Former ambulance driver Nathan Anderson first burst into public attention in 2020, when he proved that electric vehicle company Nikola had faked a video to make it look like its trucks could move forward on their own, when in reality one was staged to roll down a hill. The exposé led to the company’s CEO going to jail and to Anderson’s short-selling firm, Hindenburg Research, becoming one of the most feared names in corporate America.

When Anderson announced last Wednesday that Hindenburg was closing shop, it marked the end of an era. His famed short-selling firm lasted less than a decade, but during that time, its scathing reports exposing corporate lies and ineptitude regularly jolted the market. Hindenburg’s investigations, compiled by a staff of just 11 and blasted out to 900,000 followers on X, took aim at the likes of Block and Adani Group and became a symbol of bear investing during a period of meme-stock mania and runaway valuations.

Hindenburg also helped make “activist” short-sellers—typically smaller firms, or even individuals, that wage public campaigns against companies to drive down their stocks—a fixture of Wall Street and investing culture. Deftly using social media and TV appearances, famous short-sellers like Anderson and Andrew Left combined the roles of investigative reporter and stock trader, often earning fat profits in the process.

Despite their outsize presence, the days of high-profile short-sellers may be numbered. Their trade has long been viewed with contempt and suspicion by many executives, and more recently short-selling has come under increasing pressure from both broader market trends and regulators. Currently, Left is battling the Justice Department and Securities and Exchange Commission in a high-profile court case.

Left, who will face trial in September 2025, said that his indictment has produced a chilling effect. “It makes everyone think twice,” he told Fortune.

While other prominent activist short-sellers remain active, including Carson Block of Muddy Waters Research, Hindenburg’s departure means a further dwindling field and the loss of one of short-selling’s most visible advocates.

The perilous field of short-sellers

Short-sellers have prowled U.S. markets for decades, with some becoming Wall Street legends for taking on massive companies. The most famous example may be Jim Chanos, head of investment firm Kynikos Associates, helping take down Enron in the early 2000s. Still, short-sellers face constant criticism from executives and politicians who accuse them of shaking public confidence in the markets. During the financial crisis of 2008, regulators went so far as to temporarily ban the short-selling of financial stocks after bank CEOs decried the practice.

Still, the strategy has proved successful again and again, resulting in plummeting stocks, resignations, and even criminal charges. But because short positions can result in infinite losses if a share price keeps increasing, it involves a high degree of risk, such as when Left challenged the Reddit community Wall Street Bets on the meme stock GameStop in 2021. He argued the zealous crowd was wildly overvaluing the company. In response, the Redditors waged a war of public opinion to brand Left as a villain and force him out of his position by driving up the price of GameStop’s shares.

Left told Fortune the glut of discourse available to investors has made the job of the short-seller ever more difficult, a nod to his famous battle against Wall Street Bets. “The information pool is thick,” he said. “It adds more counterbalance to any short argument.”

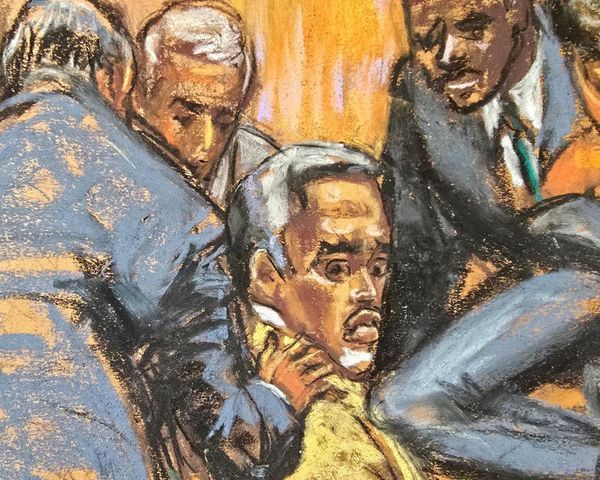

July’s civil and criminal charges against Left, which allege that he manipulated markets by misrepresenting his share positions in public reports, have made the practice even more perilous, with questions remaining about how long traders should be expected to hold positions after publicly speaking about them. (The charges against Left include both long and short positions that he held.) Left has denied the charges.

“There’s a lot more risk than reward on the market front [and] the regulatory front,” said Left.

Nathan Koppikar, a short-seller who runs Orso Partners, says the uncertain regulatory environment has created unfavorable conditions for activist short-selling. “I’ve been surprised there has not been a bigger cessation or slowdown in short-selling,” he told Fortune. “This is what I would’ve expected to happen.”

‘Smash and grab’

Predictably, a trade that involves making large bets against the market’s consensus draws an idiosyncratic crowd. One short-seller, the outspoken Marc Cohodes, has criticized activist short-selling as “smash and grab,” where traders take short-term positions and profit off their public campaigns, rather than taking longer-term positions against troubled companies.

While Cohodes lauded Anderson for exposing “some great frauds,” he still chided firms like Hindenburg Research for their approach. “I view it more as destructive, and they bring huge volatility in the market,” he told Fortune. “Color me skeptical on the whole adventure.”

In his farewell letter, Anderson said there was no specific reason to close up shop, instead writing that “the intensity and focus has come at the cost of missing a lot of the rest of the world and the people I care about.”

Hindenburg is currently under investigation by an Indian securities regulator for the bruising report it published against Adani Group, a conglomerate run by one of India’s wealthiest men, which Hindenburg accused of “pulling the largest con in corporate history.” Hindenburg’s last report earlier in January targeted the online car dealership Carvana, though the stock’s price quickly recovered and is currently higher than what it was before Hindenburg published its investigation.

Both Cohodes and Koppikar questioned Anderson’s public announcement to “disband” Hindenburg. Noting that Hindenburg does not appear to operate as a firm taking outside capital, they argued that Anderson could instead have just paused his reports. “I don’t fully understand why someone would retire when they could just take a leave of absence from publishing,” Koppikar said.

Anderson did not respond to a request for an interview.

Activist short-selling may remain a glamorous, if imperiled, practice, but Anderson’s exit from the scene also serves as a cautionary tale. “From a legacy perspective, for younger people, he probably has inspired a lot of guys who are 20 years old to go out and do this,” Koppikar told Fortune. “But it’s not all fun and games,” he added. “This is a serious thing.”