The surging cost of living is pushing more and more households towards breaking point as rapidly rising food and fuel prices send inflation to another 30-year high.

Amid warnings that the situation does not yet take account of the average 54% hike in energy bills that was applied to around 22 million households two weeks ago, how bad is the situation likely to become?

– Why is everything more expensive?

Covid-19 has hit global supply chains with a combination of pent-up demand and delays to shipping as factories across the world face lockdowns and worker absences. This has led to prices rising, particularly for raw materials. Food prices have also risen as wages increase, including for HGV drivers due to recent shortages with thousands of drivers leaving the UK to return to their home countries in the EU.

– How is the Ukraine situation affecting prices?

Pressure on prices is being exacerbated as the full impact of Russia’s invasion of Ukraine and the sanctions against President Putin’s regime unfold.

Ukraine is the world’s main supplier of sunflower oil, and Russia is the second-largest supplier, so global prices have been hit by the war. Data shows that the price of oils and fats for food increased by 7.2% in March alone, adding to a more than 18% rise in the last year.

The Office for Budget Responsibility (OBR) has said growth will be curtailed as households rein in spending in the face of the worst hit to their finances on record as the Ukraine crisis further disrupts supply chains and sends energy bills soaring.

– Will inflation remain high?

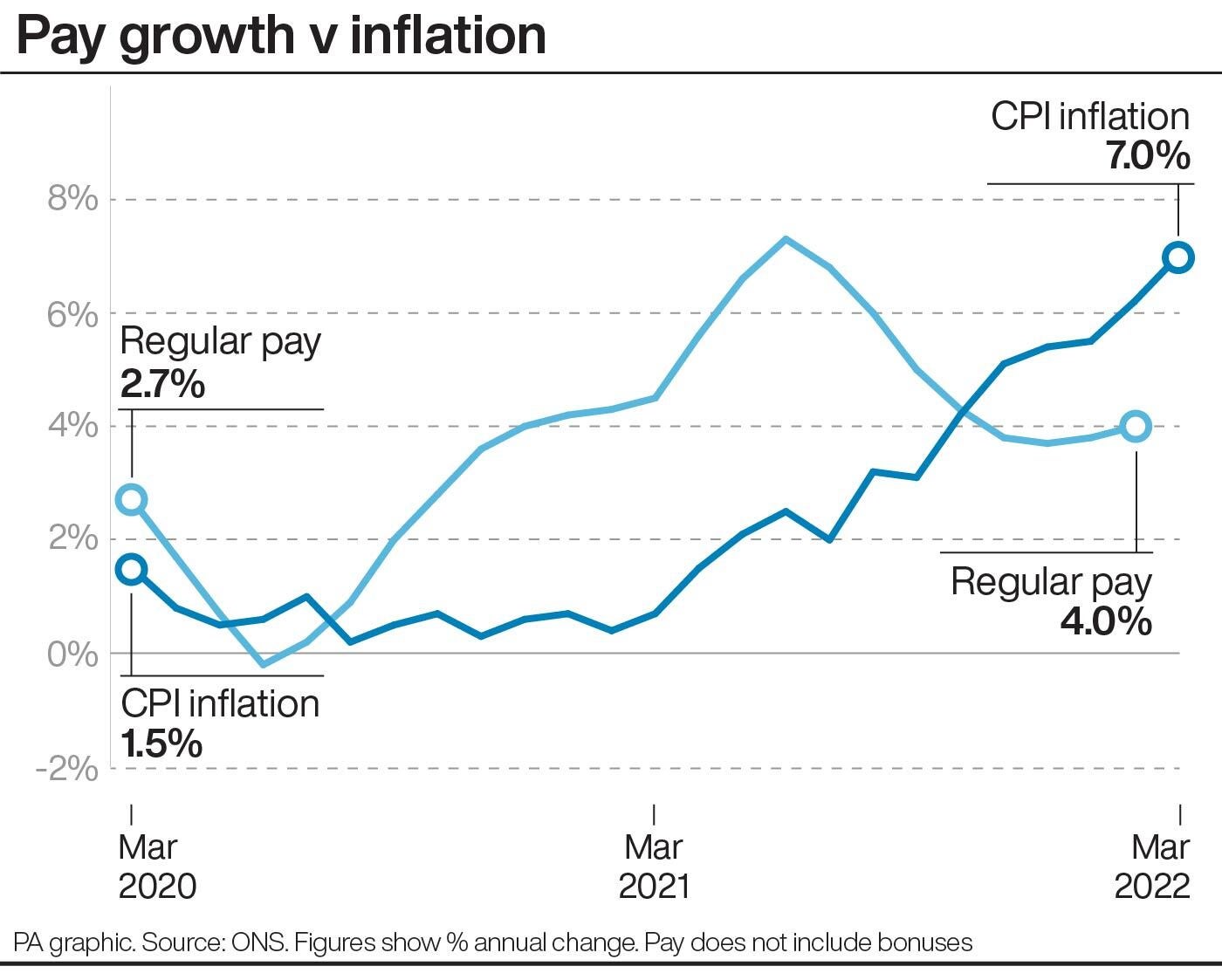

Consumer Prices Index (CPI) inflation is currently running at 7%, according to the Office for National Statistics (ONS), up from 6.2% in February and higher than the 6.7% that analysts had expected.

And unfortunately there is nothing but bad news on the horizon. March’s inflation does not yet take into account the average 54% hike in energy bills that came into effect two weeks ago but will not appear in CPI figures until next month, when April’s data is expected to show another jump.

The OBR predicts UK inflation will now average 7.4% this year and peak at 8.7% in October as the Ukraine conflict compounds the crisis – the highest level since the oil shock of the late 1970s and early 1980s.

– Will energy bills get higher?

Almost certainly. The 54% jump to the Government’s price cap from April 1 is widely predicted to rise yet again.

The OBR has forecast that household energy bills will soar to about £2,800 a year from October when the price cap on standard tariffs is likely to rise again by a record £830.

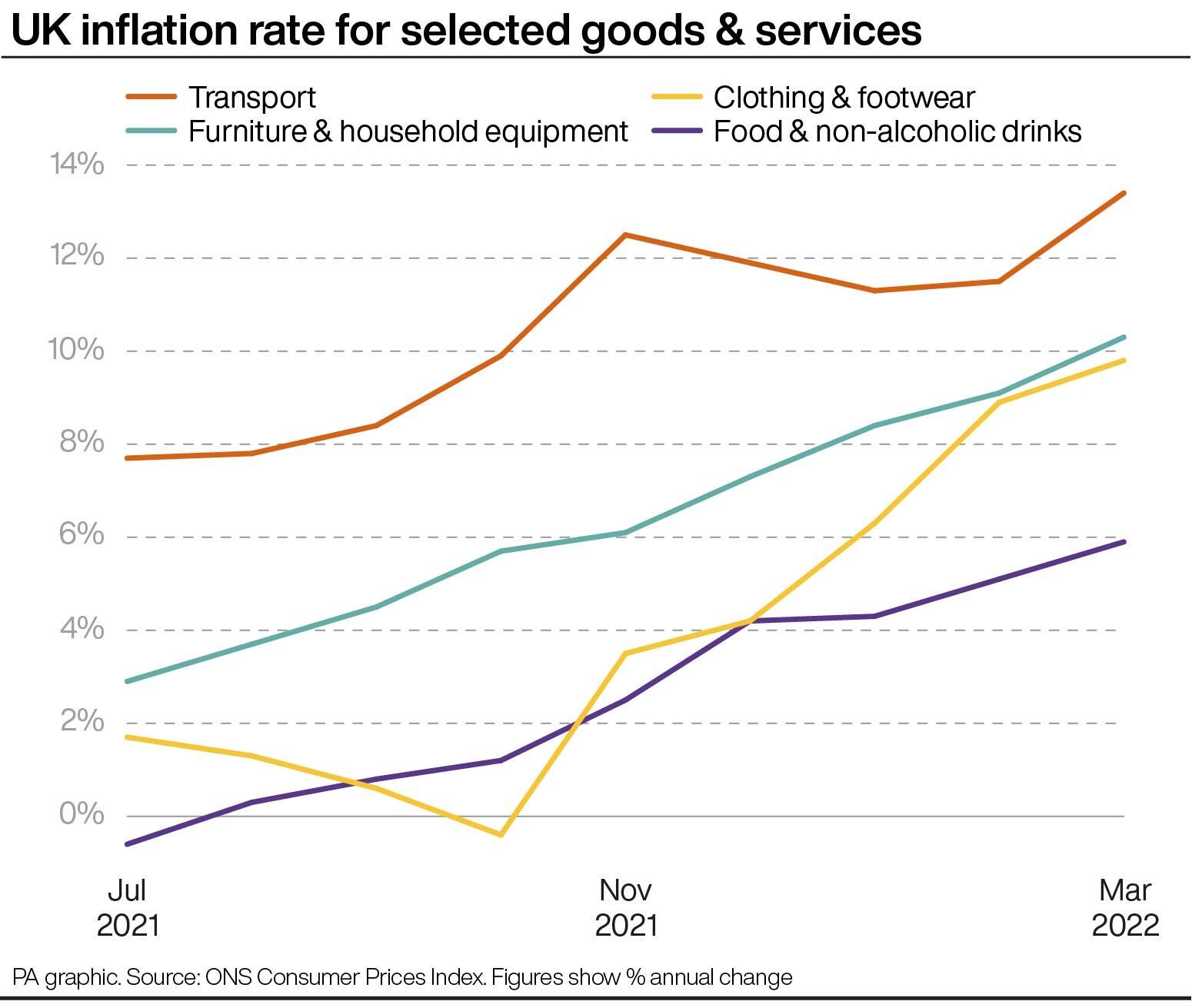

– What other costs can I expect to increase this year?

The Resolution Foundation recently said each household can expect outgoings to increase by £1,200 this year. Along with rising energy bills, there is also a National Insurance rate rise that came into effect this month.

Petrol, at 160.2p per litre on average in March and diesel at 170.5p, are both record high prices.

The cost of groceries is 5.2% higher than it was a year ago, with inflation over March hitting its highest level in nearly a decade, according to Kantar data.

Grocery price inflation is seeing more shoppers turning to cheaper products and supermarket own-brand labels, while customers are also making fewer trips to stores to save on petrol costs, Kantar said.

Meanwhile, ONS data on Tuesday shows that wages are not keeping pace with rising prices.

– What can I do to avoid the pinch?

There’s no way around it – households need to start thinking very carefully about their spending across the board to counter those price rises they cannot control such as energy and fuel.

A quick look over the monthly bank statement should be a good start.

Always shop around and use comparison sites for phone, broadband and insurance rather than just rolling over into the next year to keep charges and premiums at a minimum.

Consider whether subscriptions are still useful and providing a good deal – many people signed up to new services like Spotify, Netflix or Sky during lockdown and may no longer use them as much.

Think about shopping for own-brand grocery products and set a strict, affordable supermarket budget. Supermarket loyalty schemes can help with making savings.

Cashback sites, and their welcome offers, can be another way of making household budgets stretch further.

The Government-backed MoneyHelper service has budgeting guides at www.moneyhelper.org.uk/en/everyday-money/budgeting

.png?w=600)