Amid the talk about how streaming services are pruning their libraries, there is still more than enough choice to make it difficult for viewers to figure out what to watch next.

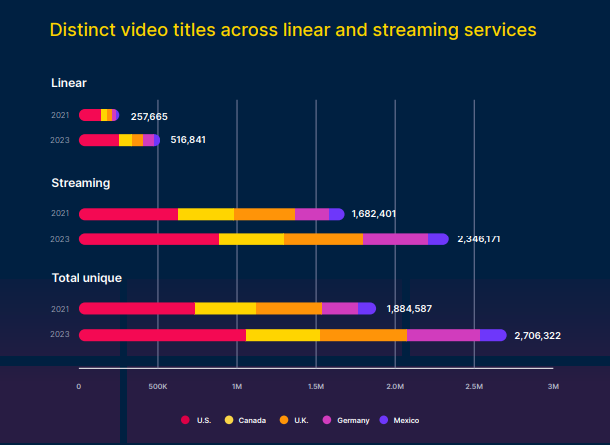

A new State of Play report by Nielsen’s Gracenote unit, looking at the United States, United Kingdom, Canada, Mexico and Germany, found that audiences now have 2.7 million video titles available in 2023, up from 1.9 million in 2021. Nearly 87% of those titles are available via streaming, or 2.3 million, up from 1.7 million in 2021.

Similarly, the number of channels has blown up, with 39,555 channels available in 2023 (about 80% of them in the U.S.), up from 36,096 in 2021.

“As it was during the age of broadcast television, content is the lifeblood of the digital, streaming-first media ecosystem,” Filiz Bahmanpour, VP of product at Gracenote, said. “So a clear understanding of content — where it’s available, what it’s about and whom it’s attracting — is more critical than ever.”

Viewers in June said they spent 10 minutes, 30 seconds looking for something to watch. That’s down from 11:16 last October but up from 7:24 in March 2019.

“The growing abundance of content and content sources has become overwhelming for audiences,” the report said. “Compared with strategies focused on adding more content to engage audiences, focusing on personalization and user experience can help audiences find what they’re looking for more quickly.”

With more streamers launching ad-supported products and using pricing to push consumers toward them, subscription VOD’s share of streaming minutes fell to 49% in May 2023 from 53% in the second half of 2021.

The report noted that the jump in the availability of free ad-supported streaming TV channels (FAST) was feeding a trend toward viewers watching classic TV.

“Compared with traditional SVOD services, which typically offer a mix of high-profile originals and titles acquired from other sources, FAST channels are predominantly set up to showcase library content — programming that originally aired somewhere else (usually on traditional TV),” the report said.

Time spent with acquired content is steadily rising, the report said. In the U.S. 60% of time spent streaming in May was dedicated to programming that first aired on linear channels. That’s up 5.2% from October 2022.

The report added that 18 of the 25 most-watched streaming programs by U.S. women 18-34 in 2022 were classic TV titles, with Grey’s Anatomy and Gilmore Girls beating out Stranger Things for the top spots. This audience watched just under 77 billion minutes of these shows, which is 73% of the total for all of the top 25 titles

Three FAST platforms — The Roku Channel, Pluto TV and Tubi — account 3.3% of total TV U.S. use in the U.S., and more viewing per month than all but the two top cable networks, Nielsen said.

Gracenote argues it can help media owners and platforms make finding content more efficient and lucrative with more granular metadata describing movies and show episodes.

“Audiences today expect seamless discovery and search across media types. Platforms and content owners can deliver on this expectation across digital channels by leveraging linked content IDs,“ the report said. “For example, if someone watches A Star is Born starring Lady Gaga and Bradley Cooper, they can easily navigate to the music featured in the film, jump to the video for Shallow, watch clips of Lady Gaga’s appearances on late night TV, or search for which podcasts she has appeared on.”

“When combined with viewership data, the ‘scenario’ video descriptors within Nielsen Gracenote’s Advanced Discovery suite can also help inform creators and distributors about which scenarios are trending from a viewer engagement perspective — and which ones aren’t — which can help identify whitespace development opportunities,“ the report said.