AMC Entertainment Holdings, Inc (NYSE:AMC) surged about 25% at one point on Monday as the stock continued to trade higher in its uptrend, which Benzinga predicted in an Aug. 5 analysis.

On Friday, AMC regained the 200-day simple moving average (SMA) as support, which indicates a new bull cycle for the stock may be on the horizon, although AMC is in desperate need of consolidation.

When AMC printed its quarterly earnings on Aug. 4, the company announced a special dividend of preferred stock, which may be helping to boost the company. For each share of AMC Class A common stock held on record as of Aug. 15, 2022, the holder will receive one AMC Preferred Equity Unit that will trade under the ticker “APE.”

AMC’s 30% rally on Friday appears to have set off a short squeeze in a number of other stocks that are highly popular with retail traders.

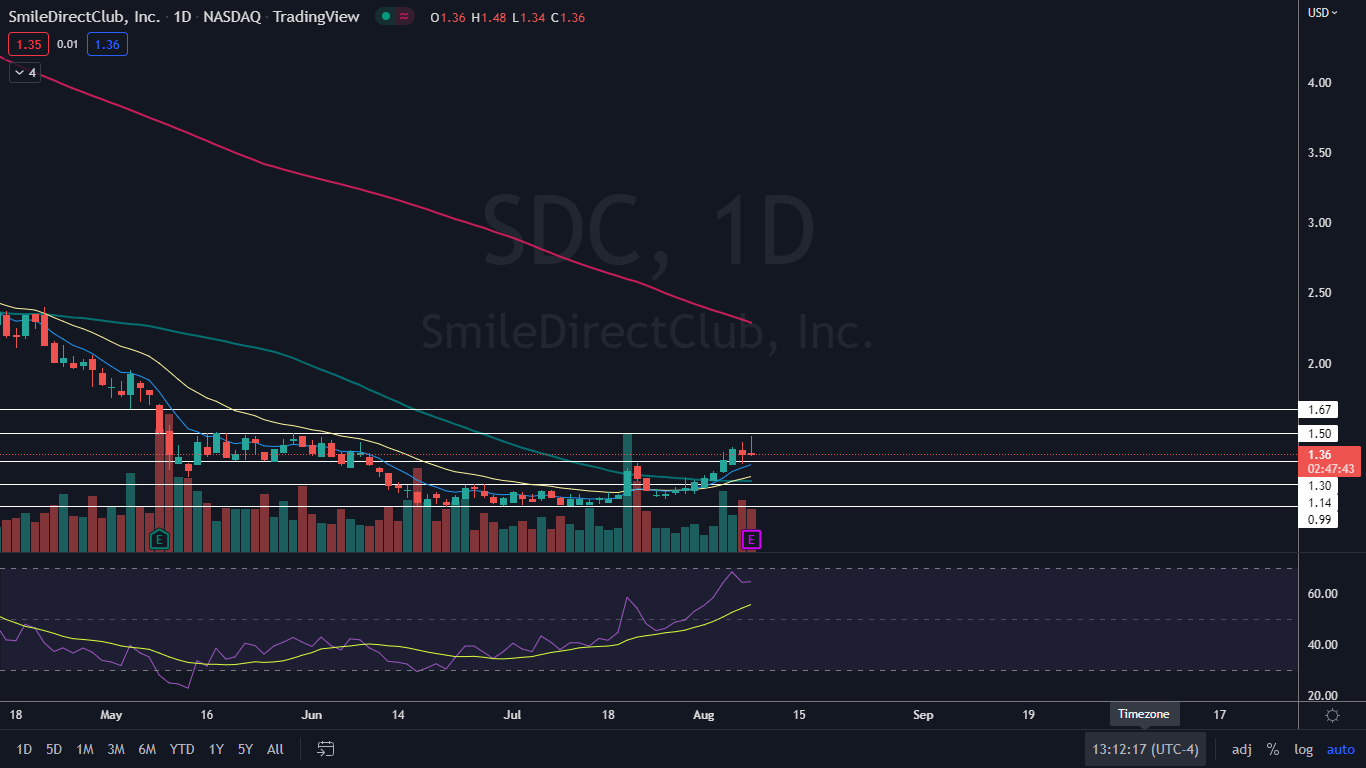

SmileDirectClub, Inc (NASDAQ:SDC) and Clover Health Investments Corp (NASDAQ:CLOV), which made parabolic moves higher in January and June 2021, respectively, surged on Monday in tandem with AMC before giving back most of their daily gains intraday.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The AMC Chart: AMC is in need of consolidation after surging about 85% between July 27 and Monday. AMC’s relative strength index (RSI) is measuring in at about 82%, and when a stock’s RSI reaches or exceeds the 70% level it becomes overbought, which can be a sell signal for technical traders.

Bullish traders want to see AMC consolidate sideways for a period of time or trade slightly lower to settle into a bull flag pattern. Sideways trading or slightly lower prices on lower-than-average volume will help to bring the stock’s RSI down to a more comfortable level.

Bullish traders would prefer to see AMC’s consolidation take place above the 200-day SMA on declining volume. Traders can then watch for a break up or down from the consolidation patterns to gauge future direction.

AMC has resistance above at $25.79 and $29.45 and support below at $20.36 and $17.07.

See Also: AMC, GameStop Are Running Again: What's Behind The Latest Meme Stock Rally?

SmileDirectClub is trading in an uptrend pattern on the daily chart and, as with AMC, SmileDirectClub’s RSI became overextended, which indicates a pullback, at least to print another higher low, may be in the cards. On Monday, SmileDirectClub’s RSI was hovering at around 65%.

The stock has resistance above at $1.50 and $1.67 and support below at $1.30 and $1.14.

Like AMC and SmileDirectClub, Clover Health is trading in an uptrend and may be preparing to print its next lower high. Clover Health’s RSI is also extended to the upside, measuring in at 72%.

Photo via Shutterstock.