Deep-pocketed investors have adopted a bullish approach towards Apple (NASDAQ:AAPL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AAPL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 68 extraordinary options activities for Apple. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 47% leaning bullish and 42% bearish. Among these notable options, 15 are puts, totaling $751,212, and 53 are calls, amounting to $2,612,234.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $145.0 to $300.0 for Apple over the last 3 months.

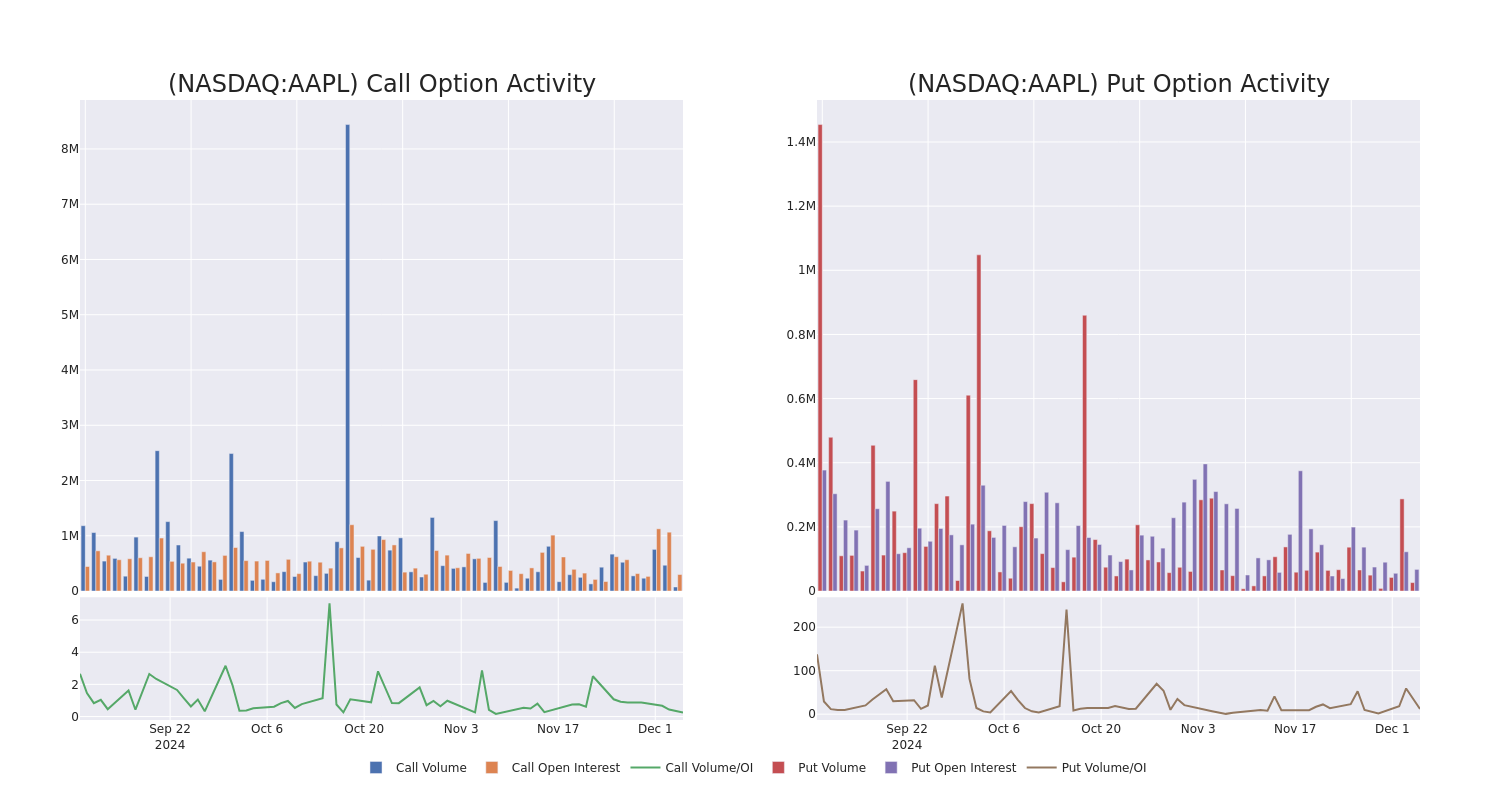

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Apple options trades today is 19756.08 with a total volume of 132,211.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Apple's big money trades within a strike price range of $145.0 to $300.0 over the last 30 days.

Apple Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | CALL | TRADE | BULLISH | 12/20/24 | $9.65 | $9.5 | $9.64 | $235.00 | $241.0K | 35.7K | 935 |

| AAPL | CALL | TRADE | BULLISH | 12/13/24 | $9.0 | $8.85 | $9.0 | $235.00 | $225.0K | 7.5K | 1.4K |

| AAPL | CALL | SWEEP | BULLISH | 01/17/25 | $25.4 | $25.35 | $25.4 | $220.00 | $137.1K | 36.7K | 1.2K |

| AAPL | PUT | SWEEP | BEARISH | 09/19/25 | $6.05 | $6.0 | $6.05 | $210.00 | $119.8K | 2.7K | 198 |

| AAPL | PUT | SWEEP | BEARISH | 12/20/24 | $2.32 | $2.3 | $2.33 | $242.50 | $116.5K | 4.5K | 1.5K |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple's iPhone makes up a majority of the firm sales, and Apple's other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple's sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

Apple's Current Market Status

- Currently trading with a volume of 22,417,179, the AAPL's price is down by -0.03%, now at $242.97.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 55 days.

Expert Opinions on Apple

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $286.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Morgan Stanley downgraded its action to Overweight with a price target of $273. * An analyst from Wedbush downgraded its action to Outperform with a price target of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Apple with Benzinga Pro for real-time alerts.