Super Micro Computer (SMCI) still hasn’t filed its annual report, which was supposed to be due last August.

That postponement has been just one of the troubles for the company in the past few months.

💰Presidents Day Sale: Get Free access to TheStreet Pro for 31 days – Claim your offer today! 💸

Supermicro specializes in server hardware. It integrates Nvidia's (NVDA) GPUs into its servers, which are then supplied to clients like cloud service providers.

Almost a year ago, Supermicro was riding high. The company saw its stock peak in March 2024 as a darling in the AI and data center boom. But the stock has tumbled 74% since that peak.

The trouble began last summer.

On Aug. 27, short-seller Hindenburg Research released a report accusing Supermicro of what it called "glaring accounting red flags, evidence of undisclosed related-party transactions, sanctions violations, and customer troubles."

A day later, Supermicro said it would delay filing its Securities and Exchange Commission Form 10-K for the fiscal year ended June 30.

In October, Supermicro's then-auditor, Ernst & Young, resigned, citing governance and transparency concerns. Supermicro's special committee of the board later said it found “no evidence of misconduct” after investigation.

In December, Supermicro was dropped from the Nasdaq 100 index and replaced by Palantir Technologies.

But relax, suggests management. The company's latest update paints a more hopeful picture.

Supermicro sets bold sales goal of $40 billion

Supermicro just said that it "believes" it will file the annual report for the fiscal year ending Jun. 30, 2024, and its quarterly report for the period ending Sep. 30, 2024, by Feb. 25, 2025.

Along with the statement came the company’s fiscal Q2 preliminary earnings, which came slightly below market expectations.

Supermicro expects second-quarter Non-GAAP earnings per share of 58 to 60 cents, falling short of the consensus estimate of 75 cents. The company also anticipates revenue between $5.6 billion and $5.7 billion, missing the consensus of $5.94 billion.

The company's Q3 revenue and earnings outlooks came in line with market consensus.

For fiscal year 2025, Supermicro lowered its revenue guidance from a range of $26 billion to $30 billion to a new range of $23.5 billion to $25 billion.

Meanwhile, the company has set a bold $40 billion revenue projection for fiscal 2026.

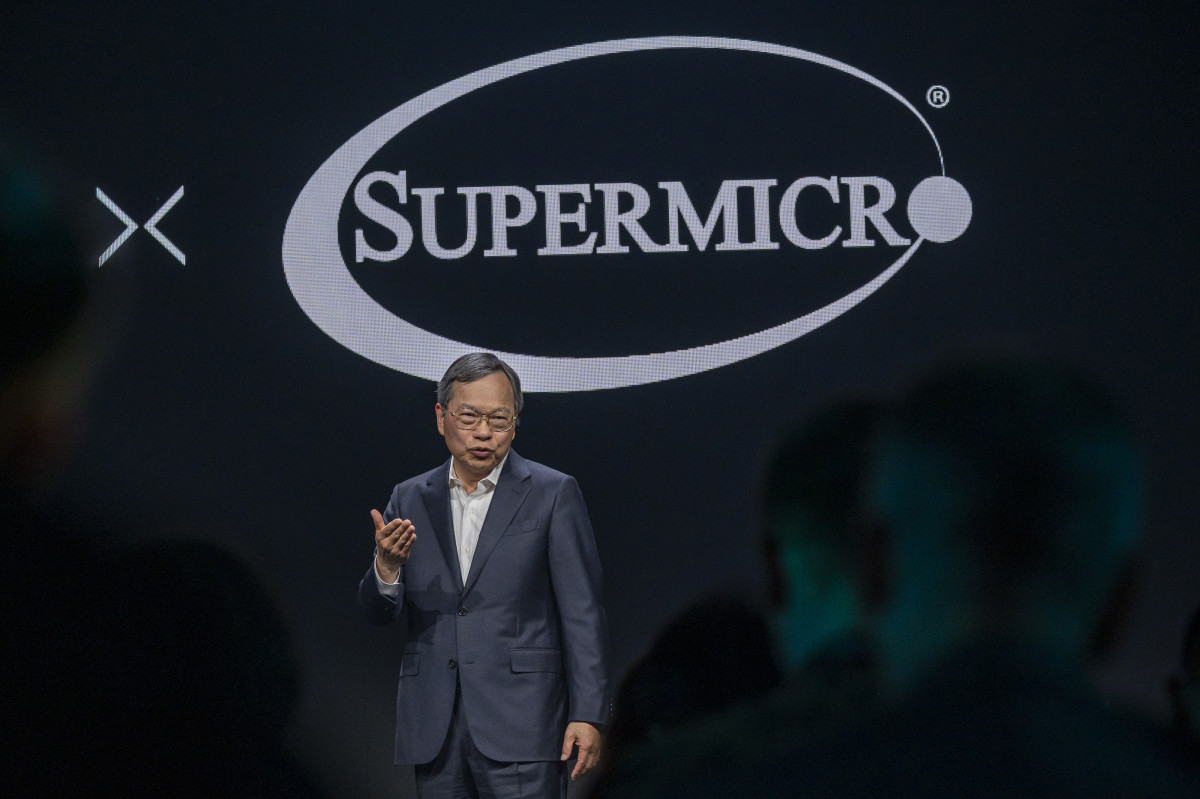

“With our leading direct-liquid cooling (DLC) technology and over 30% of new data centers expected to adopt it in the next 12 months, Supermicro is well positioned to grow AI infrastructure designs wins based on NVIDIA Blackwell and more,” said Supermicro founder and CEO Charles Liang.

Related: Fund manager who predicted Nvidia’s selloff makes a bold move

“We anticipate this technology transition sets a strong foundation for us now, resulting in FY25 revenue in the range of $23.5 billion to $25 billion, paving the way for $40 billion revenue in FY26,” Liang said.

Supermicro's annual revenue for fiscal 2023, which ended June 2023, was $7.12 billion.

Supermicro's competitors, Dell (DELL) and Cisco (CSCO) , earned $88.4 billion and $53.8 billion in revenue for their fiscal 2024, which ended in February 2024 and July 2024, respectively.

Analysts raise Supermicro stock price target

Several analysts have raised their stock price targets on Supermicro after the company’s latest announcement.

Wedbush analysts raised the firm's stock price target on Supermicro to $40 from $24 and reaffirmed a neutral rating.

"SMCI gave us a mix: softer uninspiring results, but also a vision of a significantly more robust future highlighted by a $40B guide for 2026," the firm said.

Related: Nancy Pelosi bets this unprofitable AI stock will surge

Despite the significant lift in the stock price target, "with much of the upside captured by SMCI's appreciation over the last week, we continue to see shares as appropriately valued and remain neutral on the name," the firm added.

Northland raised the firm's price target on Supermicro to $57 from $54 with an outperform rating.

The company's December quarter results and March quarter guidance were weak, but there are "multiple indications of Supermicro wielding significant differentiation," the analyst said. Therefore, the firm believes Supermicro's outlook for $40 billion in fiscal 2026 sales "is viable."

Northland continues to believe Supermicro is well positioned for share gain in the generative artificial intelligence multi-trillion dollar opportunity.

JPMorgan also raised the firm's price target on Supermicro to $35 from $23 while keeping an underweight rating, thefly.com reported.

The firm said it upped the price target to reflect the increased confidence that Supermicro would file the financials by the deadline.

More AI Stocks:

- Analysts overhaul Apple stock price targets after record Q1 earnings

- Veteran fund manager reveals startling AI stocks forecast for 2025

- These agentic AI stocks could soar in 2025

Meanwhile, JPMorgan noted that Supermicro's fiscal Q2 earnings report was mixed, with near-term results and outlook falling short, and that the company needs execution proof for its "aggressive" fiscal 2026 revenue expectations.

Year-to-date, Supermicro has surged roughly 30%.

Related: Veteran fund manager issues dire S&P 500 warning for 2025