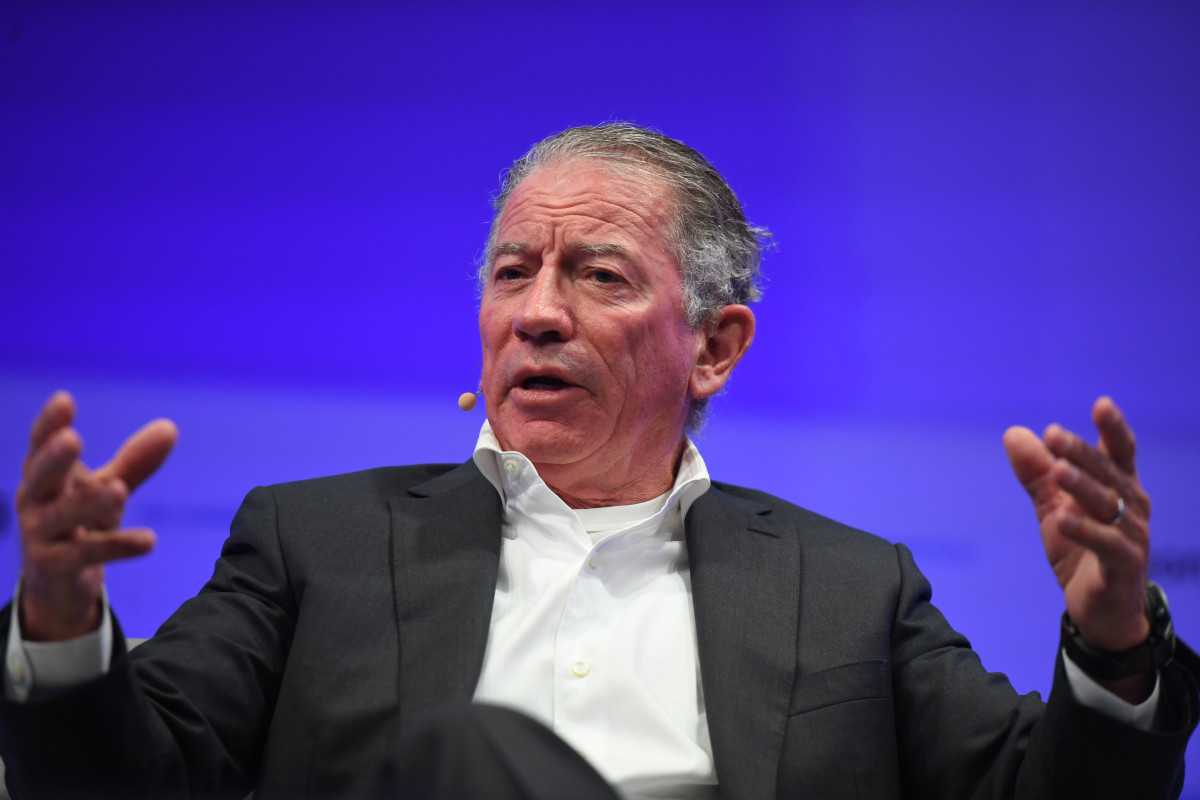

Tom Siebel wasn't born yesterday and neither was his company.

Siebel is chairman and chief executive of enterprise artificial intelligence company C3.ai (AI) , and his outfit has been in the artificial-intelligence racket for quite a while now.

Related: Veteran fund manager issues blunt warning on Nvidia stock

"At C3 AI, we've dedicated 15 years and a couple of billion dollars worth of software engineering in building a powerful AI platform that underpins some of the largest enterprise AI deployments on Earth today," Siebel told analysts during the Redwood City, Calif., company's fiscal-fourth-quarter earnings call.

"We started this effort in 2009 before anybody even talked about enterprise AI, before [Microsoft] Azure existed, before [Google Cloud Platform] existed, OK, before the [graphics-processing unit] existed," he said.

In this age where Nvidia (NVDA) and ChatGPT seem to dominate the conversation, it might be a little hard to imagine when people weren't talking about AI.

And Siebel acknowledged that "there clearly is a market frenzy today around AI infrastructure."

The frenzy has proved a challenge for some companies.

CEO sees a tailwind for company

While C3.ai's shares were climbing nearly 14% at last check on Thursday, Salesforce (CRM) saw its stock tumble 20% after the enterprise-software company posted disappointing fiscal-first-quarter earnings.

Salesforce, which has been ramping up investment in AI technologies while cutting costs, may be seeing a so-called crowding out of new spending on its flagship enterprise software offerings. This as clients shift their information-technology budgets toward AI investment over the coming quarters.

Related: Analysts revamp Salesforce stock price targets after earnings

"Let's take a look at the market dynamics in AI, OK?" Siebel told analysts. "This is proving a headwind for some companies as we're seeing, and it's proving a tailwind for us."

"The primary competitor to C3.qi remains trying to build versus buy," he added. "Building AI applications for an enterprise is incredibly difficult and unlike anything [chief information officers] have encountered before."

In fairness, Siebel added, "most CIOs have their hands full trying to install single sign-on, trying to get their security firewalls to work, and trying to figure out how to manage over-budget, delayed, sometimes multibillion-dollar SAP upgrades from Accenture and Deloitte."

The extensive infrastructure and software services required to operate AI applications at scale are exceptionally complex, he said, and are not feasible for most companies to manage with an in-house team of IT engineers.

"Today, many companies are dabbling in trivial AI projects or relying on outside integrators to try to cobble together something that works," Siebel said. "These are nothing more than large and expensive experiments. Nobody succeeds."

"In reality, enterprise customers don't want to buy tools to build applications," he said. "They want to buy applications."

As far as the numbers, C3.ai posted a loss of 11 cents a share, compared with a loss of 13 cents a share a year earlier. The latest result beat FactSet’s consensus analyst estimate of a loss of 30 cents a share.

Revenue totaled $86.6 million, up 20% from a year earlier and topping Wall Street’s call for $84.4 million in sales.

Analyst: Revenue outlook 'distinctive'

"In Q4 alone, we received almost 50,000 inquiries from 3,000 businesses, each with revenue greater than $500 million, all expressing interest in our generative-AI application," Siebel said.

Analysts updated their price targets for C3.ai after the quarterly results were reported.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

Morgan Stanley analyst Sanjit Singh raised the investment firm's price target on C3.ai to $23 from $21 and kept an underweight rating on the shares.

A fifth straight quarter of revenue acceleration and a fiscal year 2025 revenue outlook that was well ahead of consensus are "distinctive" in a tough earnings season for software, but the valuation remains "rich" compared with that of peers, the analyst told investors.

Northland analyst Michael Latimore upgraded C3.ai to outperform from market perform, affirming a price target of $35, following the earnings report.

C3.ai reported accelerating subscription growth of 41% in the quarter, providing evidence that the headwinds from a migration to a usage-based revenue model are abating, the analyst said.

Related: Analysts reboot Dell stock price targets ahead of earnings

Latimore said the company's strong pilot growth and demand for generative artificial intelligence suggests its high growth can continue.

He says the potential for outperforming growth is there, and C3.ai is able to post positive free cash flow in fiscal 2025 despite its investments.

Piper Sandler, meanwhile, lowered the firm's price target on C3.ai to $29 from $33 and affirmed a neutral rating on the shares.

The firm notes C3.ai posted upside to fourth-quarter expectations, with revenue and profit margins coming in ahead of expectations, driven by broad-based growth.

Initial fiscal 2025 revenue targets were set above consensus, while margins came in below Wall Street's forecasts, the firm said.

Related: Veteran fund manager picks favorite stocks for 2024