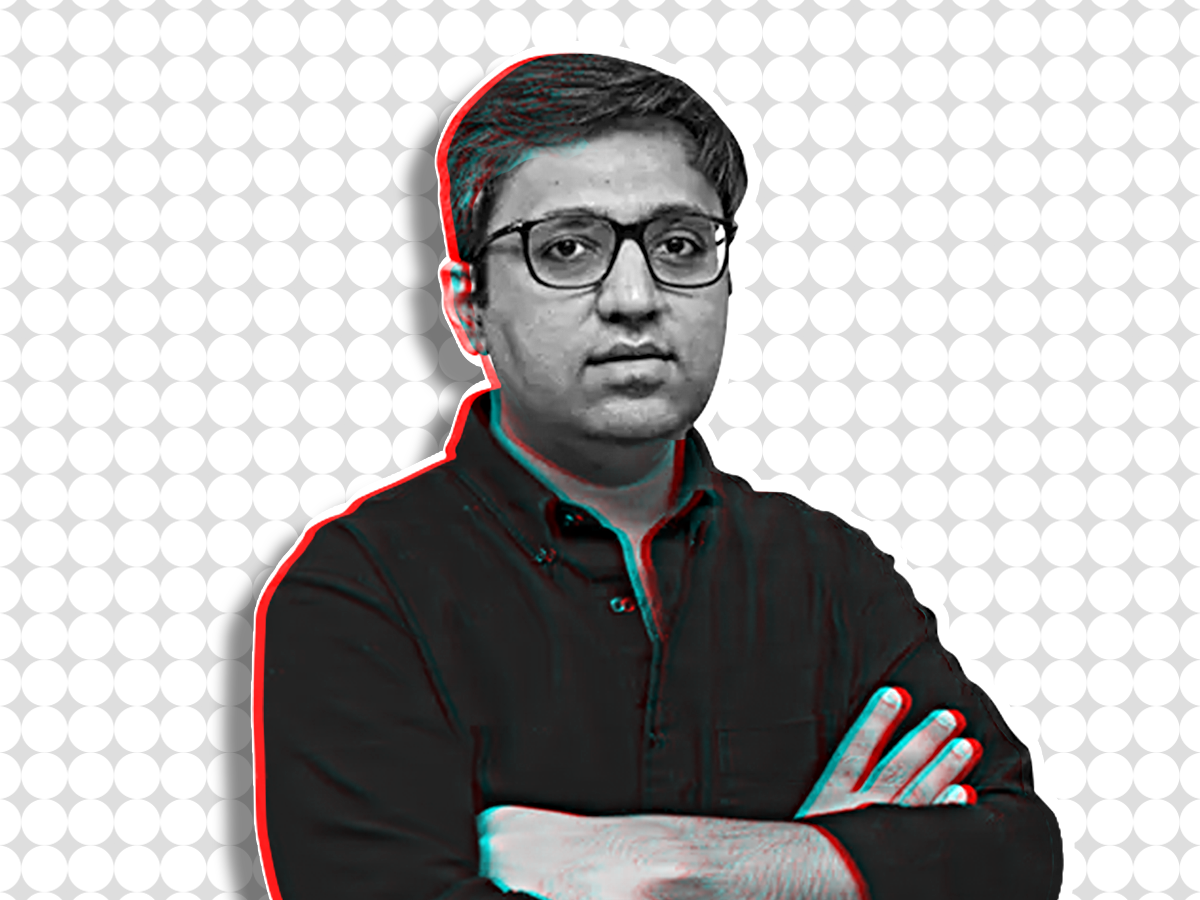

NEW DELHI: BharatPe cofounder Ashneer Grover has demanded a payout of Rs 4,000 crore from investors to buy out his stake if they want him to exit the company despite being accused of financial fraud.

The latest is that he has already held talks to sell his 9.5% stake in the fintech startup, which could pave the way for his full exit rather than being embroiled in a long, legal battle with the board members. Sequoia Capital India, Coatue Management and Ribbit Capital are the three largest shareholders of BharatPe and hold right of first refusal (rofr) on founder’s shares and tag along rights.

What is BharatPe?

BharatPe was founded in 2018 and offers a range of fintech products that cater to small merchants and also helps them accept digital payments. . BharatPe has faciliated the disbursement of loans totalling over Rs 3,000 crore to its merchants since its launch.

Grover had spent his initial years as an investment banker at Kotak Bank and later served as the chief financial officer at Grofers. Coming from an investment banking background, Grover scaled his fintech’s valuation to almost $2.85 billion within four years of launch and raised more than $600 million in equity funding from top funds, including Sequoia Capital India, Coatue Management, Insight Partners, Dragoneer Investment Group, Steadfast Capital and Tiger Global. BharatPe has also got an in-principal small finance bank licence, through a joint venture with Mumbai-based Centrum Financial Services, to take over the cooperative lender Punjab and Maharashtra Cooperative Bank and relaunch a small finance bank.

So what really happened?

It all began with an audio leak

On January 19, Ashneer Grover, cofounder and managing director of BharatPe, took voluntary leave until the end of March. The voluntary leave came two weeks after after a recording of a phone conversation was leaked online in which a man, alleged to be Grover, could be heard abusing and threatening an employee of Kotak Mahindra Bank after missing out on the IPO allotment for Nykaa’s initial public offering despite being promised one. While Ashneer first termed it as a “fake audio by some scamster trying to extort funds, he later deleted the tweet. Kotak Mahindra Bank is now pursuing legal action against Ashneer over “inappropriate language” used against their employee.

Toxic work culture

Industry experts were quick to point out that apart from the Kotak controversy, concerns were growing about the toxic work culture at BharatPe, along with Grover’s presence on start-up TV show Shark Tank when some of his comments to entrepreneurs pitching for funds sounded rather rude and harsh. Reports also said that due to his headstrong personality, he was made to step back from his role as the CEO and made the MD. Some media reports also suggested that due to foul and aggressive language becoming the norm at BharatPe, there was an exodus of top-level talent from the company.

God syndrome

Industry experts call this the ' God syndrome', when one man is single-handedly driving a company's growth and arrogance gets the better of him. “What happens is that whatever they (founders) want should happen — and it does (happen) many times. But when it doesn’t, it comes out as extreme anger and frustration.… Ashneer’s alleged remarks over the call are a typical example of this," the founder of a leading startup was quoted as saying by Economic Times.

"Grover has been allowed to get away with this so far. As long as he was getting new investors at a higher valuation, the board ignored everything else. It all boils down to money," a VC who wanted to invest in Bharat Pe but backed out in the last leg of due diligence told ET.

In August 2020 Grover also had a spat with Harshjit Sethi, a managing director at Sequoia Capital India, which holds more than 19% stake in the company after BharatPe's Series B funding was delayed due to Sequoia not committing to the round. Sequoia had also raised concerns about Grover wanting to partially sell shares in a secondary transaction.

"Messages and threats from you (Grover) over the last few days and months have been hurtful and disappointing… Specifically we have heard your message of not wanting us on the cap table [...] We need to have a decisive conversation about how the relationship between Sequoia and BharatPe changes going forward,” Sethi wrote in a mail to Grover in August 2020.

The financial irregularities angle

About a week after Grover went on leave, his wife Madhuri Jain Grover - who is Group Head - Controls at the company- followed suit as the firm decided to take an independent audit of its internal processes and systems.. The company appointed Alvarez and Marsal to conduct the independent audit after Bharat Pe came under intense media scrutiny , signalling bigger problems surrounding the board of directors and the founder.

Allegation 1: BharatPe routed money through fake HR consultant firms that were linked to each other and to Madhuri Jain’s brother Shwetank Jain.

Allegation 2: BharatPe inflated transaction values by some merchants and that some of these vendors were fake.

Select screenshots of Alvarez and Marsal early reviews that were leaked on social media show inconsistencies in dealings with vendors and have flagged payments to vendors and consultants that are non-existent. The screenshots show that payments of Rs 53.25 crore were made towards vendors that do not exist and the company incurred a loss of Rs 10.97 crore in these dealings. The report also states that BharatPe claims to pay recruitment fees to consultants for the employees they recruit for the company. Although Alvarez and Marsal could confirm that some of the employees, as claimed to be hired through consultants, were brought on board, the said employees have revealed that they had no interaction with any consultants in the process and have no knowledge of their existence.

The report mentions Madhuri Jain received at least three of these invoices herself and forwarded them to the company for payments. The invoices were created by Shwetank Jain, Jain’s brother.

The review also found spends of Rs 3.77 crore on vendors with a connection to Panipat, which is Madhuri’s home town. These vendors all had commonalities such as similar email addresses, similar physical addresses, similar formats, same bank branches, etc. and were all based in Panipat.

This is not the first instance of financial irregularity

BharatPe’s dealings with non-existent vendors were also highlighted after an investigation undertaken by the Directorate General of GST Intelligence (DGGI) in 2021 when it conducted a search operation in the company’s head office on October 21, last year. At the time, DGGI found close to Rs 51 crore was paid to 30 non-existent vendors. It issued a summons to a BharatPe official on November 1, 2021 on this matter, to which the company responded with a request to waive the show cause notice in lieu of paying the dues and necessary penalties. This letter to DGGI was signed by Deepak Jagdishram Gupta. The Alvarez & Marsal report says Gupta is Madhuri’s brother-in-law.

In addition, to correct its accounts post DGGI’s investigation, BharatPe reversed input credit of Rs 9.54 crore and additionally paid a penalty of Rs 1.54 crore. One of the questions raised in Alvarez & Marsal’s report is why BharatPe settled this matter, causing a loss of Rs. 10.97 crore, without legal representation. A&M also recommended to the board that this requires a deeper probe as to why the company was dealing with ‘non-existent vendors’.

What did Bharat Pe have to say about these leaks?

On February 4, BharatPe issued a statement saying it was yet to receive a final report from Alvarez & Marsal.

“We are deeply pained that the integrity of the BharatPe board or individual board members is being questioned time and again through misrepresentation facts and baseless allegations. The board in all its actions has followed due process in the best interest of the company. We would urge that the confidentiality and integrity of the governance review and board meetings is maintained by all. We request everyone, including the media, to show restraint and allow the governance review to take place in a thorough manner,” it said in a statement.

What does Grover have to say about these financial irregularities?

Reports suggest that Grover could be asked to leave the company permanently, and hence it is not surprising that he has hired lawyers too. In an interview with moneycontrol, he claims "What am I scared of? I am the only startup in India which has built $6 billion of value by spending less than $150 million. Forget the audit, forget the allegations, just put the numbers of Razorpay, Paytm and CRED, any fintech which is valued higher than me. How much money have they spent and what's the value being created? So by that logic, anyone who spent more money than me has done a fraud."

He also claimed that the company board is trying to 'arm-twist' him to negotiate and take lesser money for his shares. "If you don’t need me, I don’t want to make value for you either. I have created two unicorns already, I have the capacity to create three more. So make me an offer, I’ll move my way, you move yours," he said.

In comes another accounting firm

BharatPe board has now reportedly decided to rope in accounting firm PwC for an independent audit. The move is aimed at terminating the services of Grover and his wife since as per an MOU clause they can only be ousted after a report by a Big 4 audit firm indicts them.

Alvarez and Marsal are separately conducting a thorough probe into the company’s practices, including accounting, approval processes, expenses, and hiring.