Apple, Inc. (NASDAQ:AAPL) delivered another strong quarter, just ahead of the intensification of supply chain issues due to COVID disruptions in China.

The top- and bottom-line outperformance was driven by record Services revenue and strength across all products, except for the iPad. The installed base of active devices rose to a record, signaling strong momentum going forward.

Apple's Key Q2 Metrics: Apple reported fiscal year second-quarter earnings of $1.52 per share, exceeding the consensus estimate of $1.43. This compares to the year-ago EPS of $1.40 per share and the previous quarter's $2.10.

Revenue climbed 9% year-over-year from $89.6 billion to $97.3 billion. Analysts, on average, estimated revenue of $93.89 billion, according to Benzinga Pro data. The number represented a record for the March quarter.

Sequentially, the top line fell 21.5% from the first quarter's $123.9 billion, which marked an all-time record. The first quarter is the seasonally strongest period for Apple as it encompasses the key holiday selling period.

"This quarter's record results are a testament to Apple's relentless focus on innovation and our ability to create the best products and services in the world," said CEO Tim Cook.

Gross margin came in at 43.7% compared to 43.8% in the first quarter and 42.5% in the year-ago quarter.

Apple's board declared a dividend of 23 cents per share, payable on May 12, to shareholders of record, as of May 9. This represented an increase from the 22 cents per share dividend paid out in the first quarter.

The company noted that it generated $28 billion in operating cash flow and returned about $27 billion to shareholders during the quarter.

See Also: How Apple Stock Looks Heading Into Q2 Earnings Print

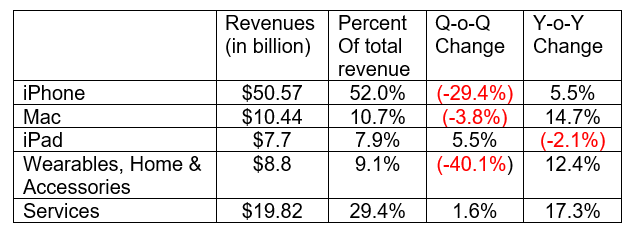

Revenue By Product Category: Apple reported year-over-year revenue growth for all product categories, except the iPad. Sequentially, the company saw revenue growth for the iPad and the Services segment.

"We are very pleased with our record business results for the March quarter, as we set an all-time revenue record for Services and March quarter revenue records for iPhone, Mac, and Wearables, Home and Accessories. Continued strong customer demand for our products helped us achieve an all-time high for our installed base of active devices," said CFO Luca Maestri.

Ahead of the quarterly results, Morgan Stanley analyst Katy Huberty said she expects better-than-expected quarterly results, with iPhone 13 and Mac strength more than offsetting relative underperformance in iPad and Services.

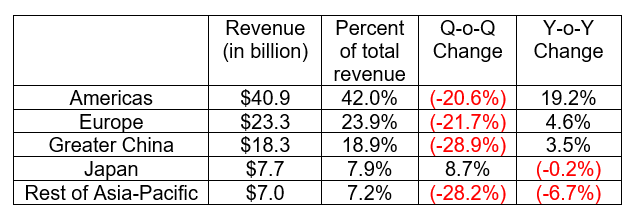

Revenue By Geography: Apple's year-over-year revenue growth was led by the Americas segment, while Europe and Greater China also saw decent growth. Japan and the rest of Asia-Pacific experienced declines compared to a year ago.

On a quarter-over-quarter basis, all the regions, except Japan reported revenue declines.

What Lies Ahead: It has been nearly two years since Apple issued a concrete guidance for the running quarter but has been providing directional insights on the earnings call.

The company's management will host a call with analysts at 5 p.m. EDT. This time around, the situation is trickier. Consumer spending has weakened amid rate hike fears and the Ukraine-Russia war has stoked input cost inflation and rendered components in short supply.

The latest crisis to rock the tech world in the resurgence of COVID in China that forced closure of production plants of several suppliers. Apple's Mac assembler Quanta Computer and iPhone contract manufacturer Pegatron were all forced to shutter operations. Investors may be keen to find out how much of hardware volume will be impacted by supply chain disruptions and when things will return to normalcy.

Analysts, on average, expect Apple to report June quarter EPS of $1.25 on revenue of $86.49 billion.

Huberty called for a more cautious June commentary. She, however, recommended buying ahead of product launch catalysts scheduled for the second half of the year.

Related Link: Camera Upgrades, Screen Size Bump, Possible Satellite Connectivity: What This Apple Analyst Sees In iPhone 14 Lineup

Apple Stock Take: Apple stock has fallen over 11% in the year-to-date period compared to a steeper 20% drop for the Invesco QQQ Trust (NASDAQ:QQQ). The sell-off has rendered the valuation reasonable, with the price-to-earnings ratio for Apple currently at 26.59.

The average analysts' price target for Apple stock is $193.30, according to TipRanks. This suggests scope for roughly 18.5% upside.

After rising 4.52% to $163.64 in regular trading on Thursday, the stock was down about 1.5% in after-hours session.