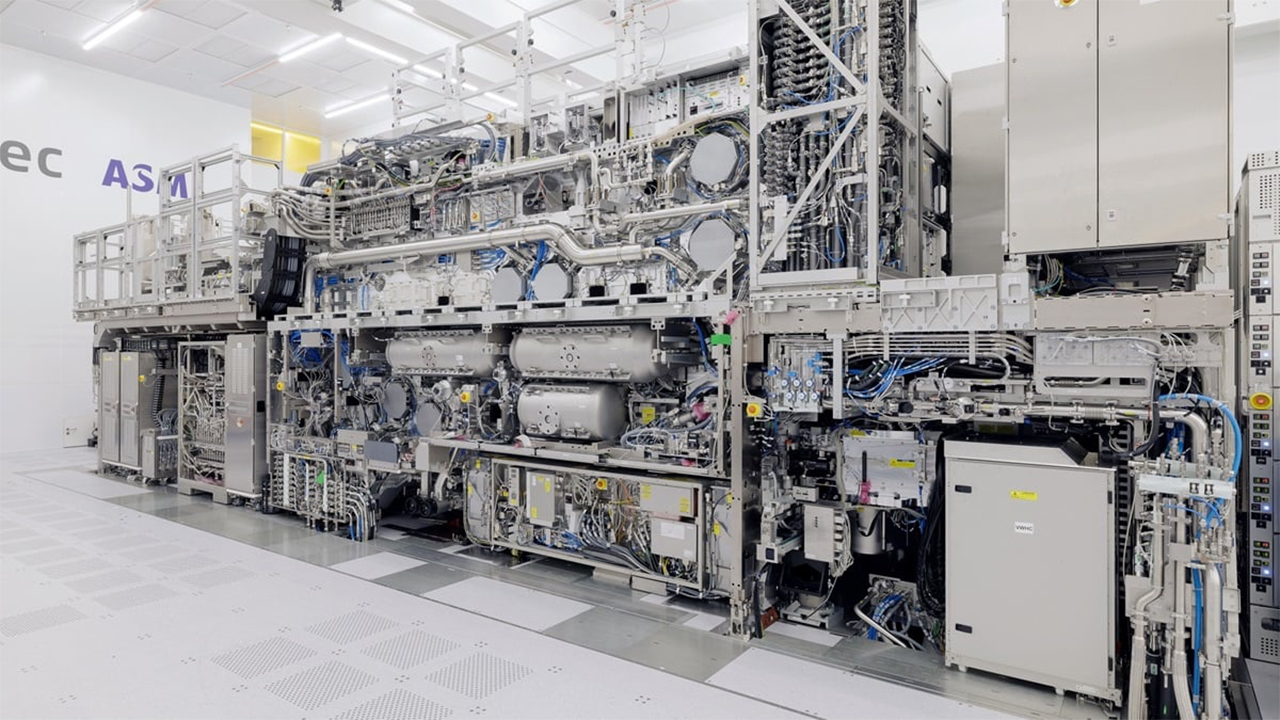

ASML has never shipped its EUV tools to China due to the Wassenaar Arrangement, despite SMIC's reported order for one EUV machine. The details remain unclear, but ASML did not deliver the machine to the Chinese foundry due to US sanctions. However, ASML kept shipping advanced DUV lithography tools, such as the Twinscan NXT:2000i, which are capable of producing chips on 5nm and 7nm-class process technologies.

As a result, SMIC has been producing chips for Huawei using its 1st-generation and 2nd-generation 7nm-class process technology for years now. This has certainly helped the Chinese high-tech giants weather U.S. government sanctions.

Having understood that EUV tools are not coming to China, Huawei and its partners have explored extreme ultraviolet lithography themselves with the aim of building their own lithography chipmaking tools and ecosystem, which will take 10 – 15 years at best. For reference, it has taken over 20 years for ASML and its partners from foundational work to complete commercial machines to build the EUV ecosystem. Keeping in mind that many of the technologies developed in the early/mid-1990s are openly known, Chinese companies will not have to develop everything from scratch. However, by the time the Chinese semiconductor industry develops Low-NA EUV tools, the Western chip industry will have High-NA EUV lithography and even Hyper-NA EUV equipment.

However, the main concern is not that Chinese companies may develop their own EUV lithography tools some 15 years down the road, but that they might copy ASML's mainstream DUV machines (such as Twinscan NXT:2000i) over the next several years.

The American government is pressuring ASML to halt the maintenance and repair of its advanced DUV systems in China, which will make it consistent with existing sanctions against China's semiconductor sector. However, the Dutch government has not agreed to this demand so far. ASML aims to retain control over its machines in China to prevent the risk of sensitive information leaking, which could happen if Chinese companies take over maintenance to keep their chip factories operational.

For now, Chinese companies are among the main customers of ASML, and the company earns billions selling DUV litho tools to SMIC, Hua Hong, and YMTC. What happens if (or rather when) Chinese makers of lithography equipment build their own DUV lithography systems (or just copy those developed by ASML) is unknown. On the one hand, they could reduce purchases from ASML, but on the other hand, they could start selling these tools outside of China, essentially competing with ASML. While it is unlikely that they will build a Twinscan NXT:2000i-like machine any time soon, replicating something less advanced could be much easier.