Apple (AAPL) has been one of the leaders of this year’s stock market rally.

Coming into this week, the Cupertino, Calif., tech giant's shares were up in seven of the past 10 weeks. What's more, the three weekly declines were minuscule: 0.12%, 0.15% and 0.58%.

The steady grind higher has helped propel the stock to an impressive 32% year-to-date gain.

Alongside impressive strength in other FAANG stocks — as well as Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA) — megacap tech has steered the ship in this year's /market performance.

Don't Miss: Buy the Dip in PepsiCo Stock...If Support Can Hold

Now weighing in with a $2.7 trillion market cap and recently off just 3.55% from its all-time high, Apple remains in the spotlight for the bulls.

The stock got a bullish reaction to the company's imperfect earnings report and outlook, but as the company is the market leader, that’s okay.

Apple stock has made a series of higher highs and higher lows as the bulls continue to buy dips and push the stock higher.

Now the question is: Can it continue as the stock approaches a key support area?

Trading Apple Stock

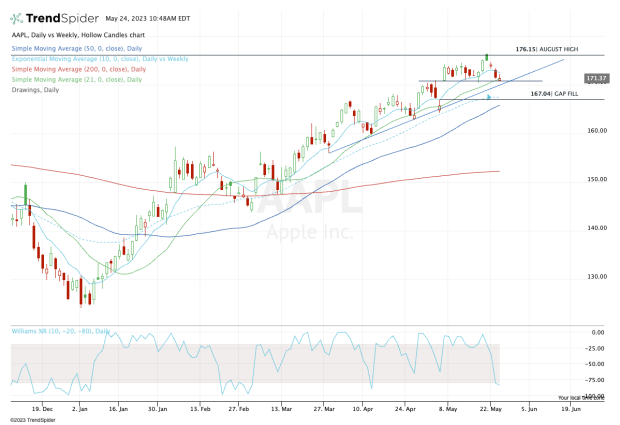

Chart courtesy of TrendSpider.com

For months now Apple stock has been riding the 21-day moving average and uptrend support higher (blue line).

Each dip to this area has ultimately been bought and has resulted in new highs amid the current rally.

But the $170.50 level has become key since the stock’s earnings-inspired gap-up on Friday May 5. The shares have bounced around since then but have continued to find support near this mark.

Aggressive bulls are adding this level to their list of catalysts as they look for a technically driven bounce.

Don't Miss: Tesla Stock: About to Run Out of Charge or Heading to $200?

While not pouring cold water on this idea, I see a more attractive buy-the-dip scenario potentially unfolding. I’m not sure that Apple shares will set up in this manner, but the scenario is heading that way.

I’m looking at a potential pullback to the $167 area, where the stock would find its post-earnings gap-fill, as well as the 10-week and 50-day moving averages. If that comes to be, it's a dip that the bulls will want to consider buying.

The shares would be down about 5% from the recent high while trading into some key measures on an intermediate-term basis. Plus the gap-fill would check one more box for the technical analysts.

Invest like a pro – for less. Our Memorial Day sale is on now! Get exclusive stock picks and ideas from our experts.