When it comes to artificial intelligence, Amazon (AMZN) isn't about to cash in its chips.

The online retail and entertainment giant is looking to expand its use of AI to boost its bottom line, streamline customers' shopping experiences and improve sustainability.

Related: Analysts reboot Amazon stock price target ahead of earnings

Now, there's little doubt Nvidia (NVDA) is the heavyweight champion of the AI world.

Mizuho Securities estimates that the Santa Clara, Calif., company controls between 70% and 95% of the market for AI chips used for training and deploying models like OpenAI’s GPT.

But NVDA's chips ain't cheap, prompting some folks to call out the so-called "Nvidia tax" as a cost of doing business.

This expense is driving Amazon and other companies like Microsoft (MSFT) and Google parent Alphabet (GOOGL) to develop their own chips.

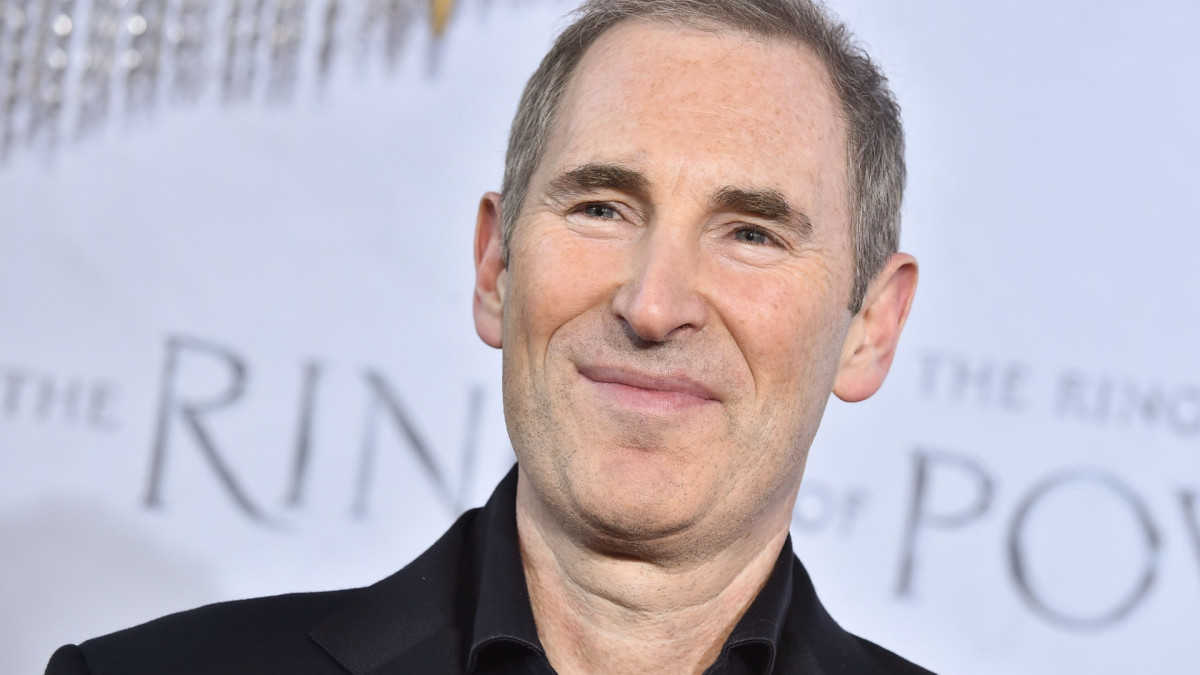

"We have a deep partnership with Nvidia and the broader selection of Nvidia instances available, but we've heard loud and clear from customers that they relish better price performance," Amazon Chief Executive Andy Jassy told analysts during the company's earnings call.

Amazon CEO: 'AI going to be a very large business for us'

"It's why we've invested in our own custom silicon in Trainium for training and Inferentia for inference," he added. "And the second versions of those chips, with Trainium coming later this year, are very compelling on price performance. We are seeing significant demand for these chips."

Jassy said that Amazon Web Services, the company's cloud-computing platform, has seen revenue growth accelerate.

Related: Apple earnings top forecasts, iPhone sales slip ahead of AI launch

Amazon's AI business continues to grow dramatically, with a multibillion-dollar revenue run rate, despite it being such early days, he said. The company, he said, "can see in our results and conversations with customers that our unique approach and offerings are resonating."

"At the heart of this strategy is a firmly held belief which we've had since the beginning of AWS that there is not one tool to rule the world," he said. "People don't want just one database option or one analytics choice, one container type. Developers and companies not only reject it, but are suspicious of it."

Amazon reported second-quarter earnings of $1.26 a share, nearly double the figure of a year earlier and topping the consensus estimate of $1.03 a share.

Revenue totaled $147.98 billion, up 10% year-over-year and short of Wall Street’s call for $148.56 billion.

Amazon forecast revenue in the current quarter to range $154 billion to $158.5 billion, up 8% to 11% year over year. Analysts are looking for $158.24 billion in sales.

Q2 AWS revenue totaled $26.3 billion, up nearly 19% year-over-year, while analysts were looking for $26 billion.

"I think that the reality right now is that while we're investing a significant amount in the AI space and in infrastructure, we would like to have more capacity than we already have today," Jassy said. "I mean we have a lot of demand right now. And I think it's going to be a very, very large business for us."

Amazon's shares fell after the earnings report and were down 9.1% to $167.38 at last check. A number of analysts adjusted their price targets.

B of A: Amazon 'remains our top large-cap stock'

Analysts at D.A. Davidson reiterated their buy rating on Amazon and $235 price target, saying the Seattle e-retail and tech company "reported mixed 2Q24 results that were characterized by a miss on top-line expectations due to retail weakness, but continued strength in Amazon Web Services and Advertising."

"The reacceleration story at AWS persists with AI services at the hyperscaler hitting a multibillion-dollar revenue run rate as demand for generative AI remains strong from customers," the firm said.

More Tech Stocks:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech company files Chapter 7 bankruptcy, closes abruptly

"Apart from AI services, core cloud growth underscored the positive AWS quarter as cloud migrations and workload expansions accelerated," D.A. Davidson added.

Goldman Sachs lowered its price target on Amazon to $230 from $250 and affirmed a buy rating on the shares following the report.

The investment firm still believes Amazon will compound a mix of solid consolidated revenue growth and expanded operating margins on a multiyear view while also making critical investments in long-term growth initiatives.

But a “more mixed” forward outlook with the high-end of third-quarter operating profit guided below Wall Street will likely reignite investors' debates about Amazon's investment cadence measured against current profitability levels, the analyst said.

Bank of America Securities retained a buy rating on the stock but cut its price target to $210 from $220.

The firm said it remained constructive on the two key stock drivers: improving AWS trends and retail margin growth still intact into the holidays

"Amazon remains our top large-cap stock given AWS acceleration and AI opportunity," B of A said.

Wells Fargo analyst Ken Gawrelski lowered the firm's price target on Amazon to $232 from $239 and maintained an overweight rating on the shares.

Twelve months of positive operating-profit revisions take a pause since despite a standout three percentage points of acceleration at AWS, a North America retail-margins miss and guidance implies further softness, the analyst said.

Long-term retail margin drivers remain in place, Gawrelski said, but he expects the stock to tread water in the near term.

Related: Veteran fund manager sees world of pain coming for stocks