When it comes to savings accounts that banks call high-yield, anything above a 4% interest rate is generally considered "very good".

While certain high-yield accounts can offer an annual percentage yield (APY) of 5% or even 6%, anything above 4% will still yield strong returns for those who do not have a considerable sum of money to deposit when they apply for a new account and touch afterwards.

DON'T MISS: Here Are Some Higher-Yielding Alternatives to Savings Accounts

While its credit card has been around since 2019, Apple (AAPL) recently joined the ranks of those offering people a place to store their money.

Apple Wants to Help Users 'Lead Healthier Financial Lives'

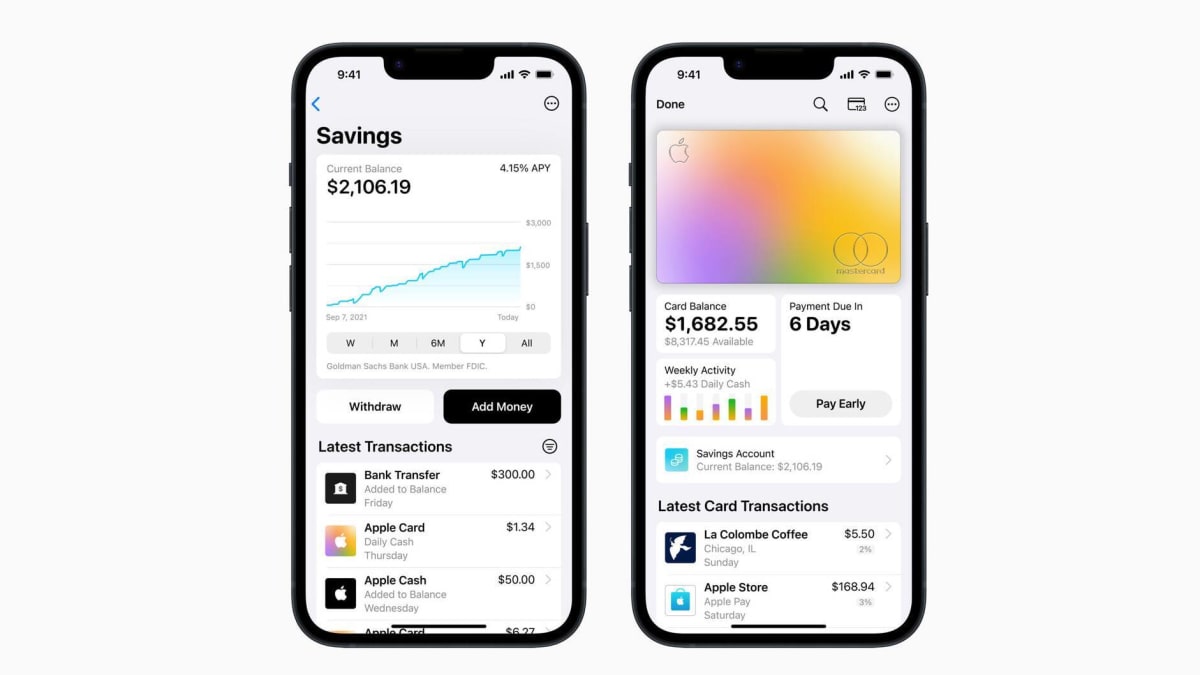

After months of lead-up, the new Apple Savings account is available to U.S. customers as of April 17. The savings account comes with a 4.15% APY and is done through Goldman Sachs TICKER just like the Apple Card.

"Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place," Jennifer Bailey, vice president of Apple Pay and Apple Wallet, said in a statement.

The account is connected to one's Apple Wallet and automatically transfers the rewards one earns from Daily Cash (the cashback money one earns when shopping with Apple's credit card). Customers can also take advantage of the rate by transferring money from an old account or change where their rewards earnings go at any time.

No fee or minimum deposit is required to sign up although one can't keep more than $250,000 in it at one time or transfer more than $10,000 at a time or $20,000 per week from a different account.

Here's All You Need to Know About High-Yield Savings Accounts and APYs

The 4.15% interest rate is quite high in comparison to both the national average and the lower rate typically offered by accounts tied to a company rather than done directly through the bank.

Data crunched by financial services company Bankrate shows that the average APY across the country is just 0.24%. High-yield savings accounts usually offer significantly higher rates in exchange for a combination of fees, minimum deposits and withdrawal limits — something that Apple Savings has all but nixed as it promotes the new account and tries to draw in new users.

"Users will also have access to an easy-to-use Savings dashboard in Wallet, where they can conveniently track their account balance and interest earned over time," Apple said in a release. "Users can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, with no fees."

Another downside of high-yield accounts is that the initially high rate offered by the bank is often very volatile and at its highest when you're being marketed to — customers should not expect it to remain that way for years after opening the savings account.

"Interest rates can vary substantially, especially in today's interest rate environment in which the Fed has raised its benchmark rate to its highest level in more than a decade," Ken Tumin, who founded the personal finance outlet Deposit Accounts, said in December 2022. "Banks make money off of customers who don't monitor their interest rates."