In what appears to be a case of "buy the rumor, sell the news," Uber Technologies (UBER) stock languished in its Monday debut as a component of the S&P 500 even as the market enjoyed broad-based gains.

Fair enough. UBER stock is up about 7% since S&P Dow Jones Indices said on December 1 the ridesharing company would replace Alaska Air Group (ALK) in the most commonly used benchmark for U.S. equity performance. That beat the broader market by four percentage points.

Also note that Uber was already on a roll when it was tapped for the S&P 500. Shares added more than 50% between the market's October nadir and mid-December – a period in which the broader market rose 15%.

That Uber stock should take a breather on the day it actually became a member of the S&P 500 is no big deal. The pop UBER stock got from being picked for the benchmark index may have run its course, but being a member of the S&P 500 also helps in the long term.

That's because the S&P 500 is the most widely tracked index in the world. Indeed, more than $11.4 trillion in assets are indexed or benchmarked to the S&P 500, according to S&P Dow Jones Indices. The market's three largest exchange-traded funds – SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV) and Vanguard 500 Index Fund (VOO) – collectively command more than a trillion dollars in assets under management. Anytime a company is included in the S&P 500, every investment vehicle following the index has to buy its stock.

Wall Street is Uber bullish

The Uber-in-the-S&P 500 trade is over, but Wall Street analysts remain uber bullish on Uber stock as a longer term holding, too.

Of the 48 analysts issuing opinions on Uber stock surveyed by S&P Global Market Intelligence, 32 rate it at Strong Buy, 14 say Buy and two call it a Hold. That works out to a rare consensus recommendation of Strong Buy. The Street is particularly excited about Uber's growth prospects. Analysts forecast Uber to generate average annual earnings per share (EPS) growth of 68% over the next three to five years.

Such an outsized growth rate makes Uber stock, trading at 54 times the Street's 2024 EPS forecast, a screaming bargain at current levels, bulls say.

"Uber is the largest company in the ridesharing industry, and the second-largest player in food delivery," writes Argus Research analyst Bill Selesky, who rates UBER at Buy. "We expect both businesses to perform strongly in Q4 2023 and in 2024, as ridership has now rebounded to pre-pandemic levels."

Selesky adds that Uber reported 21% growth in gross bookings in its most recent quarter, while trip frequency rose by 25%. Uber also posted "solid" free cash flow of $905 million, the analyst notes.

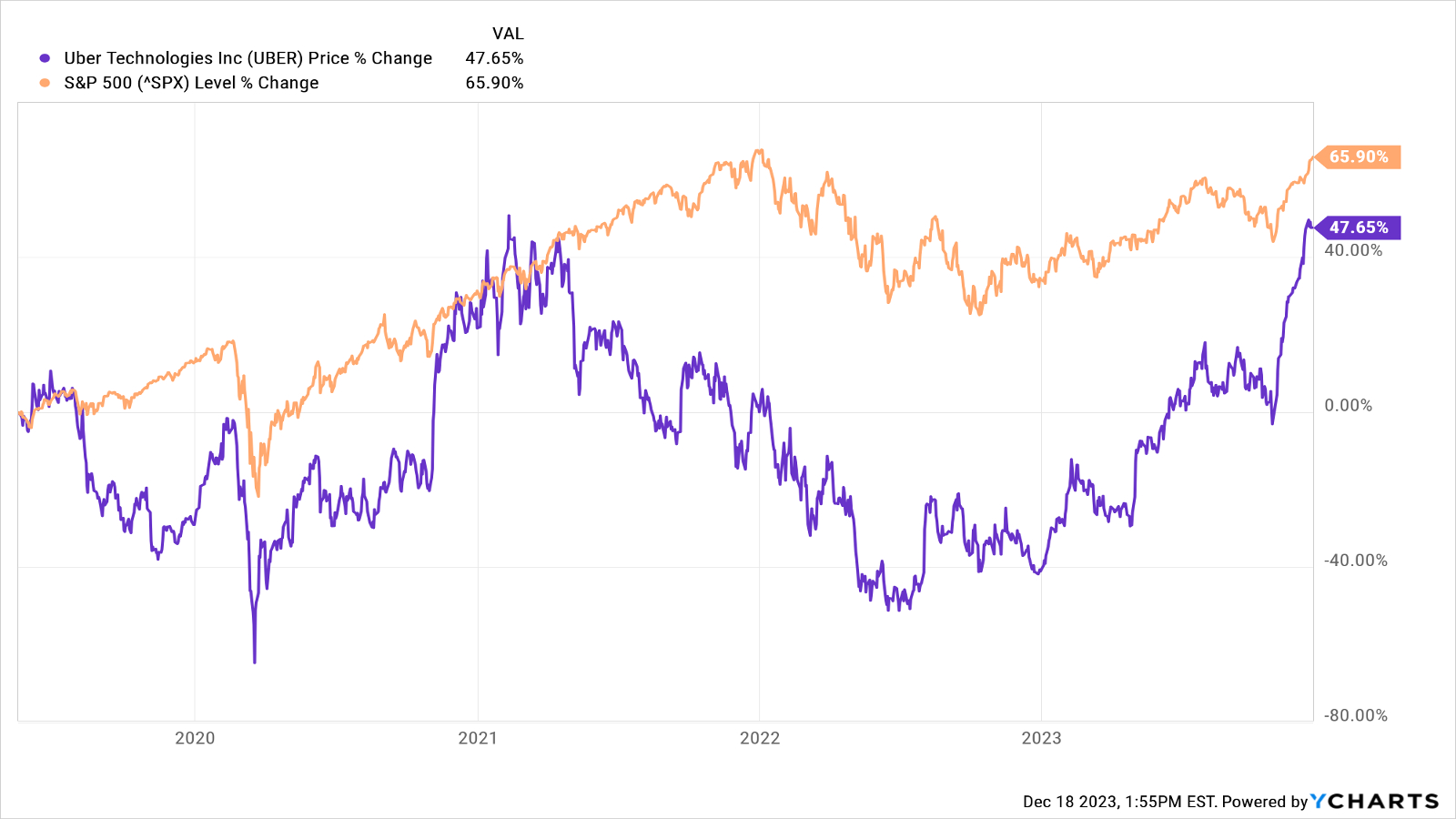

Uber stock added 150% for the year-to-date through December 18, vs a gain of 24% for the broader market. However, as you can see in the chart below, shares still lag the S&P 500 by a wide margin since Uber went public in 2019.