There's little doubt about what company currently rules the artificial intelligence universe.

Nvidia (NVDA) owns most of the high-end AI chip market and has seen its stock price skyrocket 209% over the last year.

Nvidia's CEO, Jensen Huang, expects the widespread embrace of accelerated computing and generative AI to be a "huge opportunity" for his company.

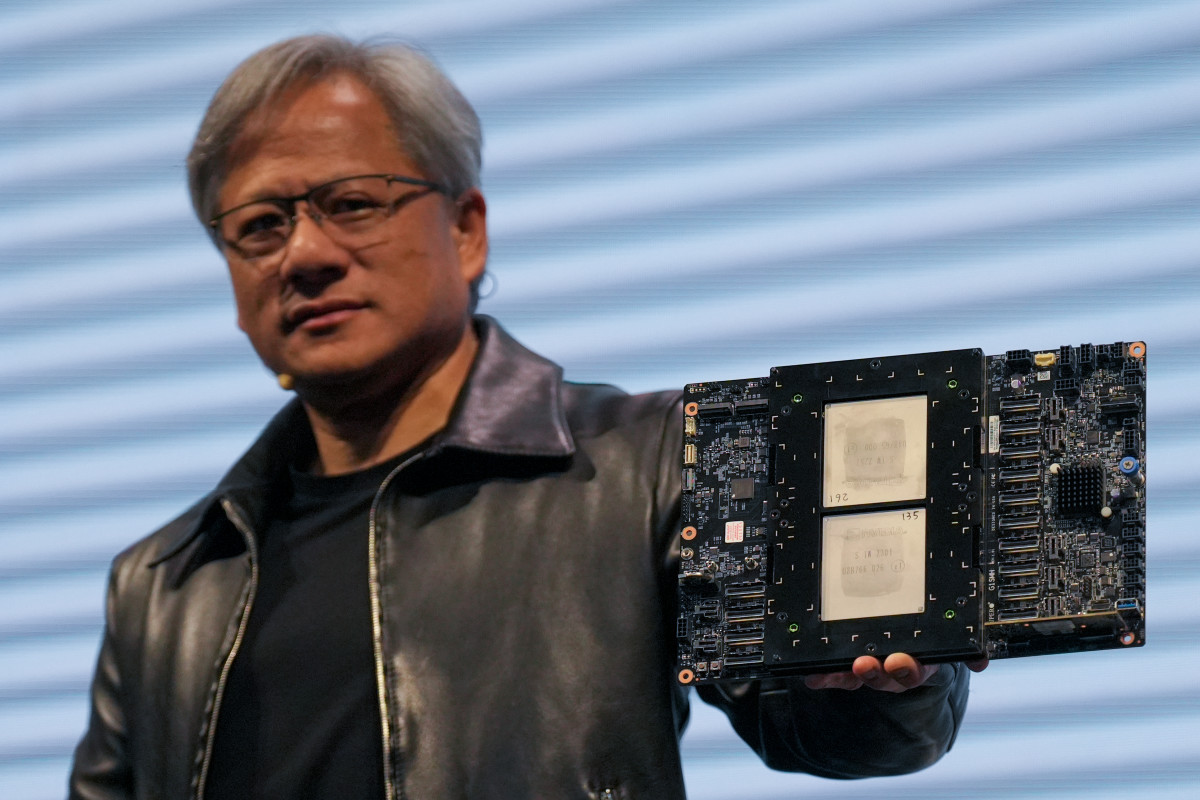

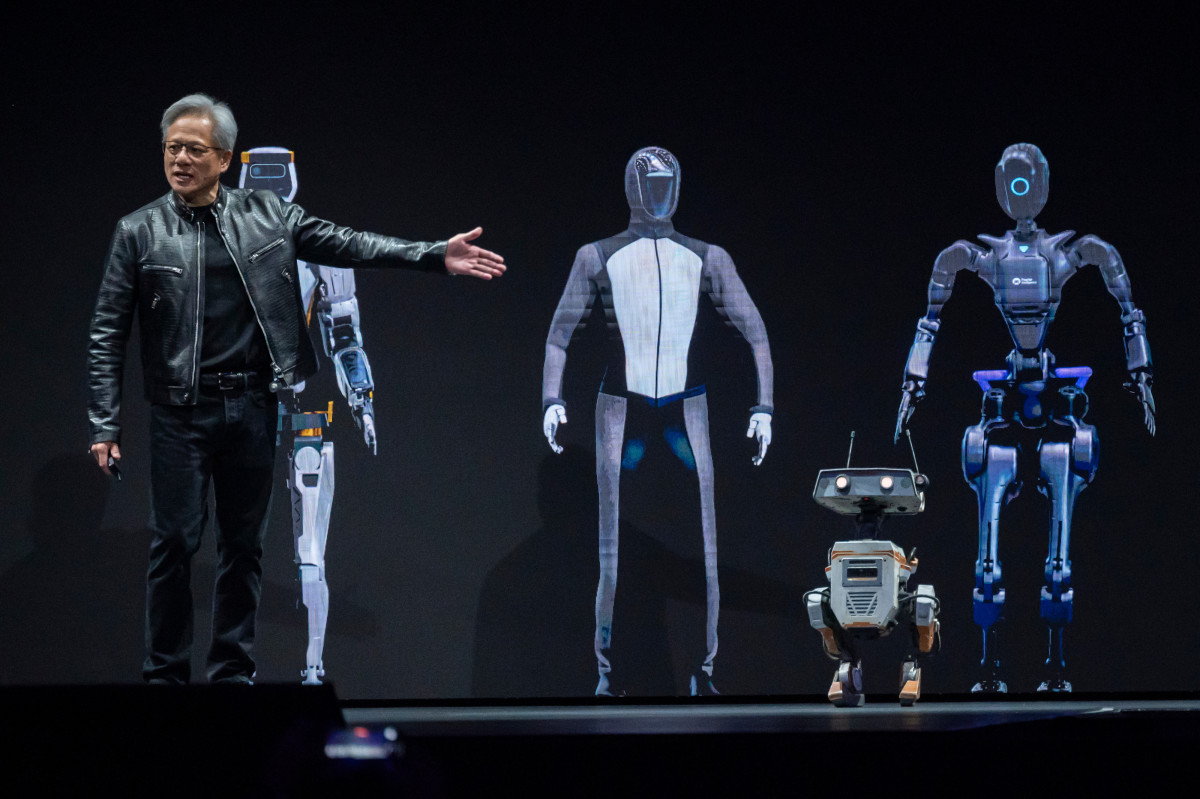

Huang's team presented its latest AI solutions in March at Nvidia's annual GTC Conference.

Nvidia's new Blackwell GPUs are 2.5 to 5 times more powerful and efficient than its Hopper platform chips, including the H100 and H200.

In February, Reuters reported that the Santa Clara, Calif.-based company was building a new business unit focused on designing bespoke chips for cloud computing firms and others, including advanced artificial intelligence processors.

Nvidia is looking to capture a portion of the exploding market for custom AI chips and shield itself from the growing number of companies pursuing silicon alternatives.

Analyst: 'Volatility is not new'

The company's shares have dipped recently, but TheStreet Pro's Chris Versace is undaunted.

"We are adding to Nvidia coming off the recent pullback as well as this week’s AI, cloud, and data center news that shows all three remain areas of corporate investment, keeping them growth drivers," he said.

Related: Analysts overhaul Tesla price targets as Q1 earnings loom

Despite news that Google (GOOG) and Facebook parent company Meta Platforms (META) will invest in their own AI chips, Versace said that "current capacity shortages, as well as estimates for Nvidia to retain up to 75% of the AI accelerator market, tell us it remains well positioned."

Tech stocks took a beating Friday after The Wall Street Journal reported that China is ordering the country’s largest telecom carriers to cease using foreign chips.

Chinese officials issued the directive earlier this year, telling telecoms to replace non-Chinese core processors by 2027, the Journal reported, citing people familiar with the matter.

Advanced Micro Devices (AMD) and Intel (INTC) finished the day in the red.

China has been Intel's biggest market, accounting for 27% of the company's 2023 revenue. AMD generated 15% of sales from China, including Hong Kong, last year

Bank of America analyst Vivek Ary addressed the recent sell-off of Nvidia shares, telling investors in an April 9, research note that "volatility is not new."

Arya maintained his buy rating for Nvidia with a $1,100 price target.

"There are some market factors such as the recent rise in inflation, volatility (VIX), AI stock fatigue, rotation towards more cyclical sectors, and possibly some pruning ahead of upcoming earnings season," he said.

Pause concerns 'unwarranted'

Nvidia's new Blackwell GPUs are 2.5 to 5 times more powerful and efficient than its Hopper platform chips, including the H100 and H200.

On a fundamental basis, the analyst said that he had heard of investors' concerns about rising competition and reducing lead times for NVDA GPU accelerators, which is expected to get longer as Blackwell demand grows.

More AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

"While there is always the potential for near-term summer consolidation in NVDA stock (such as we saw from Aug-Dec last year), we believe the fundamentals are solidly on track, and periods of consolidation (trading sideways) tend to set the stock up for strong moves later," he said.

On Thursday, Raymond James raised its stock price target to $1,100 per share from $850.

The firm's analysts held a virtual investor meeting with Simona Jankowski, Nvidia’s vice president of investor relations. While management did not comment on near-term trends, they said, “We walked away with incremental conviction on Gen AI demand, Blackwell GPU ramps, and the company’s full-stack leadership.”

"We believe concerns regarding a potential pause in customer spending ahead of Blackwell ramps are unwarranted as inferencing demand continues to outpace GPU supply," the firm said.

Raymond James said that it is typical for Nvidia to ship prior-generation products for several quarters while new products are ramping.

"In addition, H200 ramps are starting in 2Q, which should remain a tailwind for the next few quarters," the firm said.

Raymond James said that Nvidia leverages its core GPU technology in multiple markets, making its business highly scalable.

"The company supplies full-stack solutions along with its high-performance chips, which makes it unique among semiconductor peers," the firm said.

Related: Veteran fund manager picks favorite stocks for 2024