Hong Kong (AFP) - Asian markets struggled Tuesday as investors eyed the release of US inflation data later in the week that could play a key role in shaping the Federal Reserve's interest rate plans.

While the region enjoyed a healthy start to the week, there remains plenty of nervousness on trading floors after last week's upheaval in the US banking sector, which hammered financial stocks.

The turmoil saw the sale of the embattled First Republic Bank to JPMorgan Chase and came just two months after the collapse of three other regional banks and the takeover of Swiss giant Credit Suisse by rival UBS.

Still, while a much-anticipated Fed survey of banks showed tighter lending standards in the first few months of the year, which they see lasting through 2023, analysts said the reading was not as bad as feared.

Asked about their outlook for lending standards over the rest of 2023, "banks reported expecting to tighten standards across all loan categories", the central bank reported.

National Australia Bank's Rodrigo Catril said: "The survey revealed a modest deterioration in lending standards to business at a rate that was slightly higher than in January.

"But, after concerns over the health of US regional banks, the good news is that the survey did not (yet) reveal evidence of a major credit crunch."

Focus is now on Wednesday's consumer price index report for April and the following day's wholesale prices data.

A drop in the inflation reading in recent months has fanned hopes that the Fed will soon pause its tightening campaign and even begin cutting by the end of the year, with the banking crisis reinforcing that view.

After lifting borrowing costs last week, officials hinted at a possible hold at their June meeting.

After a largely flat Monday on Wall Street, Asia was mostly in the red.

Hong Kong and Shanghai sank as Chinese trade data showed a mixed picture, with April exports rising more than expected but slowing from March, while imports plunged far more than expected.

The readings suggested the recovery in the world's second-largest economy would likely be slower than initially hoped.

There were also losses in Seoul, Singapore, Wellington and Jakarta, though Tokyo, Mumbai and Taipei rose.

London was flat at the open as it reopened after a long weekend.Paris and Frankfurt both dipped.

Shanghai was also higher ahead of Chinese trade data later in the day, which will be pored over for clues about the regional giant's economic recovery.

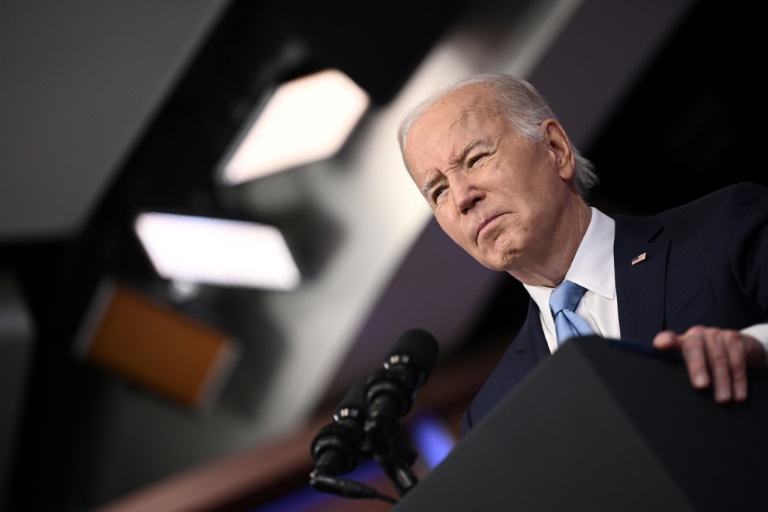

Traders are also keeping tabs on developments in Washington as President Joe Biden prepares to talk to congressional leaders, with a debate raging on raising the US debt ceiling.

There are worries that lawmakers will fail to reach a deal to increase the amount the country can borrow to meet its repayment obligations, with right-wing Republicans determined to secure spending cuts.

Treasury Secretary Janet Yellen has warned the government could hit its limit by the start of June, adding that "financial and economic chaos would ensue" if a deal was not reached.

Key figures around 0720 GMT

Tokyo - Nikkei 225: UP 1.0 percent at 29,242.82 (close)

Hong Kong - Hang Seng Index: DOWN 2.0 percent at 19,888.58

Shanghai - Composite: DOWN 1.1 percent at 3,357.67 (close)

London - FTSE 100: FLAT at 7,778.45

Euro/dollar: DOWN at $1.0996 from $1.1022 on Monday

Pound/dollar: DOWN at $1.2630 from $1.2634

Dollar/yen: UP at 134.83 yen from 134.81 yen

Euro/pound: DOWN at 87.01 pence from 87.23 pence

West Texas Intermediate: DOWN 0.6 percent at $72.69 per barrel

Brent North Sea crude: DOWN 0.7 percent at $76.50 per barrel

New York - Dow: DOWN 0.2 percent at 33,618.69 (close)