On Aug. 2, 1830, Charles X of France abdicated the throne, unable to resist the July Revolution.

On the same day in 1876, the legendary frontiersman Wild Bill Hickock was murdered in the city of Deadwood, in what is now South Dakota.

Related: Micron, inflation, and Biden-Trump debate will rock markets

And on Aug. 2, 2006, Tesla (TSLA) Chief Executive Elon Musk unleashed his Master Plan.

In a post entitled "The Secret Tesla Motors Master Plan (just between you and me)," Musk said "the overarching purpose of Tesla Motors (and the reason I am funding the company) is to help expedite the move from a mine-and-burn hydrocarbon economy towards a solar electric economy.

"Critical to making that happen is an electric car without compromises, which is why the Tesla Roadster is designed to beat a gasoline sports car like a Porsche or Ferrari in a head-to-head showdown."

The Master Plan called for building a high-performance electric car and using the profits to make affordable EVs.

"When someone buys the Tesla Roadster sports car, they are actually helping pay for development of the low cost family car," Musk said.

Musk: Tesla Master Plan 4 'will be epic'

Other master plans were to follow.

In 2016, the second plan focused on integrating solar energy, expanding the EV lineup, and advancing self-driving technology.

Related: Cathie Wood unveils surprising Tesla stock price target

The third plan, released last year, addressed scaling vehicle production, investing in renewable energy and enhancing autonomous driving.

And on Monday Musk took to X, formerly Twitter, the social-media platform he bought in 2022, to tease his next big move.

"Working on the Tesla Master Plan 4," he wrote. "It will be epic."

What should we expect from the latest master plan?

Well, Morgan Stanley analyst Adam Jonas told investors that while Tesla will still make cars, they should prepare for "something else" after the sneak preview of Master Plan 4.

The analyst expects Master Plan 4 to be underpinned by Tesla's commercial ambitions in AI, robotics, and advanced computing.

AI and robotics are entering an unprecedented phase, unlocking new total addressable markets and pushing the company “deeper into new disciplines,” said Jonas.

The analyst says investors should prepare for a plan that will more clearly link Tesla with Musk’s other ventures, including the rocket company SpaceX, the satellite network Starlink, X social media, and xAI, Musk’s artificial intelligence startup.

Morgan Stanley made no change to its overweight rating and $310 price target on Tesla stock.

RBC Capital. , on the other hand, lowered the investment firm's price target on Tesla to $227 from $293. It affirmed an outperform rating on the shares.

Related: Analyst predicts Tesla's Elon Musk may create Apple rival

The firm is reducing its outlook for the value of the company's robotaxi business to $414 billion from $627 billion previously. Barron's said RBC reduced how much of the consumer revenue in the robotaxi market will come directly to Tesla. Service providers like Uber (UBER) and Lyft (LYFT) that use robotaxis will get a sizeable share.

RBC estimates Tesla's robotaxi revenue will hit $120 billion a year by 2040.

RBC said it still saw robotaxis being the biggest driver for its Tesla valuation model at 52%, followed by Full-Self-Driving at 27%, Megapack energy-storage products at 15%, and cars at 6%.

Last week, shareholders voted overwhelmingly to support Musk's long-delayed compensation package, which was approved in 2018 but rejected by a Delaware judge last year.

'Tesla is Musk and Musk is Tesla'

"It is a pop-the-champagne time," Wedbush analyst and Tesla bull Dan Ives said after investors approved the plan, which will pay Musk around $55.8 billion. Holders also backed Musk's effort to reincorporate the company in Texas, where it moved its headquarters in 2021, and abandon its registration in Delaware.

Tesla.com

"We believe the next chapter in the Tesla growth story around autonomous and [Full-Self-Driving] is now on the near-term horizon, set to take Tesla's valuation to north of $1 trillion in 2025," said Ives, who has an outperform rating on the company's shares and a $275 price target.

More Tech Stocks:

- Nvidia has $4 trillion value in sight as AI seen powering chip sales

- Analyst updates Oracle stock price target after earnings

- Analyst revamps Palantir stock price target as software firm widens scope

The analyst added that "if this proposal went south, a lot of bad things and scenarios could have happened, including Musk beginning a path to not being CEO of Tesla.

"Instead it's roses and rainbows today in Austin, although demand challenges remain and this is [a] pivotal period for Tesla and Musk to navigate this turbulent period to see improved demand, [Full-Self-Driving] success, and new-model rollouts over the coming year," Ives said.

"Tesla is Musk and Musk is Tesla. ... [Shareholders] spoke loudly today," he declared.

Tesla Q2 delivery figures on tap

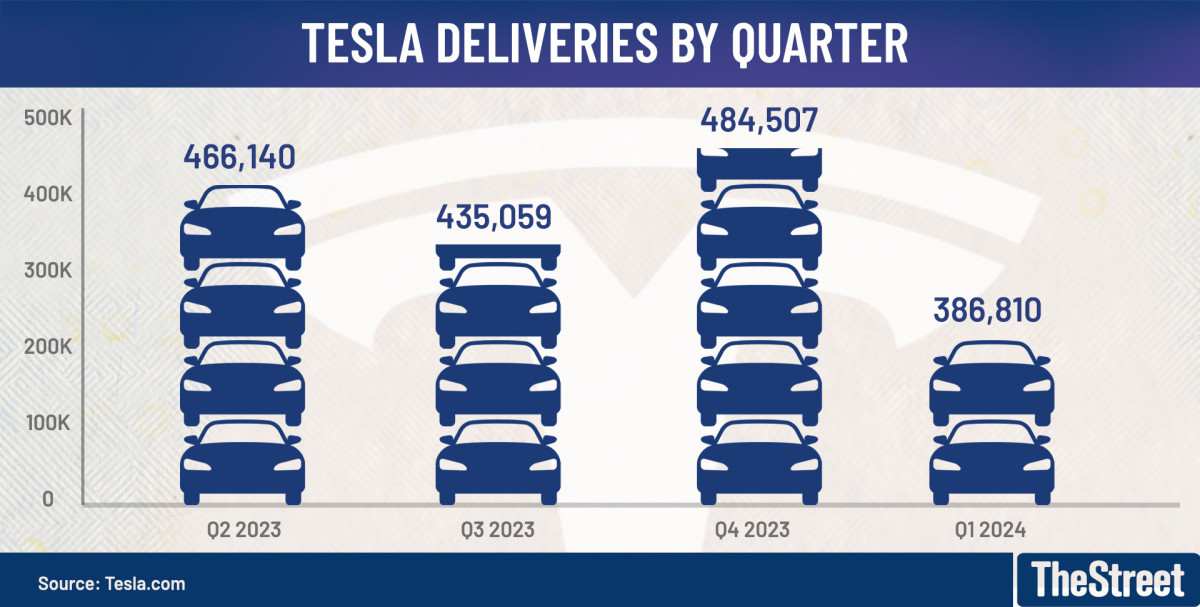

Meanwhile, Tesla is expected to soon report second-quarter deliveries.

On Friday, Barclays analysts said that they expect Tesla to deliver 415,000 units, down 11% year-over-year and below the consensus estimate of 444,000.

Analysts attributed the estimate to weak sales in Europe and modest production increases in China.

Related: Analysts reset Tesla stock outlooks after Musk’s $56 billion win

However, the investment firm says its estimate is "somewhat in line with more muted buyside expectations" and suspects the final Tesla-compiled consensus estimate will end up lower.

A soft delivery result could turn investor attention back to the currently challenging fundamental environment for Tesla, as the company is likely to face continued negative revisions on 2024 and 2025 estimates, Barclays said.

Barclays meantime maintained its equal-weight rating and $180 price target.

Related: Veteran fund manager picks favorite stocks for 2024