The current market rally, which has lifted the S&P 500 to multiple record highs this year, is set to face its sternest test in several months as the earnings season comes to a close and the Federal Reserve continues to preach patience on near-term interest-rate cuts.

Analysts, however, see further upside to the broadest measure of U.S. blue-chip stocks, noting that while much of the current gains have been powered by only a handful of mega-cap tech stocks, parallels to the internet bubble of the early 2000s are less apt than comparisons to the bull market seen in the 1990s.

Stocks in that era kicked off a 12-year run of impressive gains, including a nearly sixfold increase for the S&P 500, despite relatively high Fed rates and a still-developing global economy.

JOHANNES EISELE/AFP via Getty

The internet's nascent launch, alongside faster developments in telecommunications and related technologies, powered a corporate-productivity boom that helped stocks sail through the higher rate environment, analysts argue.

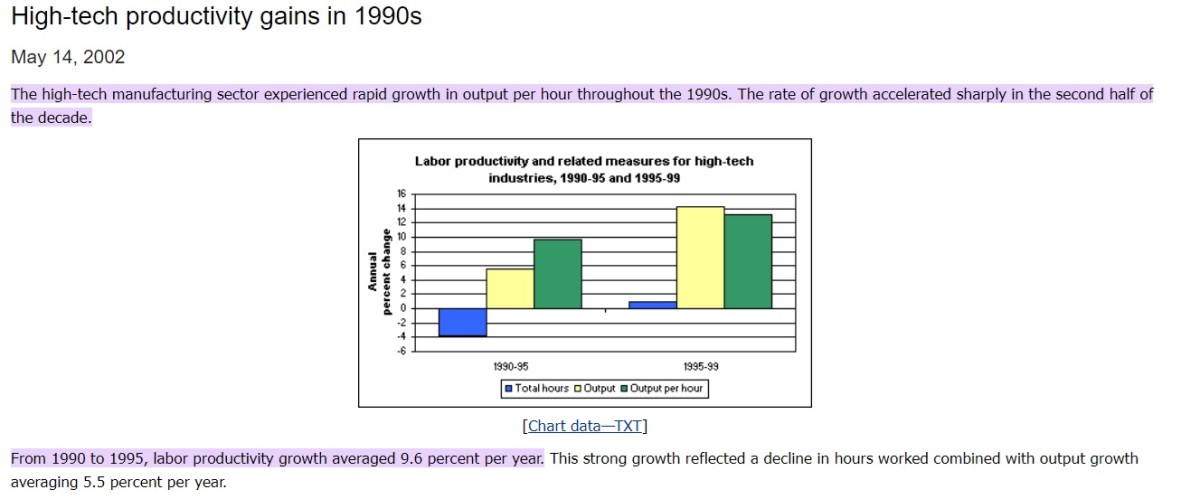

Bureau of Labor Statistics.

Party like it is NOT 1999

"Thoughts of the mid-1990s are creeping into today’s equity market, as during that time the ensuing productivity boom propelled equities for years despite relatively high interest rates," said Yung-Yu Ma, chief investment officer at BMO Wealth Management.

"We would argue that we’re in the early stage of productivity-enhancing benefits of AI," he added. "The current hype may be slightly more advanced than what AI can deliver in the near-term for productivity gains, but as of now, the hype hasn’t come unhinged."

Citigroup analyst Scott Chronert is also bullish on stocks, but he wants to see the current spending ramp on AI infrastructure translate into revenue and growth drivers.

That kind of fundamental support, he and his team argue, will be key for stocks to meet the bank's bullish year-end S&P 500 target of 5,700. But he notes that the current rally shouldn't be seen as a bubble given that valuations are notably lower than they were during the peak of the dot-com era.

Related: Big tech stocks are doubling down on AI

JP Morgan's Marko Kolanovic, however, says market performance and near-term forecasts are too closely tied to a so-called Goldilocks scenario of moderating growth and slowing inflation, and worries that increasing price pressures could delay Fed interest-rate cuts even later into the year.

"Bulls are to a good extent basing their constructive market call on the premise that corporate profits are set to accelerate, but the earnings reality might turn out to be the opposite as we move through the year." JP Morgan analysts noted in a Monday report.

"Corporate profit margins are elevated in a historical context and appear to be peaking out," the bank added. "Historically, profit margins always start to move lower ahead of the next economic downturn."

Earnings growth crucial to bullish thesis

With around 448 of the S&P 500 reporting so far, fourth-quarter earnings are forecast to rise 10% from a year earlier to a share-weighted $476.3 billion, with full-year earnings expected to rise 9.5% from 2023 levels.

Barclays strategist Venu Krishna, in fact, lifted his full-year earnings forecast for the S&P 500 to $235 per share – a $2 improvement from his prior estimate but still shy of the $260 per share level tied to Citi's 5,700 S&P 500 target – thanks in part to the ongoing tech dominance.

"The new forecast reflects our view that inflation will continue to normalize while the economy remains relatively resilient and that Big Tech will maintain leadership," Krishna wrote.

"We believe Big Tech earnings exceptionalism justifies a premium multiple for the group, while we see the S&P 500 ex-tech as trading roughly in line with fair value amid easing inflation headwinds and a shallower reset to economic growth," he added.

Related: S&P 500 record highs paper-over Fed risks and bond market signals

Two further drivers for stock market gains this year could come from excess cash that is building both on the sidelines of the investment world and in the corporate coffers of the biggest U.S. companies.

Adam Turnquist, chief technical strategist at LPL Financial, sees the broader economic resilience, as well as easing inflation pressures and a shift in Fed rate policy later in the spring, fueling the case for corporate share buybacks.

Turnquist sees overall buybacks rising around 13% from last year to $885 billion, adding that companies that execute share repurchases tend to outperform their broader benchmarks.

"Over the last 20 years, the S&P 500 Buyback Index has beaten the S&P 500 71% of the time, amassing an average annual return of 11%," he said. "This compares to the S&P 500’s average annual return of 8.9% over the same period."

More Economy:

- Fed members just hat-tipped what's next for interest rates

- Retail sales tumble clouds impact of inflation data

- Jobs report shocker: 353,000 hires crush forecasts, stokes inflation fears

Meanwhile, assets in global money market funds topped the $6 trillion mark for the first time ever earlier this month, driven in part by high short-term interest rates and a reluctance by fund managers to bet on an extended U.S. stock rally.

Total assets in money market funds have hit a record $6 trillion, increasing by $1.2 trillion over the past year and nearly doubling over the past five years. pic.twitter.com/nfsWrInmJa

— Charlie Bilello (@charliebilello) February 26, 2024

However, Summer Fed rate cuts and a pullback in Treasury bond yields could see a good portion of the cash moving back into stocks over the year's second half, adding more fuel to the bullish price targets.

This is a Teflon stock market, showing a remarkable ability to shake off bad news and focus on what is positive, which is classic bull-market behavior, noted BMO Wealth Management's Yung-Yu Ma.

Related: Veteran fund manager picks favorite stocks for 2024