Microsoft shares fell sharply in early Thursday trading, dragging tech rivals and major benchmarks lower, after the AI market pioneer hinted that its near-term ambitions for the new technology may be clouded by the costs and timing to bring them online.

Microsoft (MSFT) , which lost its place as the world's biggest tech company to Apple (AAPL) earlier this year, and slipped below Nvidia (NVDA) over the past few months, has been one of the worst-performing Magnificent 7 stocks in 2024, rising just 16.6% and trailing the 26% gain for the Nasdaq benchmark.

That disappointing performance belies that fact that Microsoft, through its partnership with ChatGPT creator OpenAI, has been at the forefront of the AI investment wave for much of the past two years, with plans to infuse the new technologies across its suite of consumer and business products.

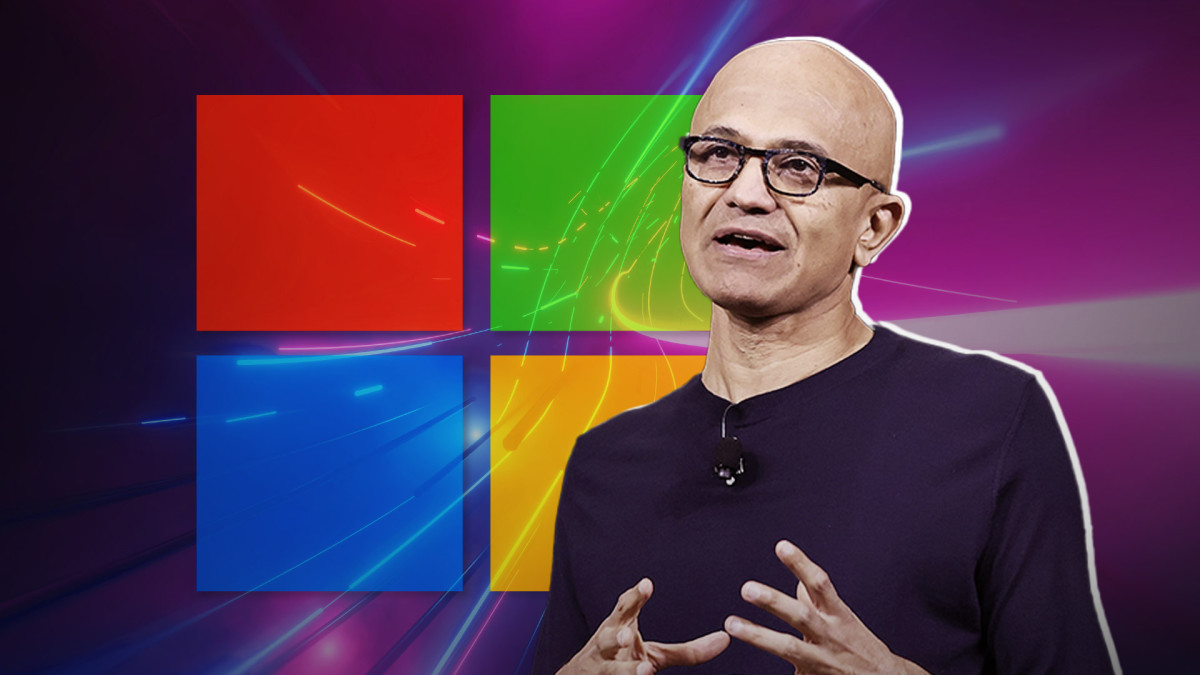

"AI-driven transformation is changing work, work artifacts and workflow across every role, function, and business process, helping customers drive new growth and operating leverage," CEO Satya Nadella told investors on a conference call late Wednesday.

TheStreet/Shutterstock/Justin Sullivan/Getty Images

"All up, our AI business is on track to surpass an annual revenue run rate of $10 billion next quarter, which will make it the fastest business in our history to reach this milestone," he added.

Microsoft capital spending surges

Those plans have come at a hefty cost, however, with Microsoft spending $55.4 billion last year to expand both its physical AI infrastructure and purchase the tens of thousands of chips and processors needed to power the energy-consuming technology.

That tally is likely to rise to around $80 billion for its current financial year, analyst estimate, and Microsoft has already laid out $20 billion over the three months ended in September, the group's fiscal first quarter.

Investors aren't seeing the kind of payoff as yet to justify that kind of outlay, however, and are looking to punish the stock for even a slight miss to Wall Street forecasts.

Related: Meta earnings blast forecasts, but Facebook parent sees big capex increase

Microsoft posted first-quarter earnings of $3.30 per share under its new reporting structure, topping Wall Street's consensus estimate of $3.10 per share, while overall revenue rose 16% to $65.6 billion.

Growth in the group's flagship Azure cloud division, the epicenter of its AI ambitions, however, came in modestly shy of Wall Street's outlook, with a 33% expansion, and will likely slow modestly into the final three months of the year.

Overall group revenue, Microsoft said, will likely rise to $68.6 billion over the current quarter, around $1 billion shy of Wall Street's forecast.

Microsoft investors need patience

"The demand around AI continues to proliferate, outpacing current supply, with an acceleration still expected in the second half of the fiscal year as more infrastructure comes online," said D.A. Davidson Gil Luria analyst Gil Luria.

"[However] ... we do not believe that this data center build out war is one that Microsoft can win, as highlighted in our proprietary semiconductor analysis, showing Azure has the least diversity of AI accelerators available compared to [Amazon Web Services] and [Google Cloud], putting them at a significant cost disadvantage," said Luria, who lowered his Microsoft price target by $25, to $425 per share, following last night's update.

Barclays's Raimo Lenschow, who reiterated the investment bank's $475 price target and overweight rating on Microsoft shares, also noted that investors are likely to need patience to enable the accelerated AI spending to start bearing fruit.

Related: Mag 7 earnings: What to know before Apple, Alphabet, Microsoft, and Meta report results

"In the short term, we fear the wait will continue for Microsoft's shares. Short-term supply issues around AI capacity are likely to cause stable Azure consumption trends in Q2 vs. Q1, which is solid but not necessarily a new catalyst that excites investors," Lenschow and his team wrote.

"Things should get better in [the second half of Microsoft's fiscal year], but investors will only find out about the magnitude of this reacceleration in April 2025 when its [third quarter] numbers come out, leaving little to be excited about in the near term," he added.

H2 ramp for Microsoft Azure: analyst

Morgan Stanley analyst Keith Weiss said, however, that investors "should see rewards for waiting" through supply constraints that limit growth in its generative AI business.

Weiss, who lifted his Microsoft price target by $42 to $548 per share, said the company remained confident it can ramp up capacity in the second half of the year.

"We still expect Azure growth to accelerate from H1 (in the second half of the financial year] as our capital investments create an increase in available AI capacity to serve more of the growing demand," Microsoft finance chief Amy Hood told investors late Wednesday.

Related: Microsoft may have a growing AI problem on its hands

Microsoft's broader improvements in its personal computing, productivity and business units, as well as the new Microsoft 365 Consumer cloud unit, also suggest the tech giant's breadth will allow for greater generation of AI-related profits once capacity is able to meet the ongoing client demand, according to CFRA analyst Angelo Zino.

Zino, who carries a strong buy rating and $490 price target on Microsoft, added that the AI contribution to Azure growth is also improving.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

"This figure has been incrementally increasing over the last several quarters as the company builds more AI capacity and organizations invest more heavily in AI workloads," Zino said.

"Also near our expectation was growth from the newly created Microsoft 365 Consumer cloud unit, with higher price points tied to AI likely to help support growth rates in future quarters."

Microsoft shares were marked 5.8% lower in early Thursday trading to change hands at $407.51 each, a move that would trim the stock's year-to-date advance to around 9.75%.

Related: Veteran fund manager sees world of pain coming for stocks