Microsoft shares turned lower in mid-day Monday trading as analysts debated the tech giant's capital spending amid broader market concerns over the billions committed to building AI-focused data centers.

Microsoft (MSFT) , which has planned to spend around $80 billion to build out is AI-enabled data centers over its current fiscal year, which ends in June, fell sharply on Friday following a report from TD Cowen that suggested it was cancelling some leases with private data center operators.

Returns on that spending have so far proven thin, however, and even Microsoft's AI-powered CoPilot has yet to find the kind of user scale required to generate network effects and bottom-line profit for what is now that world's second-largest tech company.

TD Cowen analyst Michael Elias also said Microsoft was slowing the pace of converting other agreements into formal leases, suggesting it could be "in an oversupply position" with respect to data center capacity.

"Microsoft was the most active lessee of capacity in 2023 and (the first half of 2024), at which time it was procuring capacity relative to a forecast that contemplated incremental OpenAI workload," Elias and his team wrote.

"However, we believe is indicated by its decision to pause construction on a data center in Wisconsin ... the company may have excess data center capacity relative to its new forecast," he added.

Capacity questions raise concern

Microsoft also hold a 49% profit-sharing agreement with OpenAI and backed the ChatGPT creator early in its development phase, enabling it to leapfrog its rivals when the AI race began in late 2022.

Excess capacity would raise serious questions over the efficacy of Microsoft's capital spending, and that of its hypercaling rivals such as Meta Platforms (META) , Amazon (AMZN) and Google parent Alphabet (GOOGL) , as well as the strength of AI demand heading into the coming year and beyond.

Investors are also looking for clarity on the impact of DeepSeek, the China-based startup that claimed to have built, trained and launched an AI chatbot at a fraction of the cost of its U.S. rivals.

Related: Analysts reboot Microsoft stock price targets after earnings

A note published Monday by Jefferies, however, claimed that Microsoft executives meeting with the bank's analysts in Australia are 'strongly refuting an change in their data center strategy".

The bank said Microsoft argued that the Cowen note may have misunderstood the company's definition of 'lease', which includes longer-term agreements that are operated by Microsoft but owned by a separate entity.

"Microsoft thinks AI supply/demand should be more inline by the end of their currency fiscal year, so supply will grow more in line with demand going forward rather than being in short supply," Jefferies said.

Microsoft expansion on track

Last last month, Microsoft posted a mixed set of second quarter earnings, including below-forecast growth for its flagship Azure cloud division and capital spending of around $22.6 billion.

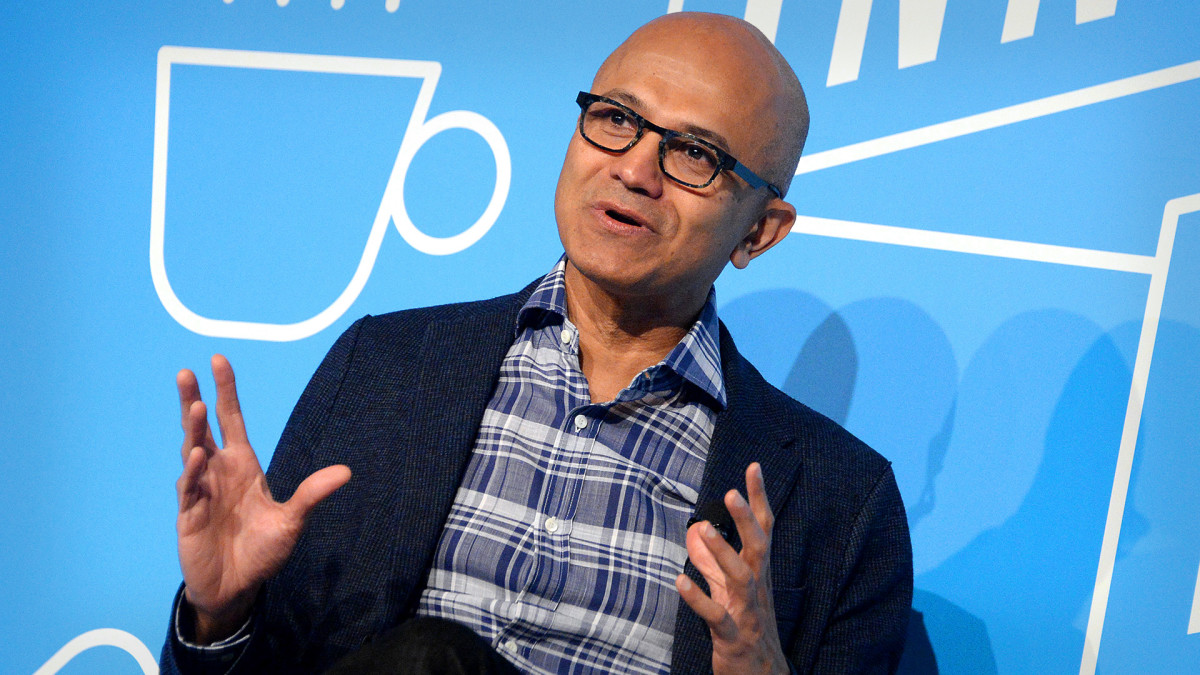

"As AI becomes more efficient and accessible, we will see exponentially more demand," CEO Satya Nadella told investors on Jan. 29.

More AI Stocks:

- AI startup smashes funding round, signals big changes for health care

- Analyst revisits Palantir stock forecast following annual report filing

- Analyst who predicted Palantir rally picks best AI software stocks

"Azure is the infrastructure layer for AI. We continue to expand our data center capacity in line with both near-term and long-term demand signals," he said. "We have more than doubled our overall data center capacity in the last three years, and we have added more capacity last year than any other year in our history."

"Our data centers, networks, racks, and silicon are all coming together as a complete system to drive new efficiencies to power both the cloud workloads of today and the next-generation AI workloads," he Nadella added.

Microsoft shares were marked 1.13% lower in mid-day Monday trading to change hands at $403.59 each.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast