Advanced Micro Devices shares slumped in early Wednesday trading, dragging its six-month performance into negative territory, after a muted set of third-quarter earnings for the AI-chip maker failed to impress Wall Street.

AMD (AMD) , which bills itself as the most comprehensive player in the AI-investment space, with divisions covering data centers, servers and personal computers, is attempting to crave into the market-share leadership of Nvidia (NVDA) with a new line of high-performance processors.

The group's flagship AI-powering graphics processing unit, dubbed the MI300, is also seeing a surge in demand from hyperscaler clients such as Meta Platforms (META) as they ramp up spending to train their massive large language model datasets.

Supplies remain tight, however, given capacity constraints at key assembly facilities and the surge in overall demand, leaving AMD, and others, to carefully manage investor expectations even as the longer-term story remains generationally compelling.

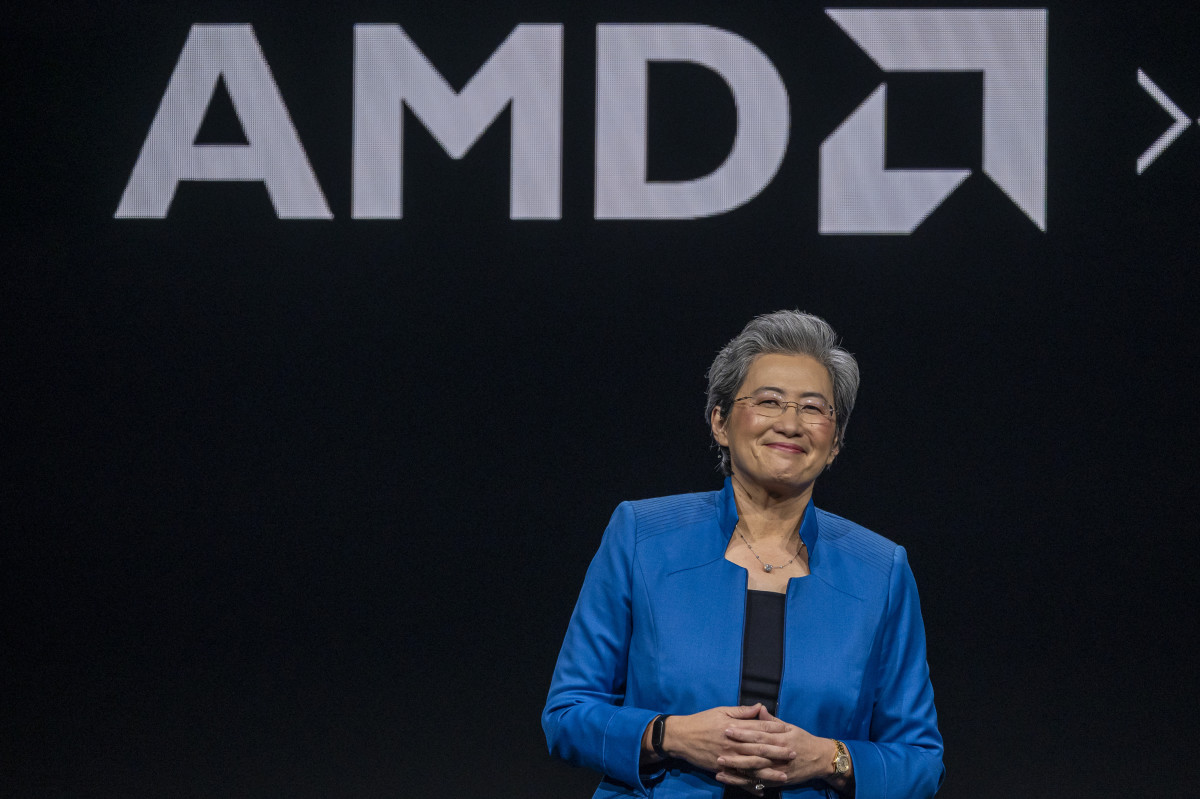

"Our opportunities are amplified exponentially by the rapid adoption of AI, which is enabling new experiences that will make high-performance computing and even more essential part of our daily lives, CEO Lisa Su told investors on a conference call late Tuesday.

"In the data center alone, we expect the AI accelerator [total addressable market] will grow at more than 60% annually to $500 billion in 2028," she added. "To put that in context, this is roughly equivalent to annual sales for the entire semiconductor industry in 2023."

AMD 'still clear #2' in AI accelerators: analyst

The group's near-term outlook, however, appeared to disappoint investors as Su laid out a $5-billion-plus 2024 sales forecast for the MI300, as well as around $7.5 billion in fourth-quarter revenue with a gross margin of around 54%.

"Our experts believe AMD is still a clear number 2 player in the AI accelerator market," said Third Bridge analyst Lucas Keh.

"They have a good opportunity to gain incremental share from Nvidia (NVDA) with their 325x and 350 Instinct products amidst the current Blackwell delay concerns from major customers, as well as the growing need for compute resources.”

Related: AMD's biggest problem is a massive opportunity

Cantor Fitzgerald analyst C.J. Muse, who carries a $180 price target on the stock, sees the MI300 line generating $12 billion in revenue over the medium-term.

"We have no doubt they will get there, just whether it's 2025 or 2026," he said. "In the interim, we view [the] shares largely range-bound in the $150-$170 territory until we gain line of sight to this earnings power, which supports upside to our price target."

KeyBanc Capital Markets analyst John Vinh was also encouraged by the MI300 outlook, as well as AMD's broader data center gains. But he noted that it was largely offset by slower growth in the group's gaming and embedded segments, the latter of which includes chips used in automotive and industrial applications.

"In [the fourth quarter] AMD sees data center once again leading quarter-on-quarter growth and client showing incremental growth, while embedded and gaming would be more modest," Vinh said.

"On a year-on-year basis, data center is expected to more than double and client to be up 29%, which is expected to offset the y/y declines in embedded and gaming."

AMD's MI300 will top server sales

Evercore ISI analyst Mark Lipacis, who raised his price target by $5 to $198 per share following last night's earnings report, sees growth in AMD's personal computing business as providing added support to the expected gains in the data center division.

Ruben Roy of Stifel, meanwhile, reiterated his buy rating and $200 price target, estimating that MI300 sales would likely top overall server CPU revenue over the near term.

"We continue to expect strong follow through on AI compute sales in 2025 as the MI325 series of processors ramps," said Roy.

"While management noted that data center infrastructure builds at a handful of large customers can, at times, be lumpy, we continue to expect significant growth, particularly in the second half of the calendar year."

Related: Analysts overhaul Alphabet stock price targets as Google parent soars

"Management commentary was largely in line with our expectations, and we continue to expect AMD to benefit from a multiyear AI infrastructure investment cycle," he added.

Goldman Sachs analyst Toshiya Hari also reiterated his 'buy' rating and $175 AMD price target, citing the growing adoption of the MI300 across hyperscalers such as Microsoft (MSFT) , Oracle (ORCL) and Meta.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

Hari, who trimmed his near-term earnings estimates following last night's updates, nonetheless sees "gains in traditional compute and the company’s participation in AI compute driving revenue growth, margin expansion and earnings accretion over the medium- to long-run in excess of the industry average."

AMD shares were marked 9.5% lower in early Wednesday trading to change hands at $150.41 each, a move that tips the stock into negative territory for the past six months.

Related: Veteran fund manager sees world of pain coming for stocks