Apple shares moved firmly higher into the close of trading Monday, putting the stock on pace for another record close, following a pair of price target upgrades from Wall Street analysts.

Apple (AAPL) has added around $300 billion in market value since it unveiled its ambitions to blend AI technologies into its new iPhone 16 and investors bet the moves will trigger a massive cycle of new handset purchases.

Apple, which has dubbed its new technologies Apple Intelligence, is planning a major reboot of its Siri digital assistant and a series of new features for its 2.2 billion-strong hardware base.

Apple's strategy aims to integrate a host of artificial intelligence-powered tasks, such as summarization, text generation, photo editing and enhanced search, into its ecosystem of iPhone, iMacs and iPads.

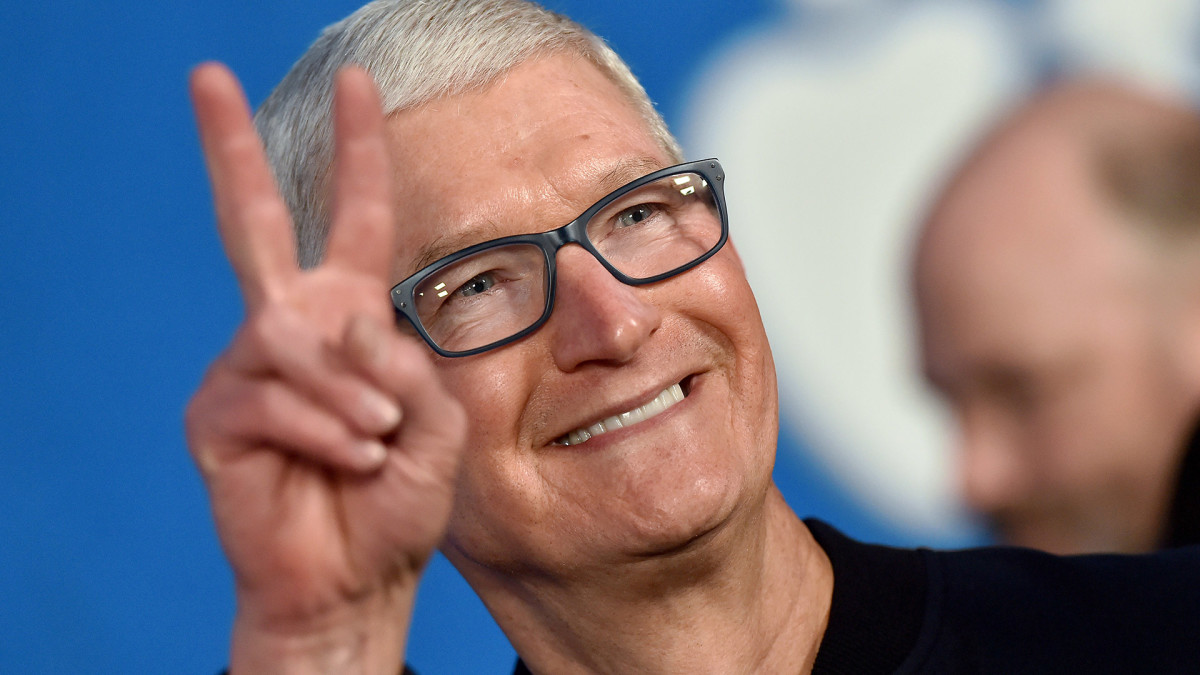

Justin Sullivan/Getty

Morgan Stanley analyst Erik Woodring, in fact, argues that investors are "underappreciating" the Apple Intelligence launch, calling it a "clear catalyst for a multiyear product upgrade cycle."

Apple a Morgan Stanley 'Top Pick'

Woodring, who lifted his Apple price target by $57 to $273 a share, said the tech giant could ship nearly 500 million iPhones over the next two years as a result of the upgrade cycle.

"This will drive 5% annual iPhone [average selling price] growth, resulting in nearly $485 billion of total revenue and $8.70 in earnings power by fiscal 2026 (vs. $459 billion and $8.20 previously), 7% to 9% above consensus," said Woodring, who also elevated Apple to a Top Pick for the investment bank among hardware-focused tech stocks.

"Near-term positive catalysts include [fiscal-third-quarter] earnings, the mid-September iPhone launch, and potential positive iPhone build revisions in mid-October," Woodring said.

Related: Top analyst revisits Apple stock price target following AI push

"Accelerating unit growth historically drives Apple stock outperformance, making the recent outperformance sustainable," he added.

Loop Capital analyst Ananda Baruah also increased his Apple price target, taking it $130 higher to $300 a share while boosting his rating to buy from hold, citing the potential impact of an accelerated upgrade cycle.

"Apple has an opportunity over the next few years to solidify itself as consumers' [generative-AI] 'base camp' of choice, similar to its impact with the iPhone for social media and the iPod for digital content consumption," Baruah wrote, citing his colleague and supply-chain analyst John Donovan.

"These trends were significant stock catalysts, and we believe generative AI has the potential to be the same," Baruah said. Generative AI derives new and original content, including text, images, video and more, from existing material.

Apple earnings in focus

Apple will report its fiscal-third-quarter earnings on Thursday, August 8, after the market close. Analysts are looking for a bottom line of $1.34 per share on revenue of $84.2 billion, a 2.9% increase from the same period last year.

Apple's overall revenue for the three months ended in March fell 4.3% from a year earlier to $90.8 billion, but the tally topped Wall Street forecasts and included a smaller-than-expected decline in overall China sales.

The group also posted a stronger-than-expected bottom line of $1.53 a share, as well as operating cash flow of $22.7 billion and an improving gross-profit margin of 46.6%.

Related: Analyst predicts Tesla's Elon Musk may create Apple rival

"Apple's June quarter is the opening act for the main event in September," said Wedbush analyst Dan Ives in a recent client note.

"We now believe initial iPhone 16 shipments will be closer to 90 million (with upside movement likely as we get closer to launch date in September) vs. original [Wall Street] expectations in the 80 million to 84 million range and up double digits year-on-year."

Since the Apple Worldwide Developers Conference in early June, "we believe optimism is growing throughout the Asia supply chain that this iPhone 16 AI-driven upgrade could represent a golden upgrade cycle for Cupertino looking ahead with pent-up demand building globally," he added.

Apple shares were marked 1.7% higher in late Monday trading to change hands at $234.40 each, a move that would extend the stock's six-month gain to around 26.8%.

The stock hit an all-time high of $237.23 earlier in the session, pegging the stock's market value at just under $3.6 trillion.

Related: Veteran fund manager sees world of pain coming for stocks